Introduction

Logistic regression is the most commonly used statistical technique

for binary response data. Many marketing applications are concerning

binary consumer decisions:

- does a consumer respond or not respond to marketing?

- do they subscribe or not subscribe?

- do they churn or not churn?

We’ll use a data set on customer churn for a telecommunications

company with several different services. We’ll use demographic, service

usage, and customer history to predict churn. We then apply this model

to a new, holdout set of customers. We calclate the confusion matrix,

the lift table, and use it to do targeted proactive churn selection.

Installing the packages and loading the data

library(car)

library(tidyverse)

library(pROC)

library(plotrix)

library(tidyverse)

library(readr)

library(kableExtra)

telco <- read_csv("telco.csv")

telco_holdout <- read_csv("telco_holdout.csv")

options("scipen"=200, "digits"=3)

Inspecting the data

Let’s get rid of the ID column, since we never need to use it. We’ll

make senior citizen a factor variable, and recode total charges so that

it’s in thousands of dollars. We also need to recode Churn for yes/no to

0/1.

telco <- telco[-c(1)]

telco$SeniorCitizen<-as.factor(telco$SeniorCitizen)

telco$TotalCharges<-telco$TotalCharges/1000

telco <- telco %>%

mutate(Churn = ifelse(Churn == "No",0,1))

Churn

What fraction of customers churn (quit)? This is the dependent

variable we want to predict. We need to use the “as.numeric” function to

transform it from a factor variable to a 0/1 continuous variable in R.

We report the average churn rate of the customer below.

summary(telco$Churn)

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## 0.000 0.000 0.000 0.266 1.000 1.000

rbar <- mean(telco$Churn)

The average churn rate in the customer base is 0.266.

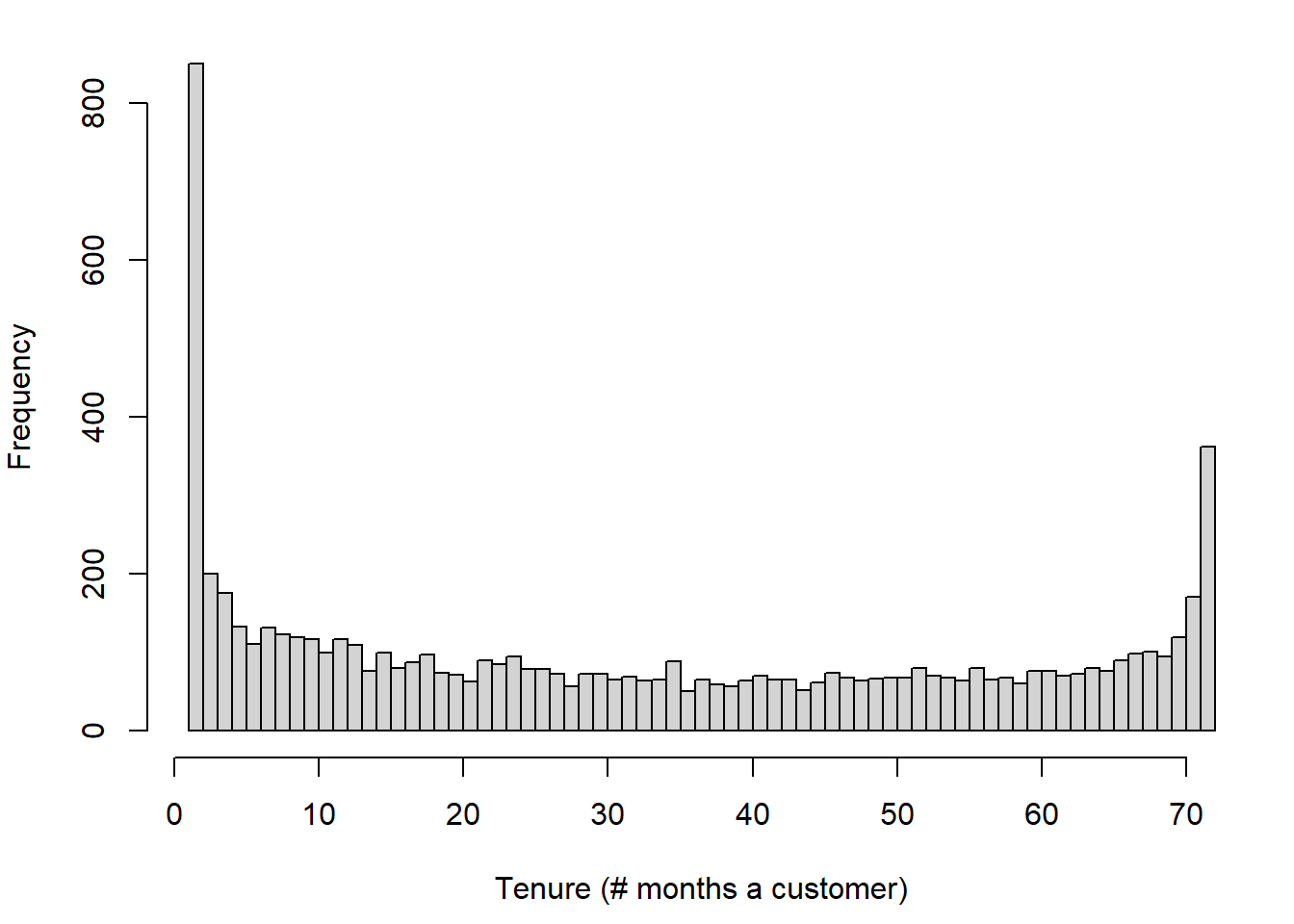

Tenure

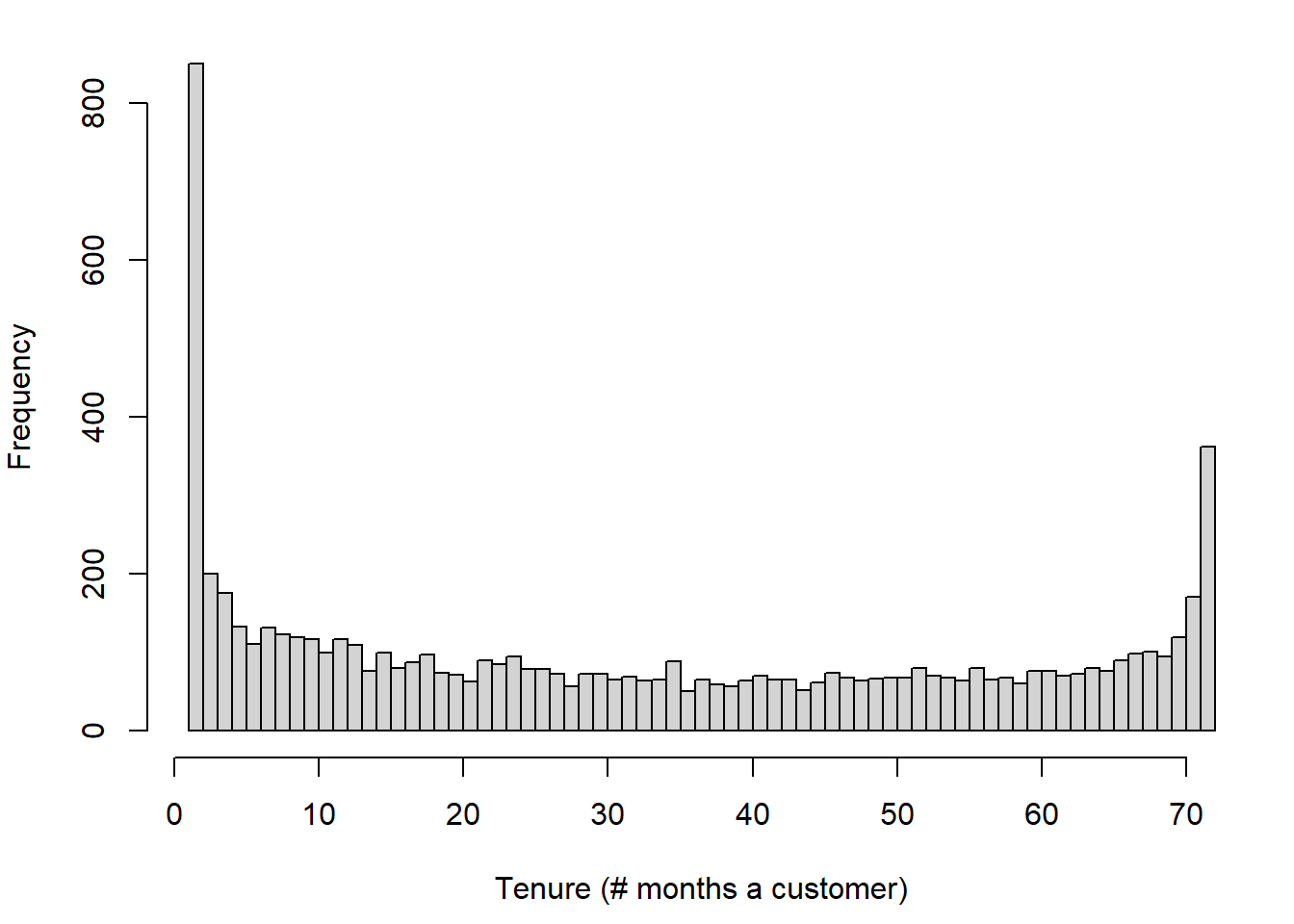

One important driver of churn is likely to be

tenure, how long a customer has been a customer for. We

can see below that there is a spike at 1, many customers just started,

and a smaller peak at 72.

par(mai=c(.9,.8,.2,.2))

hist(telco$tenure, main = "", xlab="Tenure (# months a customer)", breaks = 71)

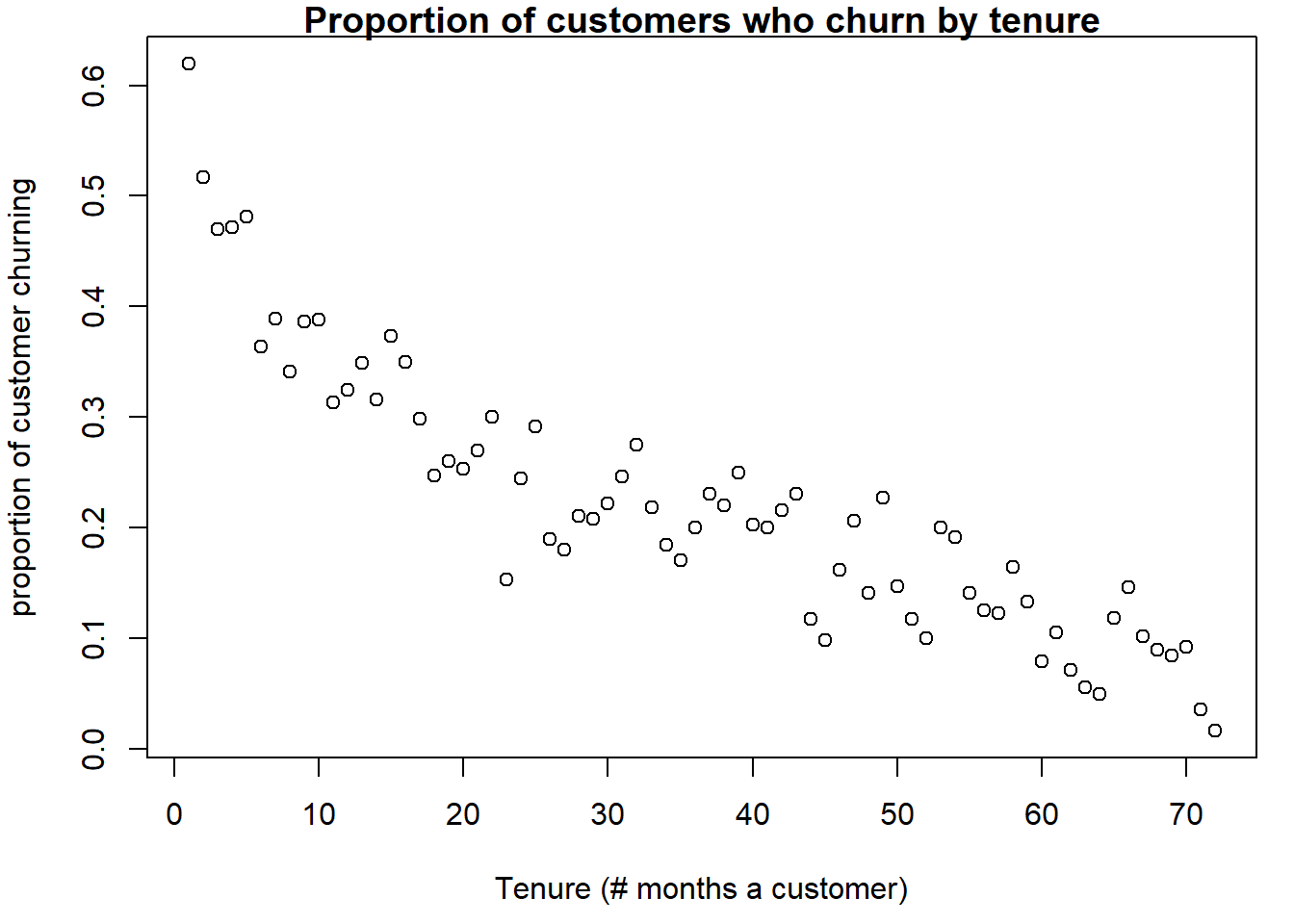

Churn Rate Variation

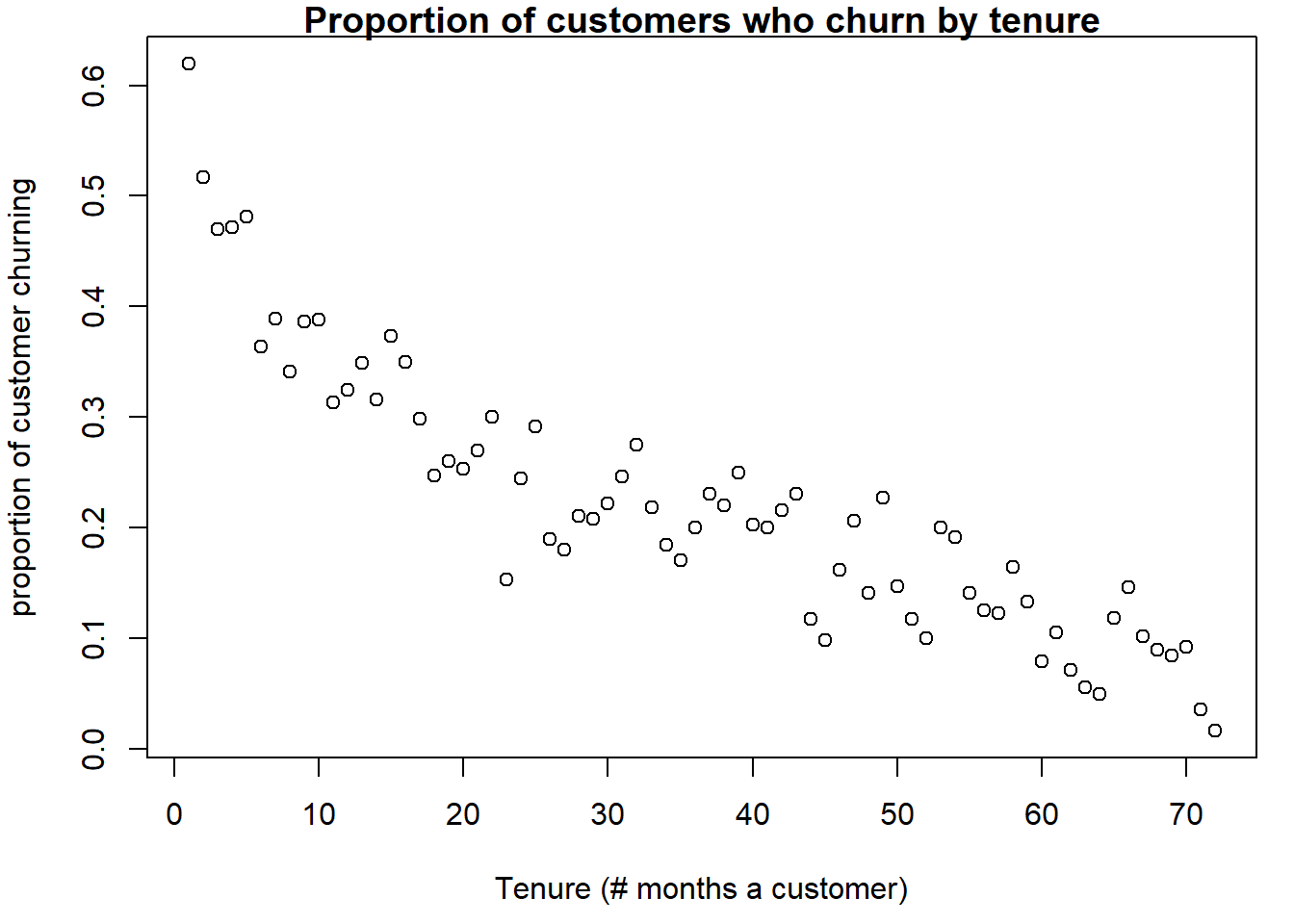

How does the rate churn vary by tenure? We create a dataset of length

72, one for each level of tenure. We calculate the proportion churning,

number of churners (n_churn), number of customers in the tenure group,

the standard error of the proportion churning (discussed in previous

lectures), and the lower and upper confidence intervals.

churn_tenure <- telco %>%

as.data.frame() %>%

group_by(tenure) %>%

summarize(tenure=mean(tenure),

p_churn=mean(Churn),

n_churners=sum(Churn), n=n(),

p_churn_se= sqrt((p_churn)*(1-p_churn)/n)) %>%

mutate(lower_CI_pchurn = p_churn - 1.96*p_churn_se,

upper_CI_pchurn = p_churn + 1.96*p_churn_se)

head(churn_tenure) %>%

kbl() %>%

kable_styling()

|

tenure

|

p_churn

|

n_churners

|

n

|

p_churn_se

|

lower_CI_pchurn

|

upper_CI_pchurn

|

|

1

|

0.620

|

380

|

613

|

0.020

|

0.581

|

0.658

|

|

2

|

0.517

|

123

|

238

|

0.032

|

0.453

|

0.580

|

|

3

|

0.470

|

94

|

200

|

0.035

|

0.401

|

0.539

|

|

4

|

0.472

|

83

|

176

|

0.038

|

0.398

|

0.545

|

|

5

|

0.481

|

64

|

133

|

0.043

|

0.396

|

0.566

|

|

6

|

0.364

|

40

|

110

|

0.046

|

0.274

|

0.454

|

par(mai=c(.9,.8,.2,.2))

plot(x = churn_tenure$tenure, y = churn_tenure$p_churn, main="Proportion of customers who churn by tenure", xlab="Tenure (# months a customer)", ylab="proportion of customer churning")

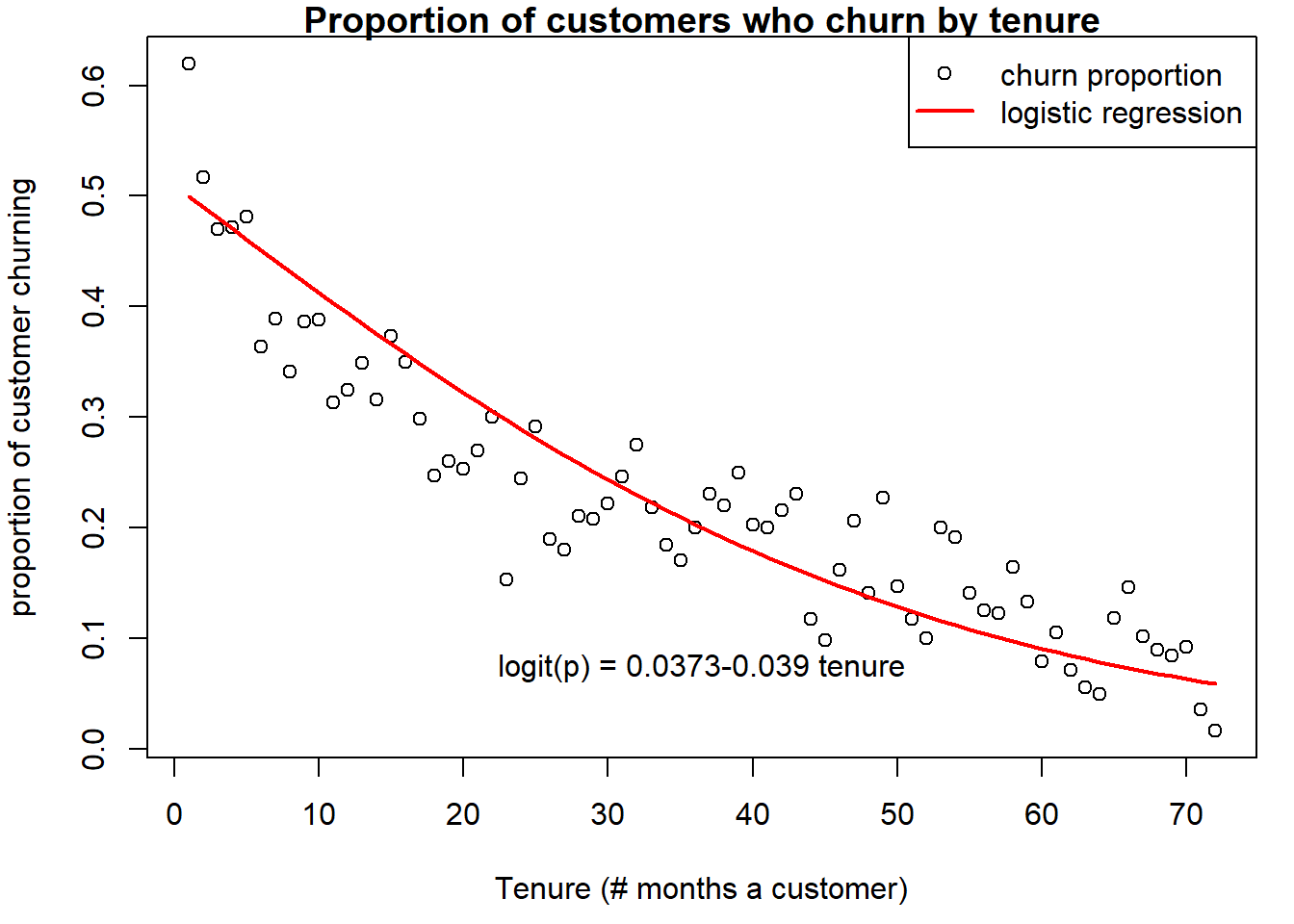

The figure shows a clear negative relationship: the longer the

customer has been a customer, the lower the probability of churn (churn

rate).

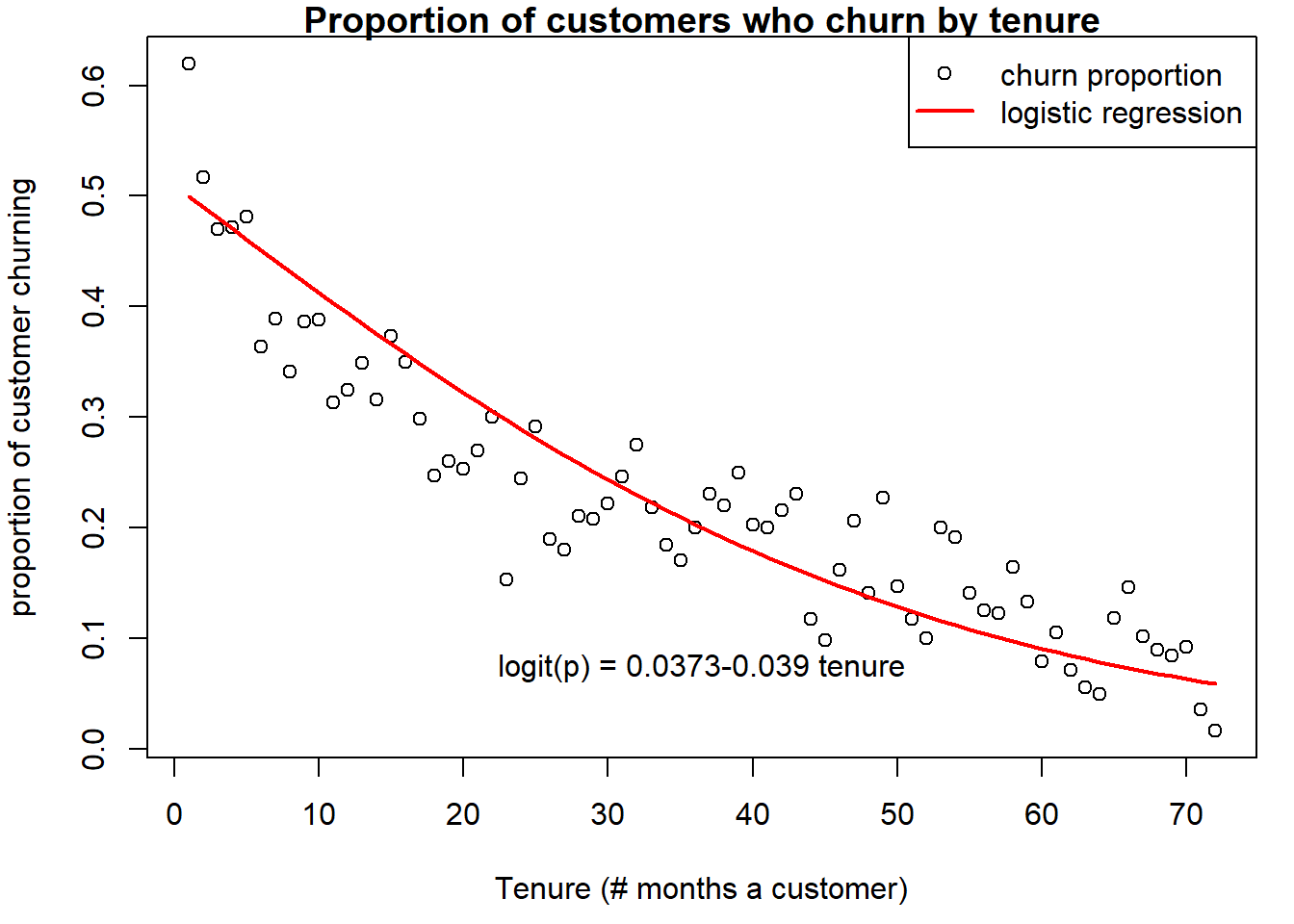

Estimating the logistic regression

- Model 0 is the simplest: The only variable is

tenure and it is treated as a continuous variable.

model_0 <- glm(Churn ~ tenure, data=telco, family = binomial(link="logit"))

summary(model_0)

##

## Call:

## glm(formula = Churn ~ tenure, family = binomial(link = "logit"),

## data = telco)

##

## Deviance Residuals:

## Min 1Q Median 3Q Max

## -1.177 -0.840 -0.479 1.178 2.380

##

## Coefficients:

## Estimate Std. Error z value Pr(>|z|)

## (Intercept) 0.03730 0.04232 0.88 0.38

## tenure -0.03901 0.00141 -27.69 <0.0000000000000002 ***

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## (Dispersion parameter for binomial family taken to be 1)

##

## Null deviance: 8143.4 on 7031 degrees of freedom

## Residual deviance: 7176.3 on 7030 degrees of freedom

## AIC: 7180

##

## Number of Fisher Scoring iterations: 4

## [1] -0.0383

Interpretation: Having 1 additional unit of tenure of

decreases the odds of churn by 0.0383or by

3.8%.

Plot: Compare observed proportion of churn by tenure

calculated separately for each level of tenure; with model

predictions.

I’m just creating a new data with the regression results:

plotdat <- data.frame(tenure=(1:72))

preddat <- predict(model_0,

type = "link",

newdata=plotdat,

se.fit=TRUE) %>%

as.data.frame() %>%

mutate(tenure=(1:72),

lower = model_0$family$linkinv(fit - 1.96*se.fit),

point.estimate = model_0$family$linkinv(fit),

upper = model_0$family$linkinv(fit + 1.96*se.fit))

Final Plot:

par(mai=c(.9,.8,.2,.2))

plot(x = churn_tenure$tenure, y = churn_tenure$p_churn, main="Proportion of customers who churn by tenure", xlab="Tenure (# months a customer)", ylab="proportion of customer churning")

lines(x=preddat$tenure, y=preddat$point.estimate, col="red", lwd=2)

legend('topright',legend=c("churn proportion", "logistic regression"),col=c("black","red"),pch=c(1,NA),lty=c(NA,1), lwd=c(NA,2))

eq <- paste0("logit(p) = ",round(coef(model_0)[1],4),

ifelse(coef(model_0)[2]<0,round(coef(model_0)[2],4),

paste("+",round(coef(model_0)[2],4))),

paste(" tenure"))

mtext(eq, 1,-3)

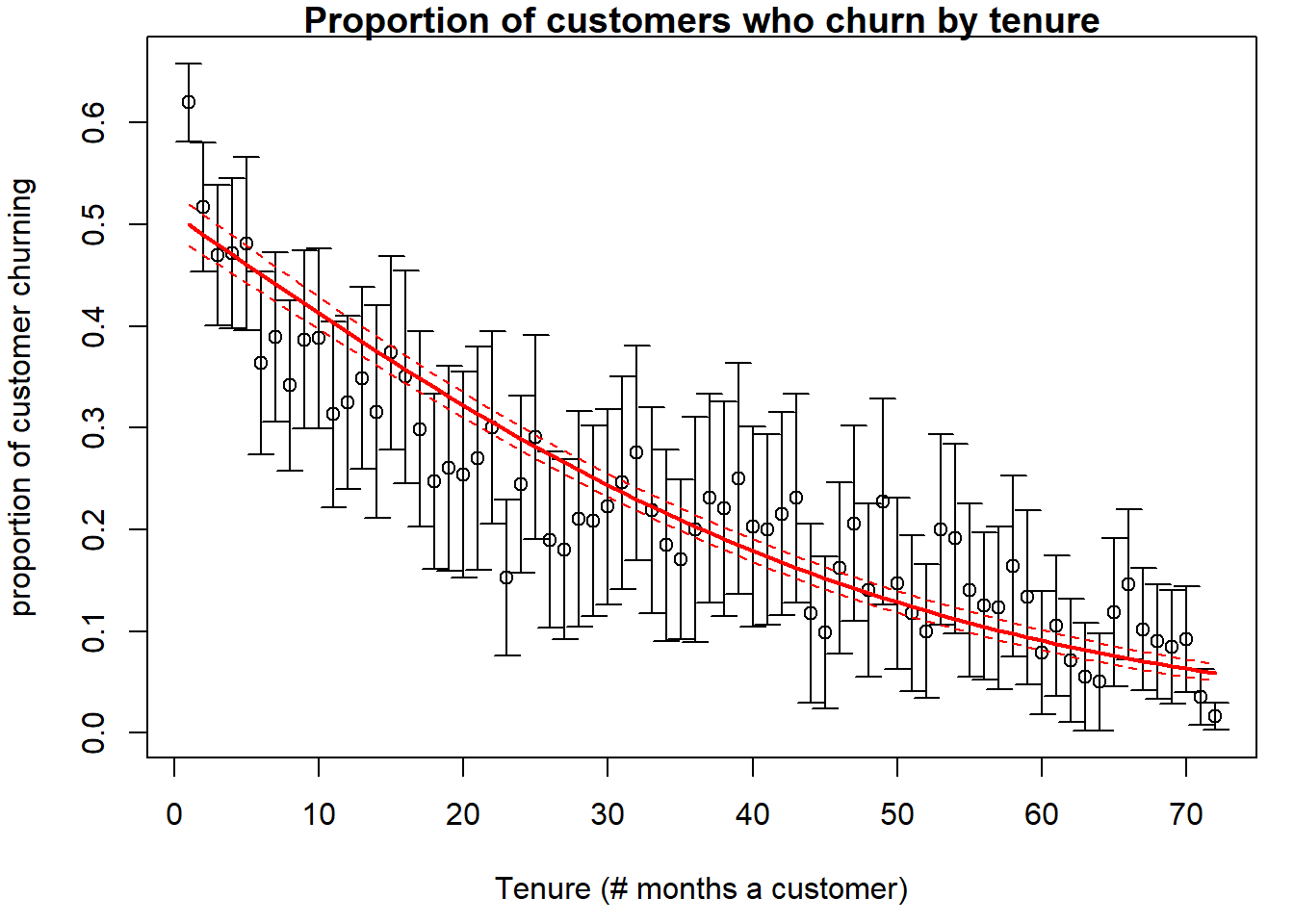

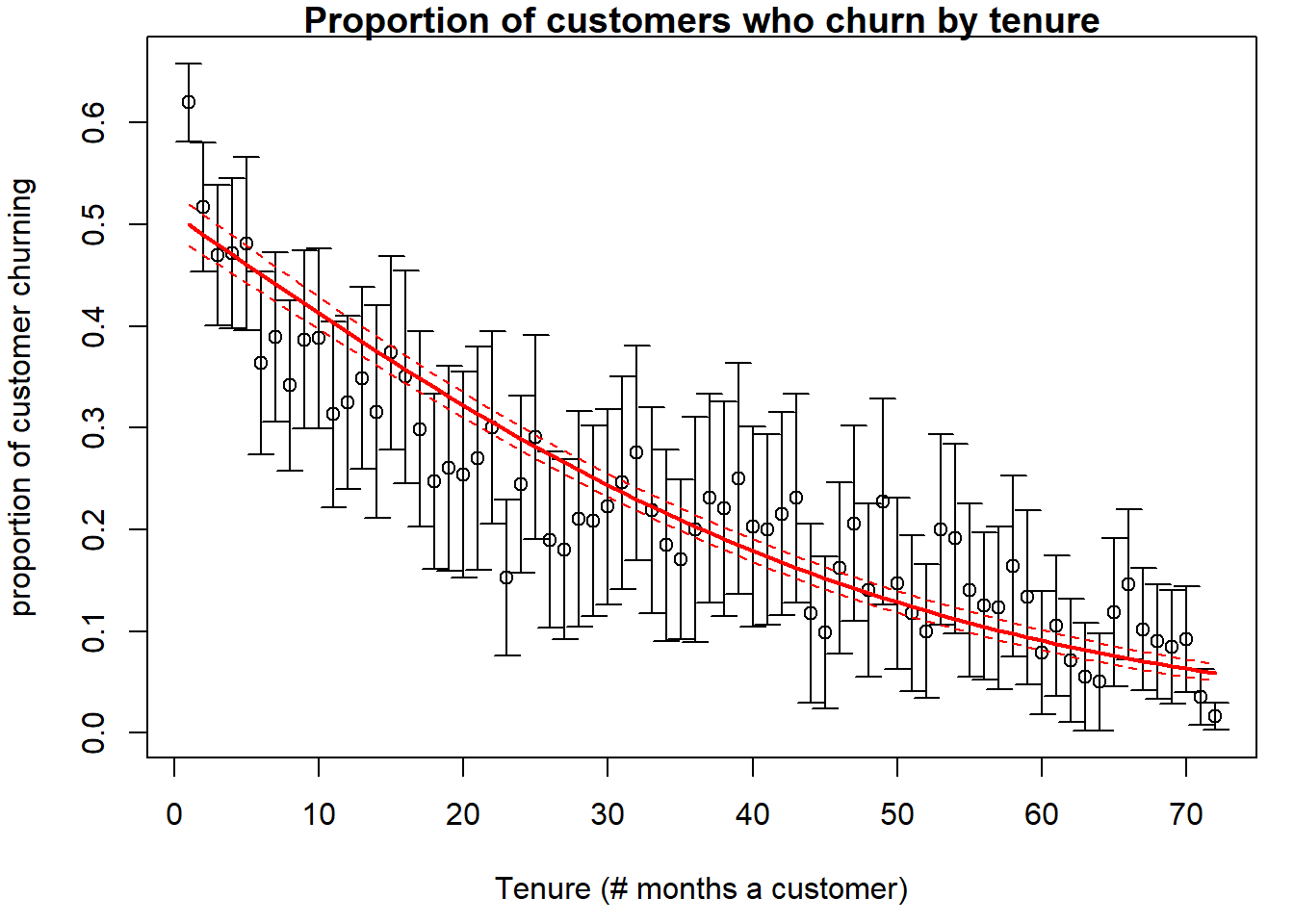

Compare the confidence intervals of the model predictions (dashed

red) to those by doing them separately for each level of tenure.

You can see we get quite a reduction in uncertainty by having a model

that relates these proportions to each other.

The cost of our lower error or error reduction is

higher bias – if the model’s functional form deviates

from the actual response rate. In other words, we have reduced variance,

but at the expense of bias.

par(mai=c(.9,.8,.2,.2))

plotCI(x = churn_tenure$tenure,

y = churn_tenure$p_churn,

li = churn_tenure$lower_CI_pchurn,

ui = churn_tenure$upper_CI_pchurn, main="Proportion of customers who churn by tenure", xlab="Tenure (# months a customer)", ylab="proportion of customer churning")

lines(x=preddat$tenure, y=preddat$point.estimate, col="red", lwd=2, type = "l")

lines(x=preddat$tenure, y=preddat$lower, col="red", lty=2, lwd=1, type = "l")

lines(x=preddat$tenure, y=preddat$upper, col="red", lty=2, lwd=1, type = "l")

- Model 1 is more complex: every variable is

included, not just tenure; tenure is treated as a continuous

variable as before.

options(width = 200)

model_1 <- glm(Churn ~ . , data=telco, family="binomial")

- Model 2 is more complex: like Model 1, except that

tenure is treated a categorical variable. In other

words there is a dummy variable for every level of tenure but one. This

way, we can flexibly capture a pattern between tenure and

churn. In R, all you have to do is write

as.factor(tenure) instead of

tenure.

model_2 <- glm(Churn ~ . +as.factor(tenure) -tenure , data=telco, family="binomial")

- Model 2 has 94 coefficients.

- Model 3 is the most complex: like Model 2, except

that there is an interaction between payment type and

tenure. Note in general and interaction is the coefficient on

the product of two variables.

model_3 <- glm(Churn ~ . +as.factor(tenure)*as.factor(PaymentMethod) -tenure -PaymentMethod, data=telco, family="binomial")

Model 3 has 307 coefficients. Note a lot of them

have large coefficients and large standard errors. If a variable is zero

almost always, (tenure==34)*(PaymentMethod==Electronic check), there is

little variation to estimate the coefficient, making it look

unstable.

So, we’ve estimated 3 models each one increasing in the number of

coefficients. Let’s see how well they predict.

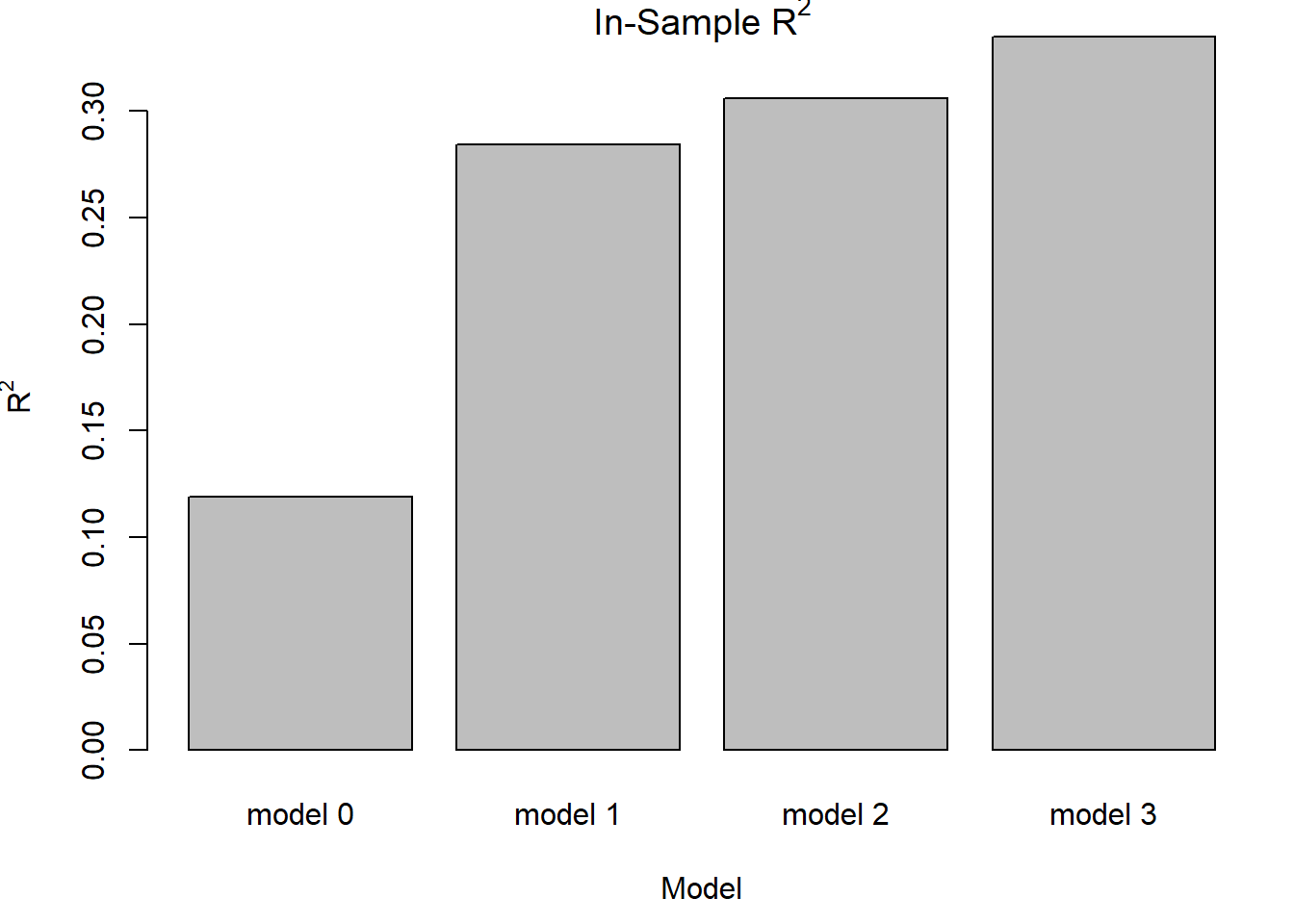

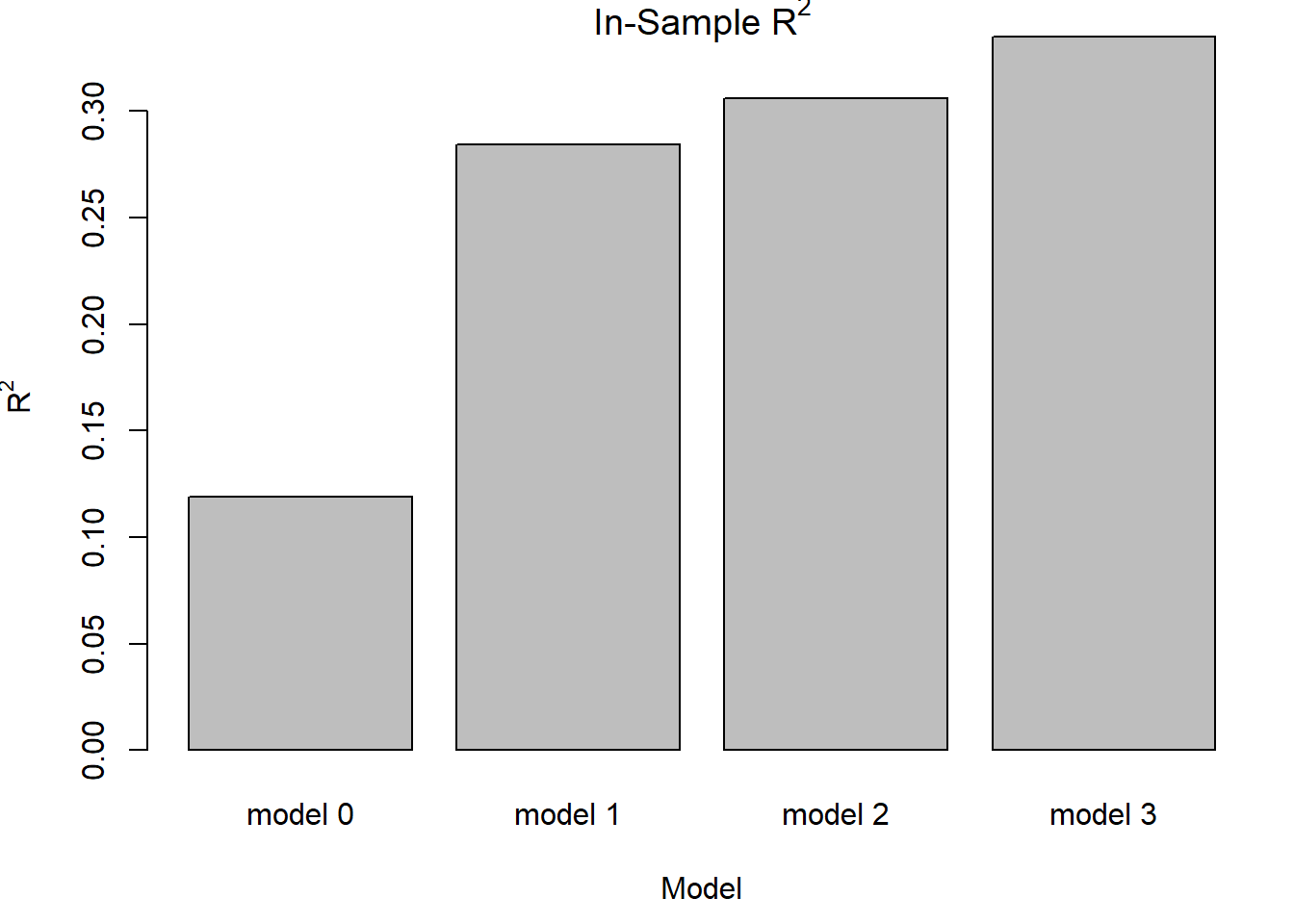

Deviance and proportion of deviance explained (R2)

Deviance is an error measure, −2ln(likelihood). We want it to be as small as

possible. The difference between the residual and the null deviance then

gives us some sense of how well our model fits overall, taken

together.

You can also look at the proportion of deviance explained by the

variables in the model.

R2=D0−DD0=1−DD0

models <- paste0("model_", 0:3)

D <- sapply(models, function(x) get(x)$deviance)

D0 <- model_0$null.deviance

R2 <- 1-D/D0

par(mai=c(.9,.8,.2,.2))

barplot(R2, names.arg = c("model 0","model 1", "model 2", "model 3"), main=expression(paste("In-Sample R"^"2")), xlab="Model", ylab=expression(paste("R"^"2")))

Models 0, 1, 2 and 3 are explaining 12% 28%, 31% and 34%,

respectively, of the deviance in customer churn.

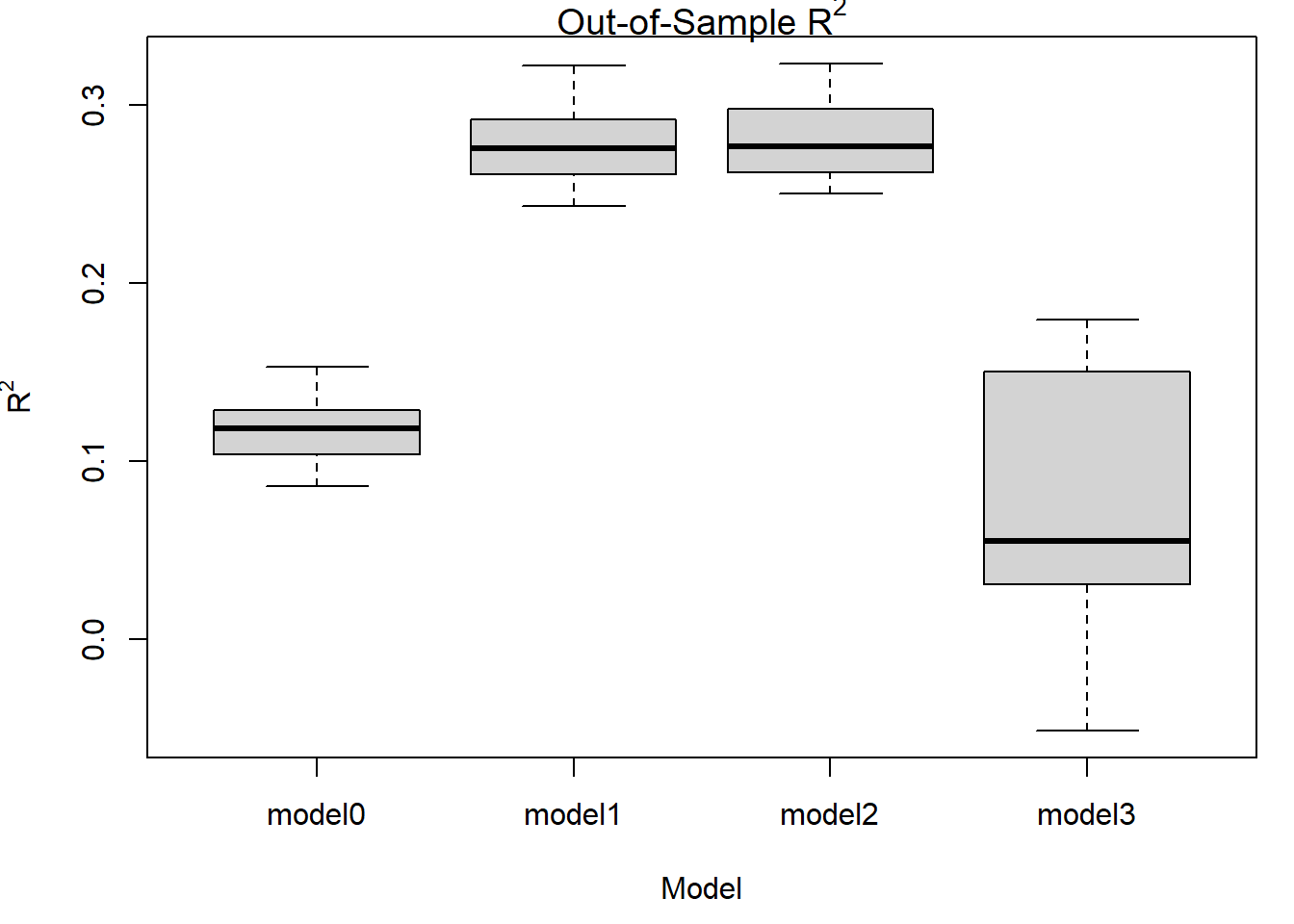

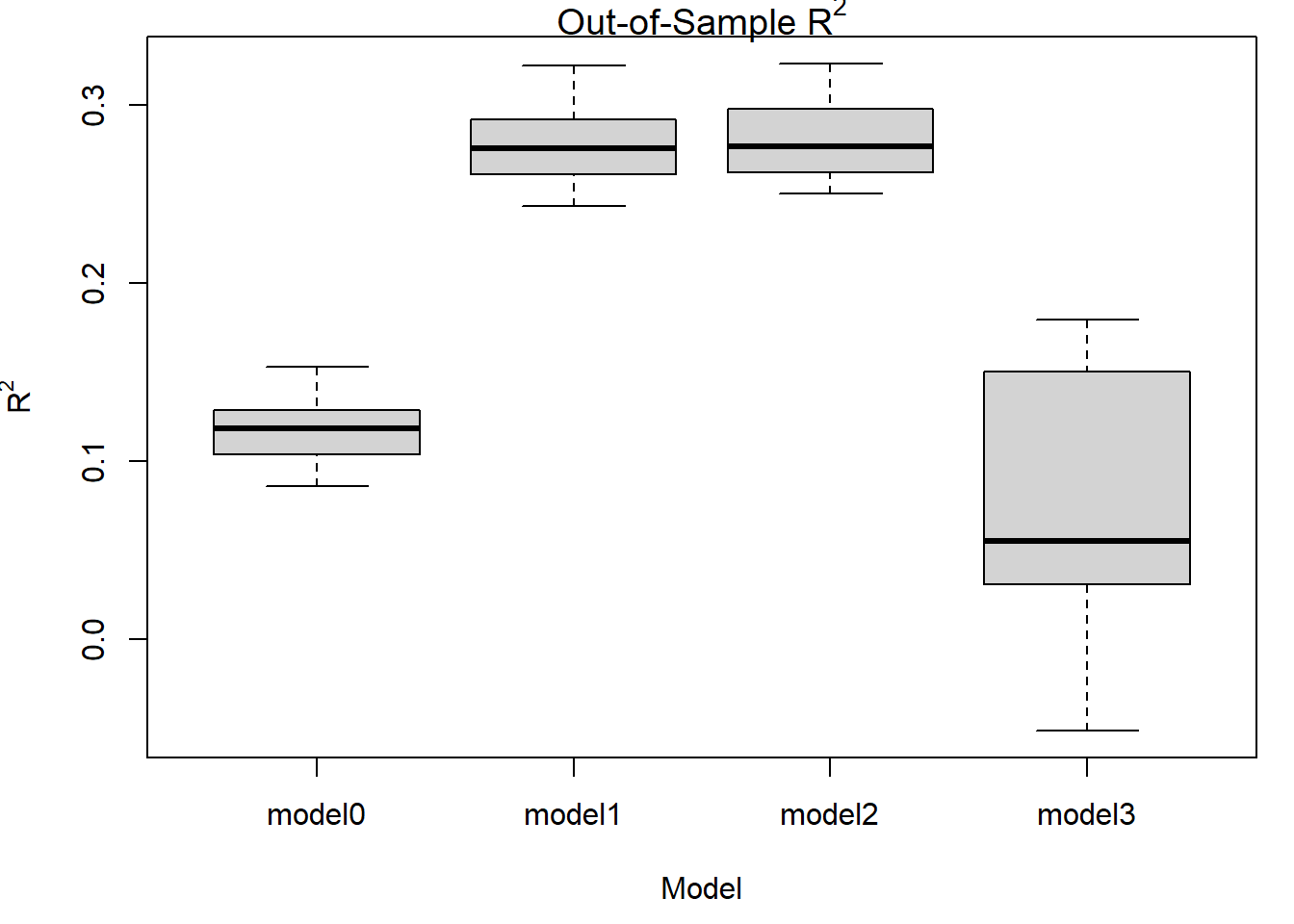

Overfitting, K-fold out of sample

But, is the better performance of model a result of

overfitting?

What we really care about is being able to predict

new data. The R2 and deviance measures are all about

in-sample, not out-of-sample fit. So it doesn’t tell us how well our

model performs on other data.

We can mimic the presence of new data by holding out part of the

data.

We use K-fold out of sample validation.

set.seed(19103)

n = nrow(telco)

K = 10

foldid = rep(1:K, each=ceiling(n/K))[sample(1:n)]

OOS <- data.frame(model0=rep(NA, K), model1=rep(NA,K), model2=rep(NA,K), model3=rep(NA,K))

deviance <- function(y, pred, family=c("gaussian","binomial")){

family <- match.arg(family)

if(family=="gaussian"){

return( sum( (y-pred)^2 ) )

}else{

if(is.factor(y)) y <- as.numeric(y)>1

return( -2*sum( y*log(pred) + (1-y)*log(1-pred) ) )

}

}

R2 <- function(y, pred, family=c("gaussian","binomial")){

fam <- match.arg(family)

if(fam=="binomial"){

if(is.factor(y)){ y <- as.numeric(y)>1 }

}

dev <- deviance(y, pred, family=fam)

dev0 <- deviance(y, mean(y), family=fam)

return(1-dev/dev0)

}

for(k in 1:K){

train = which(foldid!=k)

model_0<- glm(Churn ~ tenure, data=telco[train,], family="binomial")

summary(model_0)

model_1 <- glm(Churn ~ . , data=telco[train,], family="binomial")

summary(model_1)

model_2 <- glm(Churn ~ . +as.factor(tenure) -tenure, data=telco[train,], family="binomial")

summary(model_2)

model_3 <- glm(Churn ~ . +as.factor(tenure)*as.factor(PaymentMethod) -tenure -PaymentMethod, data=telco[train,], family="binomial")

summary(model_3)

pred0<- predict(model_0, newdata=telco[-train,], type = "response")

pred1<- predict(model_1, newdata=telco[-train,], type = "response")

pred2<- predict(model_2, newdata=telco[-train,], type = "response")

pred3<- predict(model_3, newdata=telco[-train,], type = "response")

OOS$model0[k]<-R2(y = telco$Churn[-train],pred=pred0, family="binomial")

OOS$model1[k]<-R2(y = telco$Churn[-train],pred=pred1, family="binomial")

OOS$model2[k]<-R2(y = telco$Churn[-train],pred=pred2, family="binomial")

OOS$model3[k]<-R2(y = telco$Churn[-train],pred=pred3, family="binomial")

cat(k, " ")

}

## 1 2 3 4 5 6 7 8 9 10

Plot Results:

par(mai=c(.9,.8,.2,.2))

boxplot(OOS[,1:4], data=OOS, main=expression(paste("Out-of-Sample R"^"2")),

xlab="Model", ylab=expression(paste("R"^"2")))

Model 3 had the highest in-sample R2, and now it has the worst

out-of-sample R2. It’s even

negative!

Bottom line: Model 3 is over-fitting. It is capturing patterns in

the in-sample data that do not generalize to the out-of-sample data.

This is why it does such a poor job at predicting.

Models 1 and 2 have basically the same out of sample R2.

This means favoring the simpler models. Model 1, being the

simplest, and tied for the best predictive performance is the

winner.

Predict

Here we use model 1 to predict the probability of default for a

certain customer with a specific profile: a male, senior citizen without

a partner or dependents, etc. See below.

newdata = data.frame(gender = "Male", SeniorCitizen=as.factor(1),Partner="No",Dependents="No", tenure=72,PhoneService="Yes",MultipleLines="No", InternetService="DSL", OnlineSecurity="No", OnlineBackup="No", DeviceProtection="No", TechSupport="Yes", StreamingTV="Yes", StreamingMovies="No", Contract="One year", PaperlessBilling="No", PaymentMethod="Mailed check", MonthlyCharges=30,TotalCharges=1)

predict(model_1,newdata,type="response")

## 1

## 0.0166

The probability of churn is low.

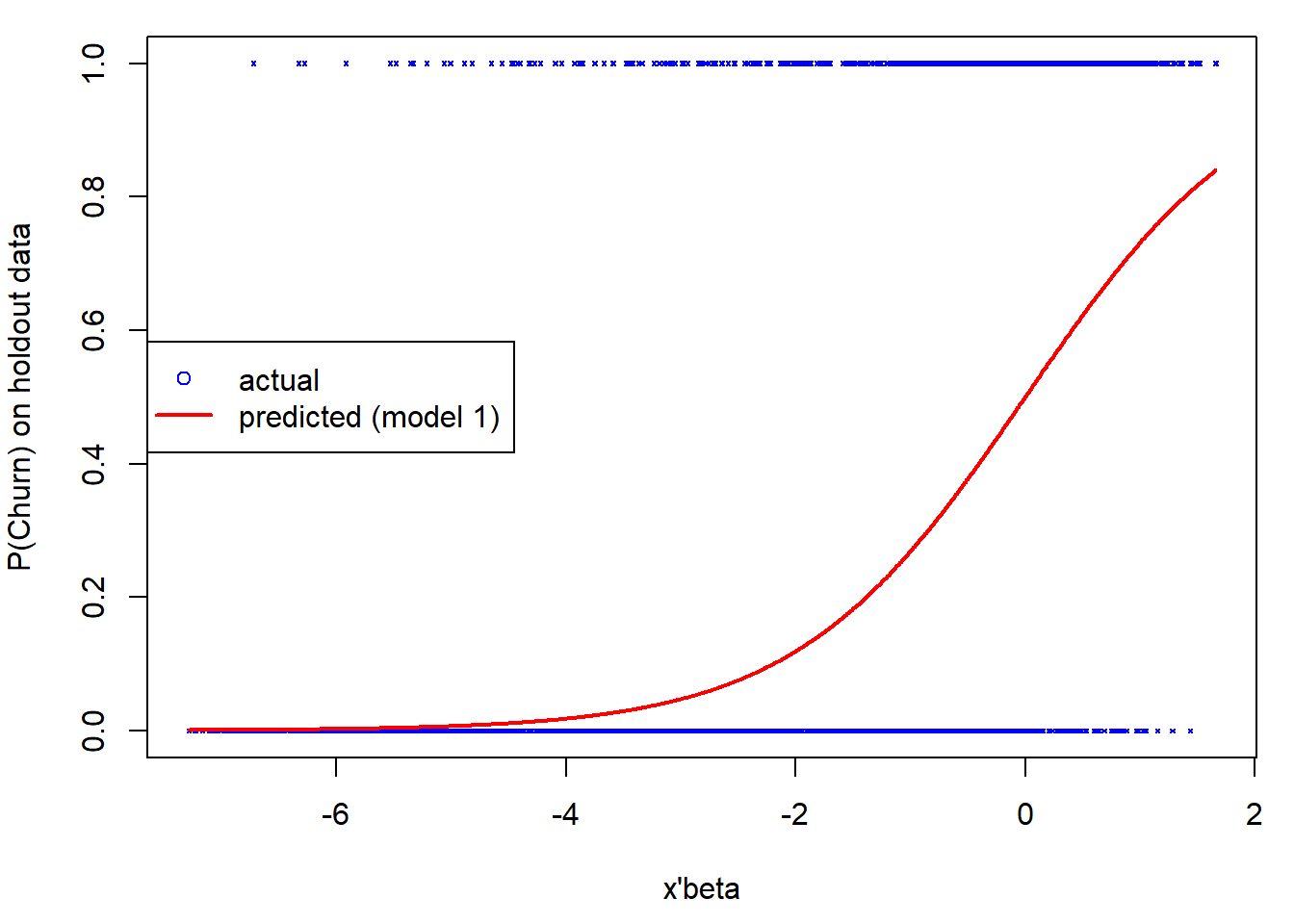

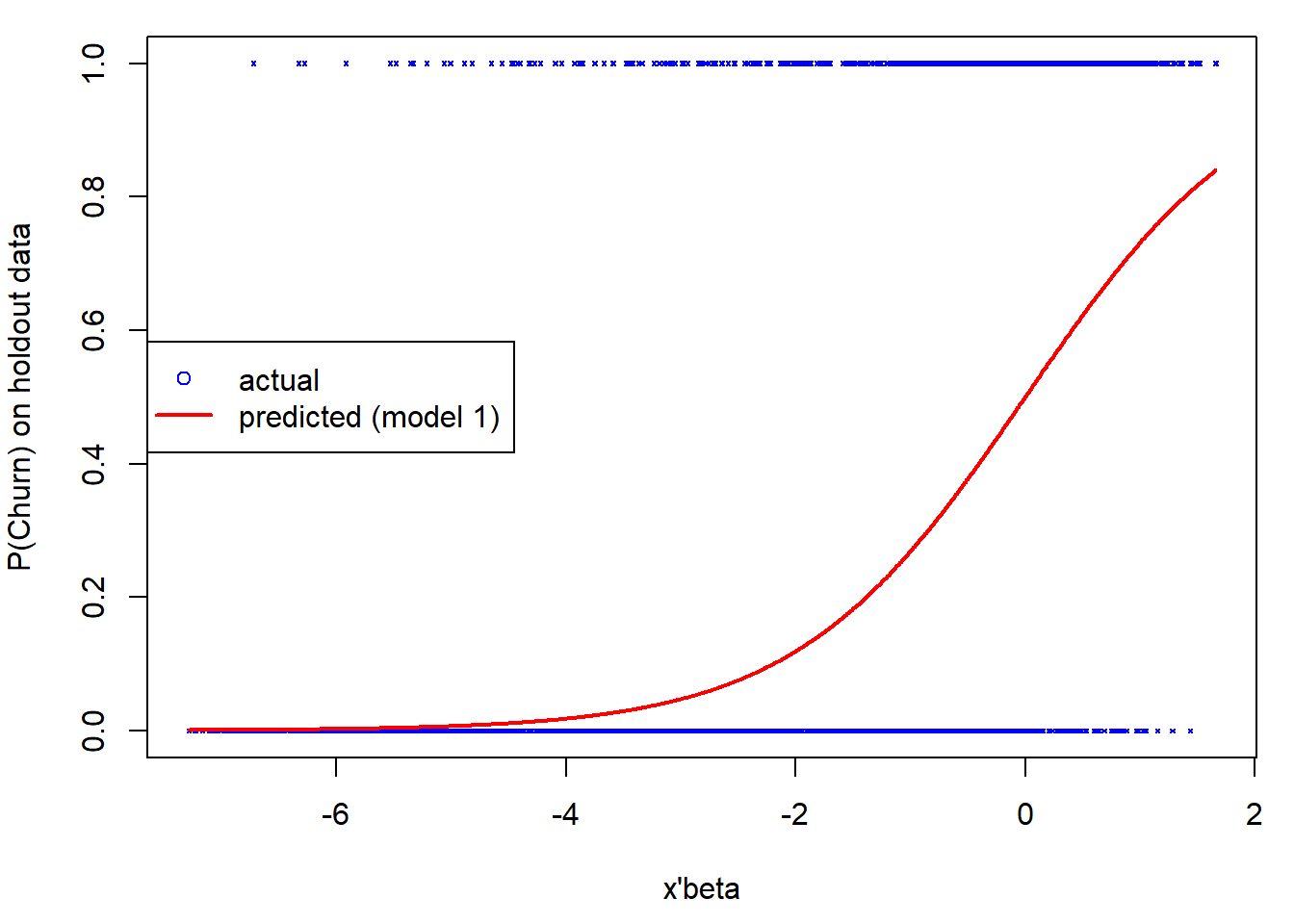

Holdout sample

Now we look at how well model 1 performs on one holdout sample,

holdout_telco.csv.

The churn rate we see in the holdout sample, 0.274, is close to that

in the estimation sample we used earlier, 0.266.

Now we use the model estimated on the other data to make predictions

on this new data. Note that our predicted probabilities lie between 0

and 1, whereas our data are binary. We can get the predictions for each

customer and graph them with the 0/1 churn decisions.

xb <- predict(model_1, type = "link", newdata=holdout_telco)

prob <- predict(model_1, type = "response", newdata=holdout_telco)

head(cbind(xb,prob)) %>%

kbl() %>%

kable_styling()

|

xb

|

prob

|

|

-3.715

|

0.024

|

|

-0.857

|

0.298

|

|

-1.460

|

0.188

|

|

-1.942

|

0.125

|

|

-5.194

|

0.006

|

|

-0.419

|

0.397

|

ind <- order(prob)

Plot

par(mai=c(.9,.8,.2,.2))

plot(xb[ind],holdout_telco$Churn[ind], pch=4,cex=0.3,col="blue", xlab="x'beta",ylab="P(Churn) on holdout data")

lines(x=xb[ind], y=prob[ind], col="red", lwd=2)

legend('left',legend=c("actual", "predicted (model 1)"),col=c("blue","red"), pch=c(1,NA),lty=c(NA,1), lwd=c(NA,2))

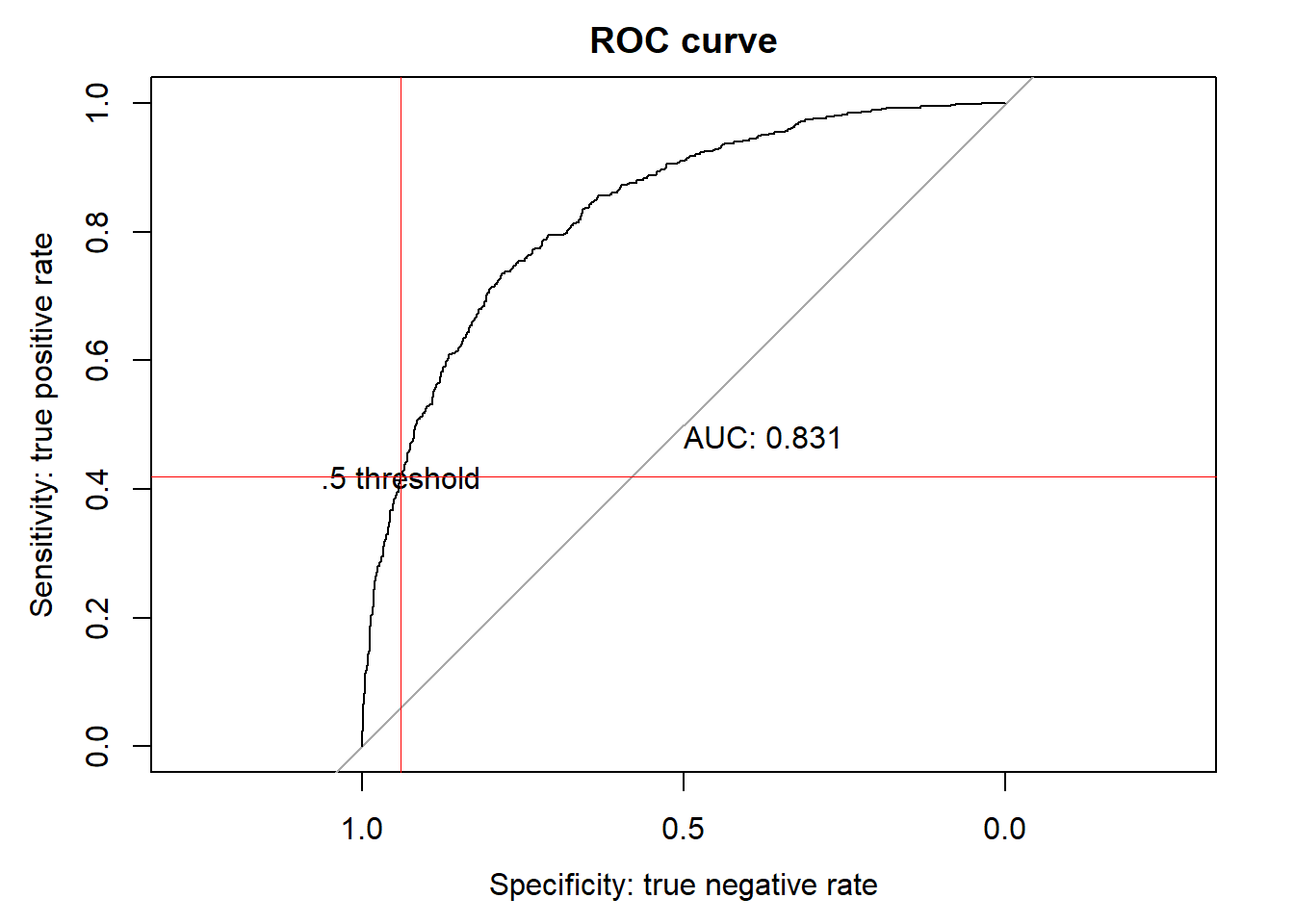

Confusion matrix

We can also classify predictions by turning them into 0’s

and 1’s. If ˆpi>0.5,pred=1 otherwise 0.

confusion_matrix <- (table(holdout_telco$Churn, prob > 0.5))

confusion_matrix <- as.data.frame.matrix(confusion_matrix)

colnames(confusion_matrix) <- c("No", "Yes")

confusion_matrix$Percentage_Correct <- confusion_matrix[1,]$No/(confusion_matrix[1,]$No+confusion_matrix[1,]$Yes)*100

confusion_matrix[2,]$Percentage_Correct <- confusion_matrix[2,]$Yes/(confusion_matrix[2,]$No+confusion_matrix[2,]$Yes)*100

print(confusion_matrix)

## No Yes Percentage_Correct

## 0 1421 92 93.9

## 1 331 239 41.9

cat('Overall Percentage:', (confusion_matrix[1,1]+confusion_matrix[2,2])/nrow(holdout_telco)*100)

## Overall Percentage: 79.7

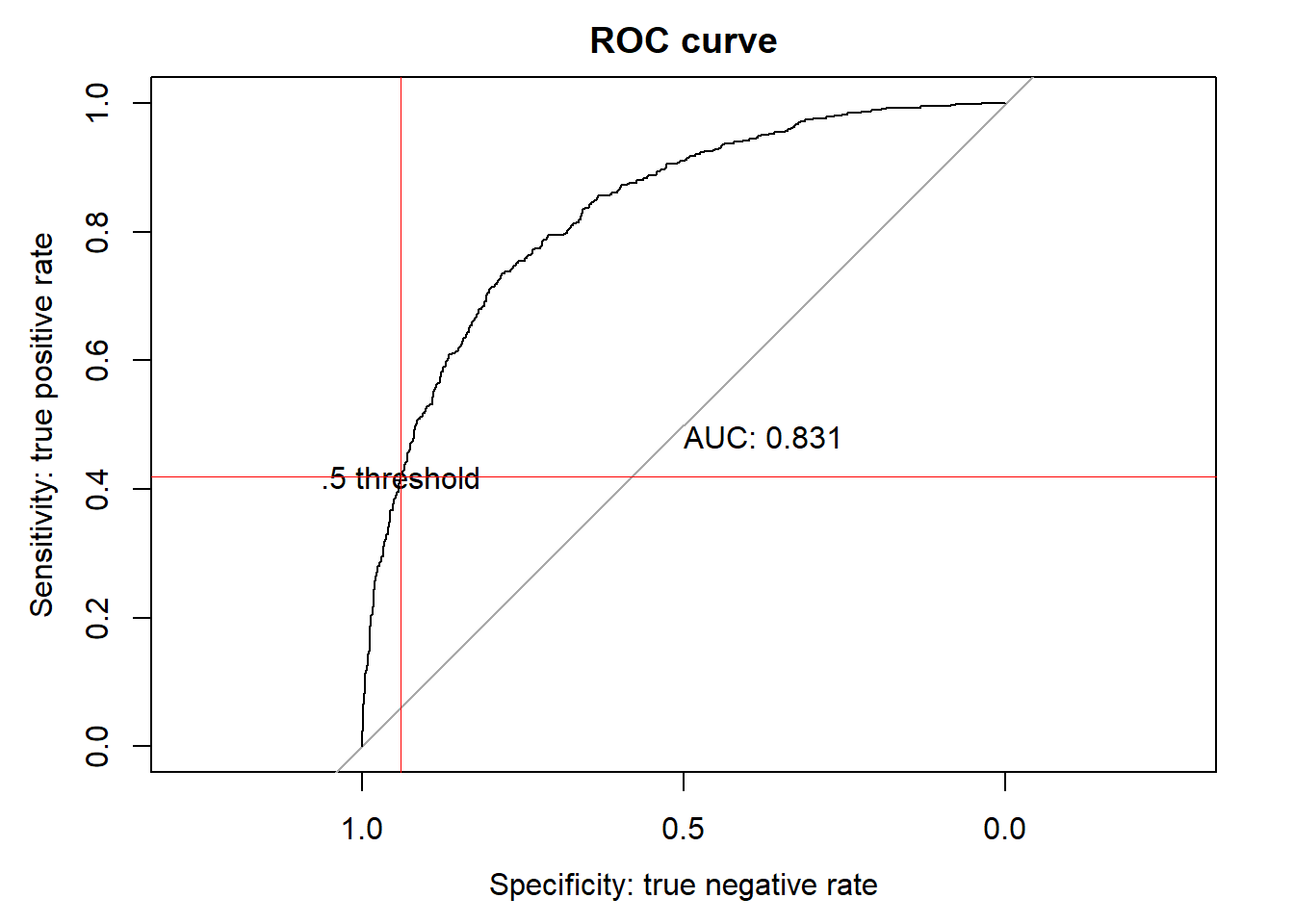

ROC curves

par(mai=c(.9,.8,.2,.2))

plot(roc(holdout_telco$Churn, prob), print.auc=TRUE,

col="black", lwd=1, main="ROC curve", xlab="Specificity: true negative rate", ylab="Sensitivity: true positive rate", xlim=c(1,0))

text(confusion_matrix$Percentage_Correct[[1]]/100, confusion_matrix$Percentage_Correct[[2]]/100, ".5 threshold")

abline(h=confusion_matrix$Percentage_Correct[[2]]/100, col="red",lwd=.3)

abline(v=confusion_matrix$Percentage_Correct[[1]]/100, col="red",lwd=.3)

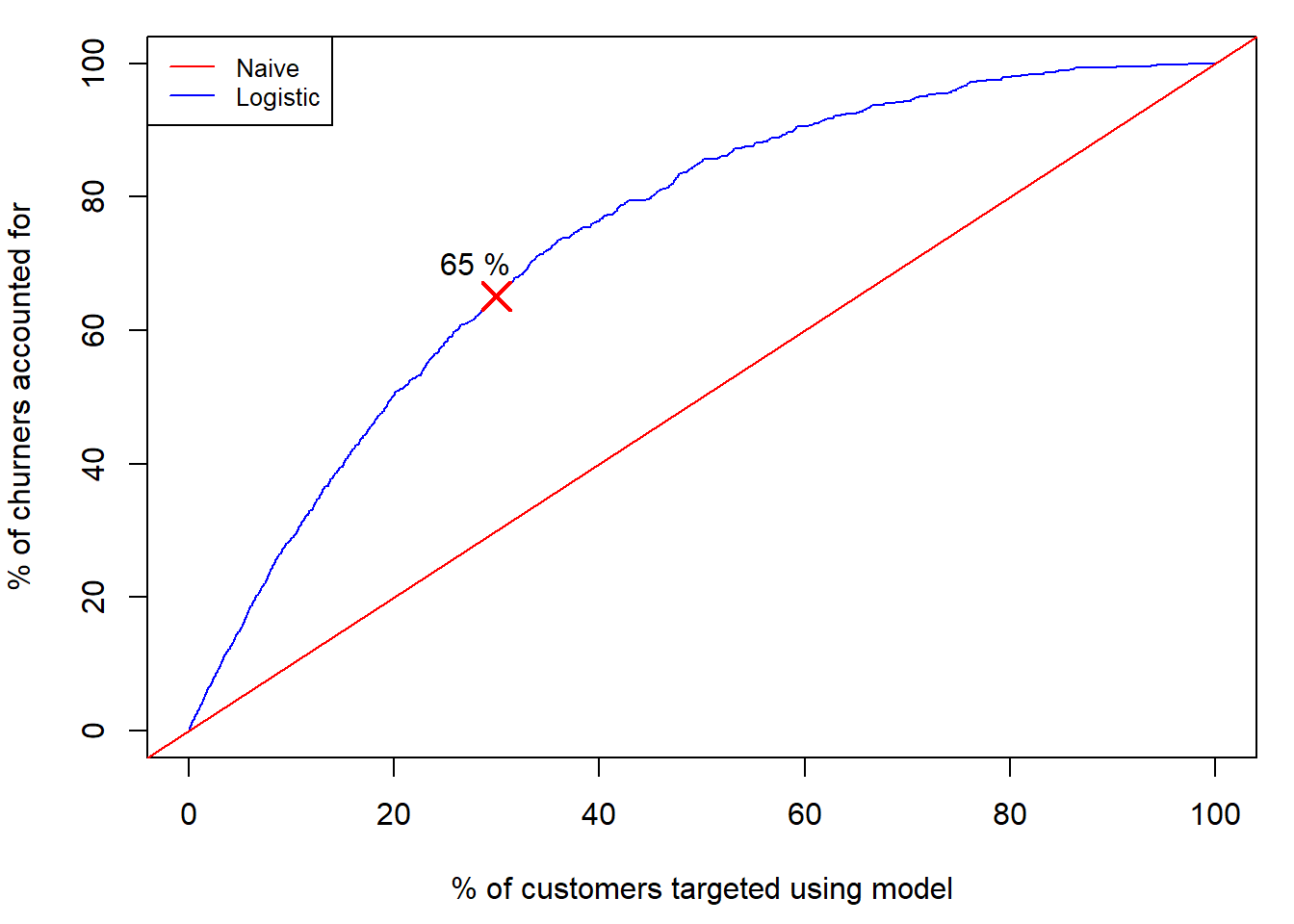

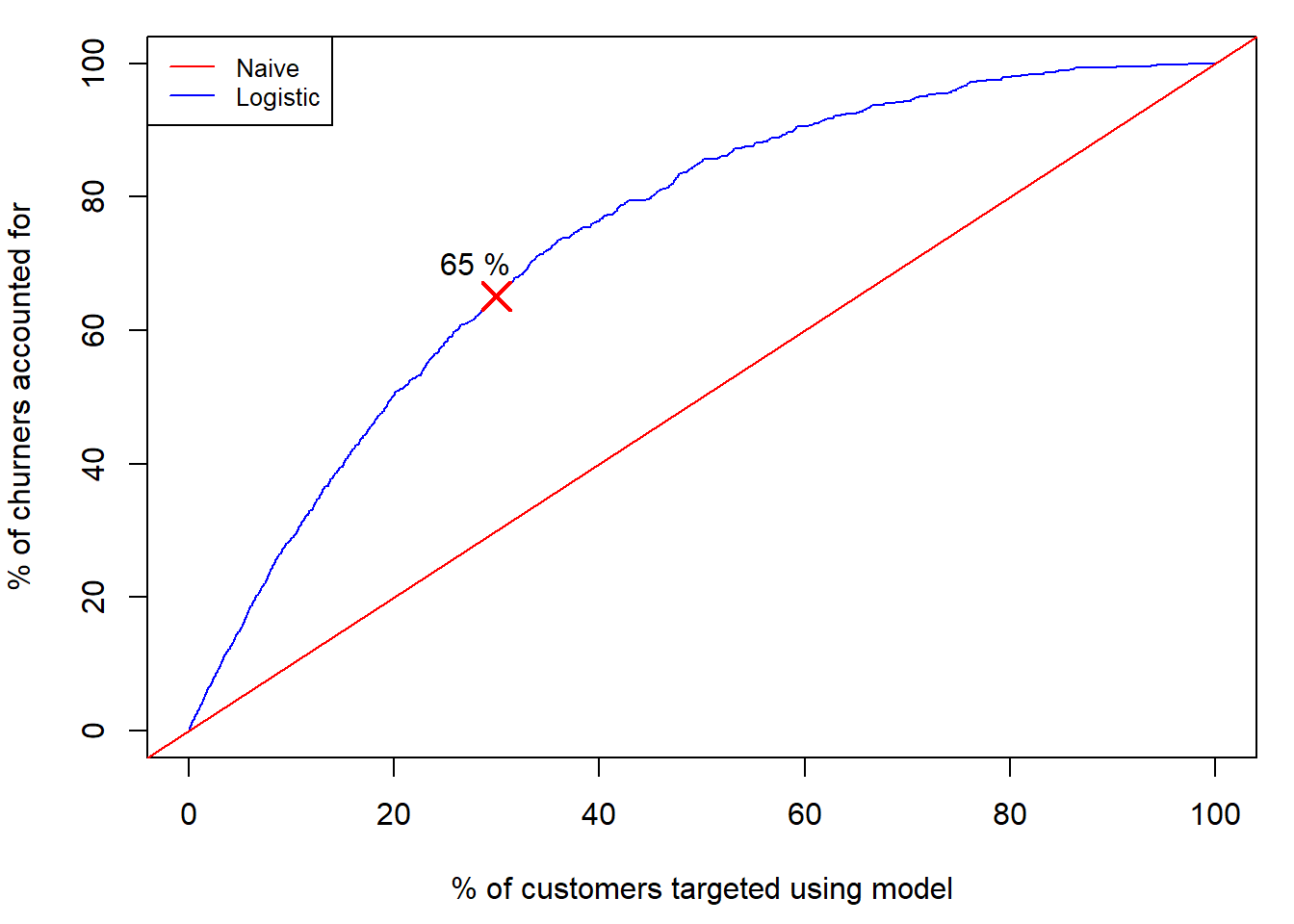

Lift curves

Lift is a common measure in marketing of model performance. The lift

asks how much more likely are customers in the top kth decile to churn compared

to the average.

ntiles <- function(x, bins) {

quantiles = seq(from=0, to = 1, length.out=bins+1)

cut(ecdf(x)(x),breaks=quantiles, labels=F)

}

prob_decile = ntiles(prob, 10)

pred<-data.frame(cbind(prob,prob_decile, holdout_telco$Churn))

colnames(pred)<-c("predicted","decile", "actual")

lift_table<-pred %>% group_by(decile) %>% summarize(actual_churn = mean(actual), lift = actual_churn/rbar_ho, n_customers=n()) %>% arrange(desc(decile)) %>% mutate(cum_customers=cumsum(n_customers)) %>% mutate(cum_lift=cumsum(actual_churn)/sum(actual_churn)*100)

head(lift_table) %>%

kbl() %>%

kable_styling()

|

decile

|

actual_churn

|

lift

|

n_customers

|

cum_customers

|

cum_lift

|

|

10

|

0.785

|

2.868

|

209

|

209

|

28.7

|

|

9

|

0.591

|

2.161

|

208

|

417

|

50.3

|

|

8

|

0.404

|

1.476

|

208

|

625

|

65.1

|

|

7

|

0.311

|

1.137

|

209

|

834

|

76.5

|

|

6

|

0.245

|

0.896

|

208

|

1042

|

85.4

|

|

5

|

0.139

|

0.510

|

208

|

1250

|

90.5

|

Customers in the top decile are the top 10% most likely to churn

according to our model. The top decile lift is 2.868. Customers

in the top decile are 2.868 times more likely to actually churn

than the average customer.

The rightmost column shows the cumulative lift. The cumulative lift

for the k decile is the percentage

of all churners accounted for cumulatively by the first k deciles. The first decile contains 209%

of all churners in the data set (in total there are 570 churners in the

holdout dataset).

The cumulative lift of decile 2 is 208% of all churners are in the

top 2 deciles. In the bottom most deciles there are barely any churners,

so the cumulative lift increases little or not at all.

We can graph this out below. The top three deciles account for 208%

of all churners. We can use this to compare models. The higher the lift

for a given decile, the better the model. A straight line, where we

randomly sorted customers instead of using a model, is the naive

model.

pred<-pred %>% arrange(desc(predicted)) %>% mutate(prop_churn = cumsum(actual)/sum(actual)*100, prop_cust = seq(nrow(pred))/nrow(pred)*100)

head(pred) %>%

kbl() %>%

kable_styling()

|

|

predicted

|

decile

|

actual

|

prop_churn

|

prop_cust

|

|

430

|

0.840

|

10

|

1

|

0.175

|

0.048

|

|

1887

|

0.840

|

10

|

1

|

0.351

|

0.096

|

|

320

|

0.821

|

10

|

1

|

0.526

|

0.144

|

|

811

|

0.820

|

10

|

1

|

0.702

|

0.192

|

|

179

|

0.817

|

10

|

1

|

0.877

|

0.240

|

|

88

|

0.814

|

10

|

1

|

1.053

|

0.288

|

par(mai=c(.9,.8,.2,.2))

plot(pred$prop_cust,pred$prop_churn,type="l",xlab="% of customers targeted using model",ylab="% of churners accounted for",xlim = c(0,100), ,ylim = c(0,100),col="blue")

legend('topleft', legend=c("Naive", "Logistic"), col=c("red", "blue"), lty=1:1, cex=0.8)

abline(a=0,b=1,col="red")

points(x=30, y= lift_table$cum_lift[3], pch=4, col="red", cex=2, lwd=2)

text(x = 28,y= lift_table$cum_lift[3]+5, paste(round(lift_table$cum_lift[3],0), "%" ))

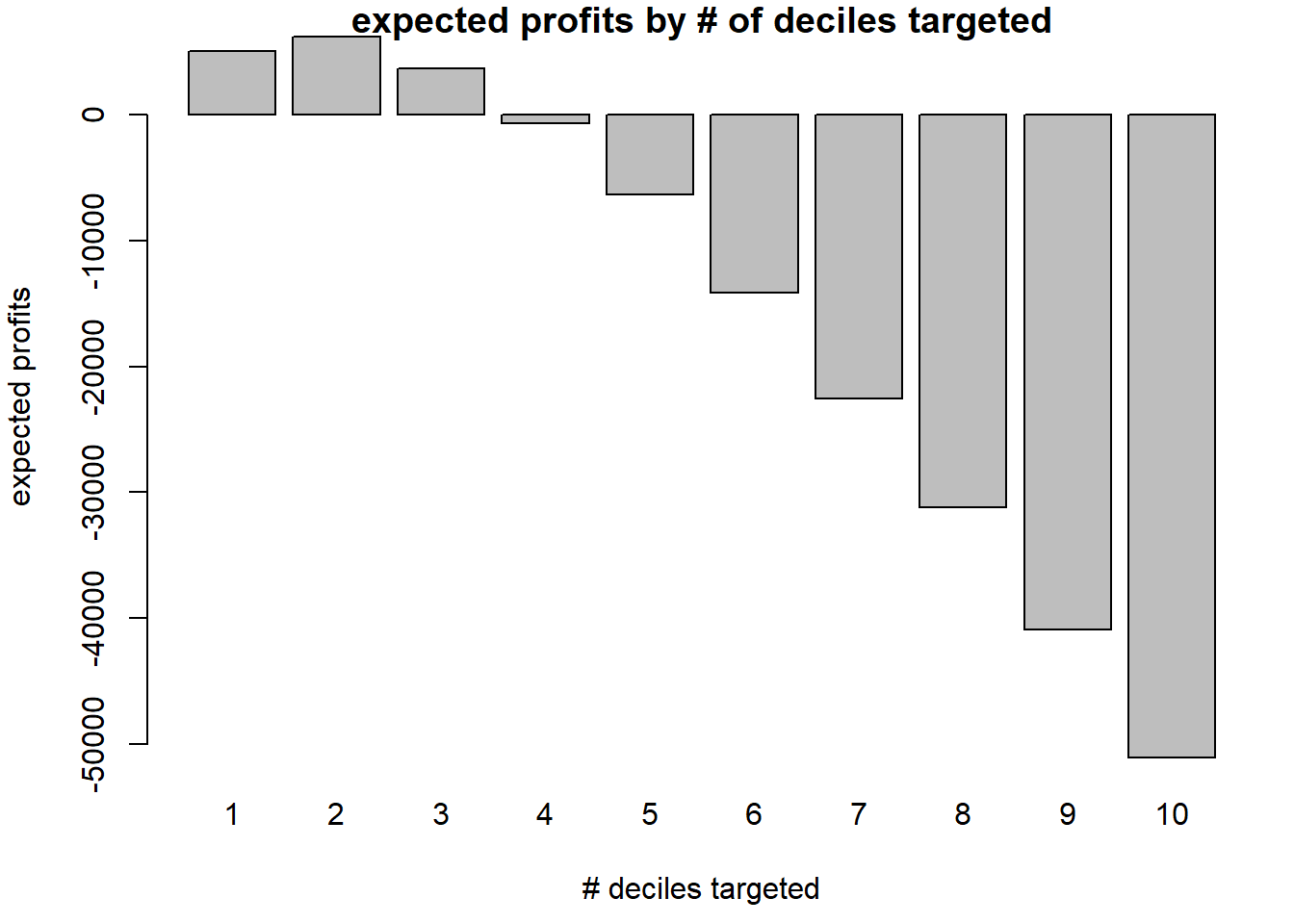

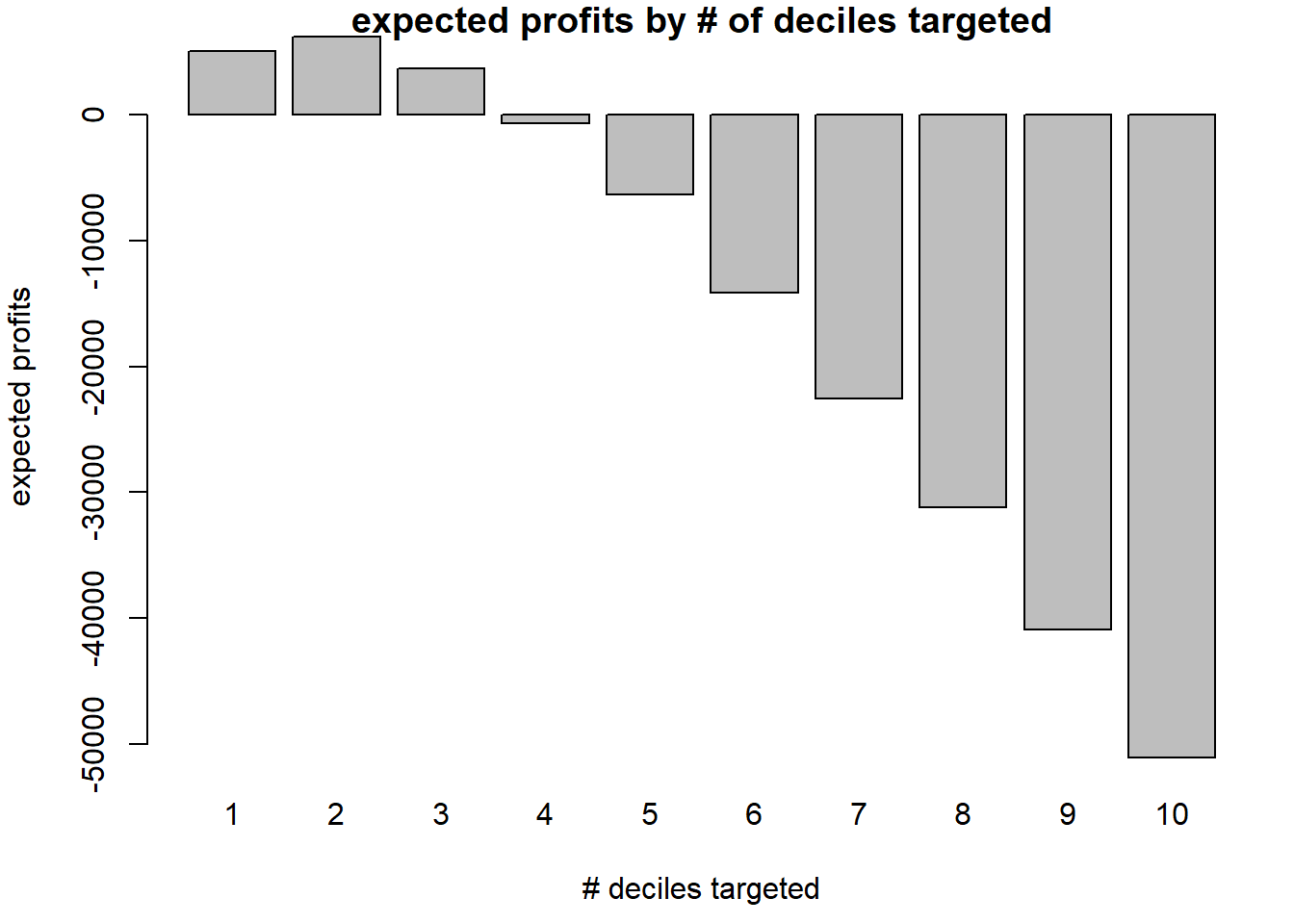

Selecting deciles to target

Once we have used the model to put customers in the right decile,

targeting is simple. We calculate the profit from each n-tile and target

customers who are in the profitable tiles. We will use the proactive

churn framework from Blattberg, Kim and Neslin to calculate expected

profits. This approach takes into account the actual proportion of

churners as identified by the model.

The key parameter is βK,

the proportion of churners in the top K deciles contacted.

βK=∑Kk=1rknk∑Kk=1nkwhereK=1,2,..…,10

We calculate β, the

probability that a targeted customer is a churner, by taking the

cumulative proportion of churners in the top k deciles.

gamma = 0.1

LTV = 500

delta = 50

c = 0.50

profit_table<-lift_table %>% mutate(

cum_prop_churners = cumsum(actual_churn*n_customers)/cum_customers,

profit = cum_customers*((gamma*LTV+delta*(1-gamma))*cum_prop_churners-delta-c),

decile=11-decile)

head(profit_table) %>%

kbl() %>%

kable_styling()

|

decile

|

actual_churn

|

lift

|

n_customers

|

cum_customers

|

cum_lift

|

cum_prop_churners

|

profit

|

|

1

|

0.785

|

2.868

|

209

|

209

|

28.7

|

0.785

|

5026

|

|

2

|

0.591

|

2.161

|

208

|

417

|

50.3

|

0.688

|

6206

|

|

3

|

0.404

|

1.476

|

208

|

625

|

65.1

|

0.594

|

3682

|

|

4

|

0.311

|

1.137

|

209

|

834

|

76.5

|

0.523

|

-697

|

|

5

|

0.245

|

0.896

|

208

|

1042

|

85.4

|

0.467

|

-6356

|

|

6

|

0.139

|

0.510

|

208

|

1250

|

90.5

|

0.413

|

-14105

|

par(mai=c(.9,.8,.2,.2))

bp<-barplot(profit_table$profit ~ profit_table$decile, main="expected profits by # of deciles targeted", xlab="# deciles targeted", ylab="expected profits")

We see from the table below that given this model, the profit

maximizing number of deciles to target is the top 2.

LS0tDQp0aXRsZTogIlR1dG9yaWFsIDM6IExvZ2l0IFJlZ3Jlc3Npb25zIg0KYXV0aG9yOiAiRGFuaWVsIFJlZGVsIg0KZGF0ZTogIjIwMjItMTEtMDciDQpvdXRwdXQ6IA0KICBodG1sX2RvY3VtZW50Og0KICAgIHRvYzogVFJVRQ0KICAgIHRvY19mbG9hdDogVFJVRQ0KICAgIGNvZGVfZG93bmxvYWQ6IFRSVUUNCi0tLQ0KDQojIyMgSW50cm9kdWN0aW9uDQoNCkxvZ2lzdGljIHJlZ3Jlc3Npb24gaXMgdGhlIG1vc3QgY29tbW9ubHkgdXNlZCBzdGF0aXN0aWNhbCB0ZWNobmlxdWUgZm9yIGJpbmFyeSByZXNwb25zZSBkYXRhLiBNYW55IG1hcmtldGluZyBhcHBsaWNhdGlvbnMgYXJlIGNvbmNlcm5pbmcgYmluYXJ5IGNvbnN1bWVyIGRlY2lzaW9uczoNCg0KLSAgIGRvZXMgYSBjb25zdW1lciByZXNwb25kIG9yIG5vdCByZXNwb25kIHRvIG1hcmtldGluZz8NCi0gICBkbyB0aGV5IHN1YnNjcmliZSBvciBub3Qgc3Vic2NyaWJlPw0KLSAgIGRvIHRoZXkgY2h1cm4gb3Igbm90IGNodXJuPw0KDQpXZSdsbCB1c2UgYSBkYXRhIHNldCBvbiBjdXN0b21lciBjaHVybiBmb3IgYSB0ZWxlY29tbXVuaWNhdGlvbnMgY29tcGFueSB3aXRoIHNldmVyYWwgZGlmZmVyZW50IHNlcnZpY2VzLiBXZSdsbCB1c2UgZGVtb2dyYXBoaWMsIHNlcnZpY2UgdXNhZ2UsIGFuZCBjdXN0b21lciBoaXN0b3J5IHRvIHByZWRpY3QgY2h1cm4uIFdlIHRoZW4gYXBwbHkgdGhpcyBtb2RlbCB0byBhIG5ldywgaG9sZG91dCBzZXQgb2YgY3VzdG9tZXJzLiBXZSBjYWxjbGF0ZSB0aGUgY29uZnVzaW9uIG1hdHJpeCwgdGhlIGxpZnQgdGFibGUsIGFuZCB1c2UgaXQgdG8gZG8gdGFyZ2V0ZWQgcHJvYWN0aXZlIGNodXJuIHNlbGVjdGlvbi4NCg0KIyMjIEluc3RhbGxpbmcgdGhlIHBhY2thZ2VzIGFuZCBsb2FkaW5nIHRoZSBkYXRhDQoNCmBgYHtyLCB3YXJuaW5nPUZBTFNFLCBtZXNzYWdlPUZBTFNFLCBlcnJvcj1GQUxTRX0NCiMgaW5zdGFsbC5wYWNrYWdlcygicFJvYyIpDQojIGluc3RhbGwucGFja2FnZXMoInBsb3RyaXgiKSAgIA0KbGlicmFyeShjYXIpDQpsaWJyYXJ5KHRpZHl2ZXJzZSkNCmxpYnJhcnkocFJPQykNCmxpYnJhcnkocGxvdHJpeCkgIA0KbGlicmFyeSh0aWR5dmVyc2UpDQpsaWJyYXJ5KHJlYWRyKQ0KbGlicmFyeShrYWJsZUV4dHJhKQ0KDQojIHNldCB3b3JraW5nIGRpcmVjdG9yeSANCnRlbGNvIDwtIHJlYWRfY3N2KCJ0ZWxjby5jc3YiKQ0KdGVsY29faG9sZG91dCA8LSByZWFkX2NzdigidGVsY29faG9sZG91dC5jc3YiKQ0KDQpvcHRpb25zKCJzY2lwZW4iPTIwMCwgImRpZ2l0cyI9MykNCmBgYA0KDQojIyMgSW5zcGVjdGluZyB0aGUgZGF0YQ0KDQpMZXQncyBnZXQgcmlkIG9mIHRoZSBJRCBjb2x1bW4sIHNpbmNlIHdlIG5ldmVyIG5lZWQgdG8gdXNlIGl0LiBXZSdsbCBtYWtlIHNlbmlvciBjaXRpemVuIGEgZmFjdG9yIHZhcmlhYmxlLCBhbmQgcmVjb2RlIHRvdGFsIGNoYXJnZXMgc28gdGhhdCBpdCdzIGluIHRob3VzYW5kcyBvZiBkb2xsYXJzLiBXZSBhbHNvIG5lZWQgdG8gcmVjb2RlIENodXJuIGZvciB5ZXMvbm8gdG8gMC8xLg0KDQpgYGB7cn0NCiMgZHJvcCB0aGUgSUQgY29sdW1uLCBtYWtlIHNlbmlvciBjaXRpemVuIGEgZmFjdG9yIHZhcmlhYmxlLCBhbmQgZGl2aWRlIHRvdGFsY2hhcmdlcyBieSAxMDAwDQp0ZWxjbyA8LSB0ZWxjb1stYygxKV0NCnRlbGNvJFNlbmlvckNpdGl6ZW48LWFzLmZhY3Rvcih0ZWxjbyRTZW5pb3JDaXRpemVuKQ0KdGVsY28kVG90YWxDaGFyZ2VzPC10ZWxjbyRUb3RhbENoYXJnZXMvMTAwMA0KDQojIENoYW5nZSBDaHVybiBmcm9tICJubyIgInllcyIgdG8gMCAxDQp0ZWxjbyA8LSB0ZWxjbyAlPiUNCiAgICAgIG11dGF0ZShDaHVybiA9IGlmZWxzZShDaHVybiA9PSAiTm8iLDAsMSkpDQpgYGANCg0KIyMjIENodXJuDQoNCldoYXQgZnJhY3Rpb24gb2YgY3VzdG9tZXJzIGNodXJuIChxdWl0KT8gVGhpcyBpcyB0aGUgZGVwZW5kZW50IHZhcmlhYmxlIHdlIHdhbnQgdG8gcHJlZGljdC4gV2UgbmVlZCB0byB1c2UgdGhlICJhcy5udW1lcmljIiBmdW5jdGlvbiB0byB0cmFuc2Zvcm0gaXQgZnJvbSBhIGZhY3RvciB2YXJpYWJsZSB0byBhIDAvMSBjb250aW51b3VzIHZhcmlhYmxlIGluIFIuIFdlIHJlcG9ydCB0aGUgYXZlcmFnZSBjaHVybiByYXRlIG9mIHRoZSBjdXN0b21lciBiZWxvdy4NCg0KYGBge3J9DQpzdW1tYXJ5KHRlbGNvJENodXJuKQ0KcmJhciA8LSBtZWFuKHRlbGNvJENodXJuKQ0KYGBgDQoNClRoZSBhdmVyYWdlIGNodXJuIHJhdGUgaW4gdGhlIGN1c3RvbWVyIGJhc2UgaXMgYHIgcm91bmQocmJhciwzKWAuDQoNCiMjIyBUZW51cmUNCg0KT25lIGltcG9ydGFudCBkcml2ZXIgb2YgY2h1cm4gaXMgbGlrZWx5IHRvIGJlICoqdGVudXJlKiosIGhvdyBsb25nIGEgY3VzdG9tZXIgaGFzIGJlZW4gYSBjdXN0b21lciBmb3IuIFdlIGNhbiBzZWUgYmVsb3cgdGhhdCB0aGVyZSBpcyBhIHNwaWtlIGF0IDEsIG1hbnkgY3VzdG9tZXJzIGp1c3Qgc3RhcnRlZCwgYW5kIGEgc21hbGxlciBwZWFrIGF0IDcyLg0KDQpgYGB7ciwgd2FybmluZz1GQUxTRSwgbWVzc2FnZT1GQUxTRX0NCnBhcihtYWk9YyguOSwuOCwuMiwuMikpDQpoaXN0KHRlbGNvJHRlbnVyZSwgbWFpbiA9ICIiLCB4bGFiPSJUZW51cmUgKCMgbW9udGhzIGEgY3VzdG9tZXIpIiwgYnJlYWtzID0gNzEpDQpgYGANCg0KIyMjIyBDaHVybiBSYXRlIFZhcmlhdGlvbg0KDQpIb3cgZG9lcyB0aGUgcmF0ZSBjaHVybiB2YXJ5IGJ5IHRlbnVyZT8gV2UgY3JlYXRlIGEgZGF0YXNldCBvZiBsZW5ndGggNzIsIG9uZSBmb3IgZWFjaCBsZXZlbCBvZiB0ZW51cmUuIFdlIGNhbGN1bGF0ZSB0aGUgcHJvcG9ydGlvbiBjaHVybmluZywgbnVtYmVyIG9mIGNodXJuZXJzIChuX2NodXJuKSwgbnVtYmVyIG9mIGN1c3RvbWVycyBpbiB0aGUgdGVudXJlIGdyb3VwLCB0aGUgc3RhbmRhcmQgZXJyb3Igb2YgdGhlIHByb3BvcnRpb24gY2h1cm5pbmcgKGRpc2N1c3NlZCBpbiBwcmV2aW91cyBsZWN0dXJlcyksIGFuZCB0aGUgbG93ZXIgYW5kIHVwcGVyIGNvbmZpZGVuY2UgaW50ZXJ2YWxzLg0KDQpgYGB7ciwgd2FybmluZz1GQUxTRX0NCmNodXJuX3RlbnVyZSA8LSB0ZWxjbyAlPiUgDQogIGFzLmRhdGEuZnJhbWUoKSAlPiUgDQogIGdyb3VwX2J5KHRlbnVyZSkgJT4lIA0KICBzdW1tYXJpemUodGVudXJlPW1lYW4odGVudXJlKSwgDQogICAgICAgICAgICBwX2NodXJuPW1lYW4oQ2h1cm4pLCANCiAgICAgICAgICAgIG5fY2h1cm5lcnM9c3VtKENodXJuKSwgbj1uKCksIA0KICAgICAgICAgICAgcF9jaHVybl9zZT0gc3FydCgocF9jaHVybikqKDEtcF9jaHVybikvbikpICU+JSANCiAgbXV0YXRlKGxvd2VyX0NJX3BjaHVybiA9IHBfY2h1cm4gLSAxLjk2KnBfY2h1cm5fc2UsICMjIENJIG9mIGNodXJuIGJ5IHRlbnVyZS1sZXYuDQogICAgICAgICB1cHBlcl9DSV9wY2h1cm4gPSBwX2NodXJuICsgMS45NipwX2NodXJuX3NlKSANCmhlYWQoY2h1cm5fdGVudXJlKSAlPiUgDQogIGtibCgpICU+JQ0KICBrYWJsZV9zdHlsaW5nKCkNCmBgYA0KDQpgYGB7cn0NCnBhcihtYWk9YyguOSwuOCwuMiwuMikpDQpwbG90KHggPSBjaHVybl90ZW51cmUkdGVudXJlLCB5ID0gY2h1cm5fdGVudXJlJHBfY2h1cm4sIG1haW49IlByb3BvcnRpb24gb2YgY3VzdG9tZXJzIHdobyBjaHVybiBieSB0ZW51cmUiLCB4bGFiPSJUZW51cmUgKCMgbW9udGhzIGEgY3VzdG9tZXIpIiwgeWxhYj0icHJvcG9ydGlvbiBvZiBjdXN0b21lciBjaHVybmluZyIpDQpgYGANCg0KVGhlIGZpZ3VyZSBzaG93cyBhIGNsZWFyIG5lZ2F0aXZlIHJlbGF0aW9uc2hpcDogdGhlIGxvbmdlciB0aGUgY3VzdG9tZXIgaGFzIGJlZW4gYSBjdXN0b21lciwgdGhlIGxvd2VyIHRoZSBwcm9iYWJpbGl0eSBvZiBjaHVybiAoY2h1cm4gcmF0ZSkuDQoNCiMjIyBFc3RpbWF0aW5nIHRoZSBsb2dpc3RpYyByZWdyZXNzaW9uDQoNCi0gICAqKk1vZGVsIDAqKiBpcyB0aGUgc2ltcGxlc3Q6IFRoZSBvbmx5IHZhcmlhYmxlIGlzIHRlbnVyZSBhbmQgaXQgaXMgdHJlYXRlZCBhcyBhIGNvbnRpbnVvdXMgdmFyaWFibGUuDQoNCmBgYHtyfQ0KIyBmaXQgDQptb2RlbF8wIDwtIGdsbShDaHVybiB+IHRlbnVyZSwgZGF0YT10ZWxjbywgZmFtaWx5ID0gYmlub21pYWwobGluaz0ibG9naXQiKSkNCg0KIyBzaG93IHVzIGNvZWZmaWNpZW50cyBhbmQgb3RoZXIgbW9kZWwgZml0IHN0YXRpc3RpY3MNCnN1bW1hcnkobW9kZWxfMCkNCmBgYA0KDQpgYGB7ciwgZWNobz1GQUxTRX0NCmV4cCgtMC4wMzkwMSktMQ0KYGBgDQoNCkludGVycHJldGF0aW9uOiBIYXZpbmcgMSBhZGRpdGlvbmFsIHVuaXQgb2YgdGVudXJlIG9mICoqZGVjcmVhc2VzKiogdGhlIG9kZHMgb2YgY2h1cm4gYnkgYDAuMDM4M2BvciBieSBgMy44JWAuDQoNCioqUGxvdCoqOiBDb21wYXJlIG9ic2VydmVkIHByb3BvcnRpb24gb2YgY2h1cm4gYnkgdGVudXJlIGNhbGN1bGF0ZWQgc2VwYXJhdGVseSAqZm9yIGVhY2ggbGV2ZWwgb2YgdGVudXJlKjsgd2l0aCBtb2RlbCBwcmVkaWN0aW9ucy4NCg0KSSdtIGp1c3QgY3JlYXRpbmcgYSBuZXcgZGF0YSB3aXRoIHRoZSByZWdyZXNzaW9uIHJlc3VsdHM6DQoNCmBgYHtyfQ0KIyBjcmVhdGUgZGF0YSBzZXQgb2YgdGVudXJlIGZyb20gMSB0byA3Mg0KcGxvdGRhdCA8LSBkYXRhLmZyYW1lKHRlbnVyZT0oMTo3MikpDQoNCiMgcHV0IHByZWRpY3Rpb25zIGFuZCA5NSUgY29uZmlkZW5jZSBpbnRlcnZhbHMgb2YgdGhvc2UgDQpwcmVkZGF0IDwtIHByZWRpY3QobW9kZWxfMCwNCiAgICAgICAgICAgICAgIHR5cGUgPSAibGluayIsDQogICAgICAgICAgICAgICBuZXdkYXRhPXBsb3RkYXQsICMjIFByZWRpY3Rpb24gYnkgZWFjaCBsZXZlbCBvZiB0ZW51cmUNCiAgICAgICAgICAgICAgIHNlLmZpdD1UUlVFKSAlPiUgDQogIGFzLmRhdGEuZnJhbWUoKSAlPiUgDQogIG11dGF0ZSh0ZW51cmU9KDE6NzIpLCAjIyMgSEVSRSB3ZSBhcmUgcHV0dGluZyBvdXIgcmVzdWx0cyAjIyMjDQogIyBtb2RlbCBvYmplY3QgbW9kZWxfMCBoYXMgYSBjb21wb25lbnQgY2FsbGVkIGxpbmtpbnYgdGhhdCANCiAjIGlzIGEgZnVuY3Rpb24gdGhhdCBpbnZlcnRzIHRoZSBsaW5rIGZ1bmN0aW9uIG9mIHRoZSBHTE06DQogICAgICAgICBsb3dlciA9IG1vZGVsXzAkZmFtaWx5JGxpbmtpbnYoZml0IC0gMS45NipzZS5maXQpLCANCiAgICAgICAgIHBvaW50LmVzdGltYXRlID0gbW9kZWxfMCRmYW1pbHkkbGlua2ludihmaXQpLCANCiAgICAgICAgIHVwcGVyID0gbW9kZWxfMCRmYW1pbHkkbGlua2ludihmaXQgKyAxLjk2KnNlLmZpdCkpDQpgYGANCg0KKipGaW5hbCBQbG90Kio6DQoNCmBgYHtyfQ0KIyBwbG90IGFjdHVhbCB2cy4gbG9naXN0aWMgcmVncmVzc2lvbg0KcGFyKG1haT1jKC45LC44LC4yLC4yKSkNCnBsb3QoeCA9IGNodXJuX3RlbnVyZSR0ZW51cmUsIHkgPSBjaHVybl90ZW51cmUkcF9jaHVybiwgbWFpbj0iUHJvcG9ydGlvbiBvZiBjdXN0b21lcnMgd2hvIGNodXJuIGJ5IHRlbnVyZSIsIHhsYWI9IlRlbnVyZSAoIyBtb250aHMgYSBjdXN0b21lcikiLCB5bGFiPSJwcm9wb3J0aW9uIG9mIGN1c3RvbWVyIGNodXJuaW5nIikNCmxpbmVzKHg9cHJlZGRhdCR0ZW51cmUsIHk9cHJlZGRhdCRwb2ludC5lc3RpbWF0ZSwgY29sPSJyZWQiLCBsd2Q9MikNCmxlZ2VuZCgndG9wcmlnaHQnLGxlZ2VuZD1jKCJjaHVybiBwcm9wb3J0aW9uIiwgImxvZ2lzdGljIHJlZ3Jlc3Npb24iKSxjb2w9YygiYmxhY2siLCJyZWQiKSxwY2g9YygxLE5BKSxsdHk9YyhOQSwxKSwgbHdkPWMoTkEsMikpDQoNCmVxIDwtIHBhc3RlMCgibG9naXQocCkgPSAiLHJvdW5kKGNvZWYobW9kZWxfMClbMV0sNCksDQogICAgICAgICAgICAgaWZlbHNlKGNvZWYobW9kZWxfMClbMl08MCxyb3VuZChjb2VmKG1vZGVsXzApWzJdLDQpLA0KICAgICAgICAgICAgICAgICAgICBwYXN0ZSgiKyIscm91bmQoY29lZihtb2RlbF8wKVsyXSw0KSkpLA0KICAgICAgICAgICAgICAgICAgICBwYXN0ZSgiIHRlbnVyZSIpKQ0KIyBwdXRzIGVxdWF0aW9uIGluIGZpZ3VyZQ0KbXRleHQoZXEsIDEsLTMpDQpgYGANCg0KQ29tcGFyZSB0aGUgY29uZmlkZW5jZSBpbnRlcnZhbHMgb2YgdGhlIG1vZGVsIHByZWRpY3Rpb25zICgqZGFzaGVkIHJlZCopIHRvIHRob3NlIGJ5IGRvaW5nIHRoZW0gc2VwYXJhdGVseSBmb3IgZWFjaCBsZXZlbCBvZiB0ZW51cmUuIFlvdSBjYW4gc2VlIHdlIGdldCBxdWl0ZSBhIHJlZHVjdGlvbiBpbiB1bmNlcnRhaW50eSBieSBoYXZpbmcgYSBtb2RlbCB0aGF0IHJlbGF0ZXMgdGhlc2UgcHJvcG9ydGlvbnMgdG8gZWFjaCBvdGhlci4NCg0KVGhlIGNvc3Qgb2Ygb3VyICoqbG93ZXIgZXJyb3IqKiBvciBlcnJvciByZWR1Y3Rpb24gaXMgKipoaWdoZXIgYmlhcyoqIC0tIGlmIHRoZSBtb2RlbCdzIGZ1bmN0aW9uYWwgZm9ybSBkZXZpYXRlcyBmcm9tIHRoZSBhY3R1YWwgcmVzcG9uc2UgcmF0ZS4gSW4gb3RoZXIgd29yZHMsIHdlIGhhdmUgcmVkdWNlZCB2YXJpYW5jZSwgYnV0IGF0IHRoZSBleHBlbnNlIG9mIGJpYXMuDQoNCmBgYHtyfQ0KcGFyKG1haT1jKC45LC44LC4yLC4yKSkNCnBsb3RDSSh4ID0gY2h1cm5fdGVudXJlJHRlbnVyZSwgICAgICAgICAgICAgICAjIHBsb3RyaXggcGxvdCB3aXRoIGNvbmZpZGVuY2UgaW50ZXJ2YWxzDQogICAgICAgeSA9IGNodXJuX3RlbnVyZSRwX2NodXJuLA0KICAgICAgIGxpID0gY2h1cm5fdGVudXJlJGxvd2VyX0NJX3BjaHVybiwNCiAgICAgICB1aSA9IGNodXJuX3RlbnVyZSR1cHBlcl9DSV9wY2h1cm4sIG1haW49IlByb3BvcnRpb24gb2YgY3VzdG9tZXJzIHdobyBjaHVybiBieSB0ZW51cmUiLCB4bGFiPSJUZW51cmUgKCMgbW9udGhzIGEgY3VzdG9tZXIpIiwgeWxhYj0icHJvcG9ydGlvbiBvZiBjdXN0b21lciBjaHVybmluZyIpDQoNCmxpbmVzKHg9cHJlZGRhdCR0ZW51cmUsIHk9cHJlZGRhdCRwb2ludC5lc3RpbWF0ZSwgY29sPSJyZWQiLCBsd2Q9MiwgdHlwZSA9ICJsIikNCmxpbmVzKHg9cHJlZGRhdCR0ZW51cmUsIHk9cHJlZGRhdCRsb3dlciwgY29sPSJyZWQiLCBsdHk9MiwgbHdkPTEsIHR5cGUgPSAibCIpDQpsaW5lcyh4PXByZWRkYXQkdGVudXJlLCB5PXByZWRkYXQkdXBwZXIsIGNvbD0icmVkIiwgbHR5PTIsIGx3ZD0xLCB0eXBlID0gImwiKQ0KDQpgYGANCg0KLSAgICoqTW9kZWwgMSoqIGlzIG1vcmUgY29tcGxleDogKipldmVyeSB2YXJpYWJsZSBpcyBpbmNsdWRlZCoqLCBub3QganVzdCB0ZW51cmU7IHRlbnVyZSBpcyB0cmVhdGVkIGFzIGEgY29udGludW91cyB2YXJpYWJsZSBhcyBiZWZvcmUuDQoNCmBgYHtyfQ0Kb3B0aW9ucyh3aWR0aCA9IDIwMCkNCm1vZGVsXzEgPC0gZ2xtKENodXJuIH4gLiAsIGRhdGE9dGVsY28sIGZhbWlseT0iYmlub21pYWwiKQ0KYGBgDQoNCi0gICAqKk1vZGVsIDIqKiBpcyBtb3JlIGNvbXBsZXg6IGxpa2UgTW9kZWwgMSwgZXhjZXB0IHRoYXQgKip0ZW51cmUgaXMgdHJlYXRlZCBhIGNhdGVnb3JpY2FsIHZhcmlhYmxlKiouIEluIG90aGVyIHdvcmRzIHRoZXJlIGlzIGEgZHVtbXkgdmFyaWFibGUgZm9yIGV2ZXJ5IGxldmVsIG9mIHRlbnVyZSBidXQgb25lLiBUaGlzIHdheSwgd2UgY2FuICpmbGV4aWJseSBjYXB0dXJlIGEgcGF0dGVybiBiZXR3ZWVuKiB0ZW51cmUgYW5kIGNodXJuLiBJbiBSLCBhbGwgeW91IGhhdmUgdG8gZG8gaXMgd3JpdGUgKiphcy5mYWN0b3IodGVudXJlKSoqIGluc3RlYWQgb2YgKip0ZW51cmUqKi4NCg0KYGBge3J9DQptb2RlbF8yIDwtIGdsbShDaHVybiB+IC4gK2FzLmZhY3Rvcih0ZW51cmUpIC10ZW51cmUgLCBkYXRhPXRlbGNvLCBmYW1pbHk9ImJpbm9taWFsIikNCmBgYA0KDQotICAgKipNb2RlbCAyKiogaGFzIGByIGxlbmd0aChjb2VmKG1vZGVsXzIpKWAgY29lZmZpY2llbnRzLg0KLSAgICoqTW9kZWwgMyoqIGlzIHRoZSBtb3N0IGNvbXBsZXg6IGxpa2UgTW9kZWwgMiwgZXhjZXB0IHRoYXQgdGhlcmUgaXMgYW4gKippbnRlcmFjdGlvbiBiZXR3ZWVuIHBheW1lbnQgdHlwZSBhbmQgdGVudXJlKiouIE5vdGUgaW4gZ2VuZXJhbCBhbmQgaW50ZXJhY3Rpb24gaXMgdGhlIGNvZWZmaWNpZW50IG9uIHRoZSBwcm9kdWN0IG9mIHR3byB2YXJpYWJsZXMuDQoNCmBgYHtyfQ0KbW9kZWxfMyA8LSBnbG0oQ2h1cm4gfiAuICthcy5mYWN0b3IodGVudXJlKSphcy5mYWN0b3IoUGF5bWVudE1ldGhvZCkgLXRlbnVyZSAtUGF5bWVudE1ldGhvZCwgZGF0YT10ZWxjbywgZmFtaWx5PSJiaW5vbWlhbCIpDQpgYGANCg0KLSAgICoqTW9kZWwgMyoqIGhhcyBgciBsZW5ndGgoY29lZihtb2RlbF8zKSlgIGNvZWZmaWNpZW50cy4gTm90ZSBhIGxvdCBvZiB0aGVtIGhhdmUgbGFyZ2UgY29lZmZpY2llbnRzIGFuZCBsYXJnZSBzdGFuZGFyZCBlcnJvcnMuIElmIGEgdmFyaWFibGUgaXMgemVybyBhbG1vc3QgYWx3YXlzLCAodGVudXJlPT0zNClcKihQYXltZW50TWV0aG9kPT1FbGVjdHJvbmljIGNoZWNrKSwgdGhlcmUgaXMgbGl0dGxlIHZhcmlhdGlvbiB0byBlc3RpbWF0ZSB0aGUgY29lZmZpY2llbnQsIG1ha2luZyBpdCBsb29rIHVuc3RhYmxlLg0KDQotICAgU28sIHdlJ3ZlIGVzdGltYXRlZCAzIG1vZGVscyBlYWNoIG9uZSBpbmNyZWFzaW5nIGluIHRoZSBudW1iZXIgb2YgY29lZmZpY2llbnRzLiBMZXQncyBzZWUgaG93IHdlbGwgdGhleSBwcmVkaWN0Lg0KDQojIyMgRGV2aWFuY2UgYW5kIHByb3BvcnRpb24gb2YgZGV2aWFuY2UgZXhwbGFpbmVkIChSMikNCg0KRGV2aWFuY2UgaXMgYW4gZXJyb3IgbWVhc3VyZSwgJC0yIFxsbihcdGV4dHJte2xpa2VsaWhvb2R9KSQuIFdlIHdhbnQgaXQgdG8gYmUgYXMgc21hbGwgYXMgcG9zc2libGUuIFRoZSBkaWZmZXJlbmNlIGJldHdlZW4gdGhlIHJlc2lkdWFsIGFuZCB0aGUgbnVsbCBkZXZpYW5jZSB0aGVuIGdpdmVzIHVzIHNvbWUgc2Vuc2Ugb2YgaG93IHdlbGwgb3VyIG1vZGVsIGZpdHMgb3ZlcmFsbCwgdGFrZW4gdG9nZXRoZXIuDQoNCllvdSBjYW4gYWxzbyBsb29rIGF0IHRoZSBwcm9wb3J0aW9uIG9mIGRldmlhbmNlIGV4cGxhaW5lZCBieSB0aGUgdmFyaWFibGVzIGluIHRoZSBtb2RlbC4NCg0KJCQNClJeMiA9IFxmcmFje0RfMCAtIER9e0RfMH0gPSAxIC0gXGZyYWN7RH17RF8wfQ0KJCQNCg0KYGBge3J9DQptb2RlbHMgPC0gcGFzdGUwKCJtb2RlbF8iLCAwOjMpICMgbGlzdCBvZiBtb2RlbHMNCkQgPC0gc2FwcGx5KG1vZGVscywgZnVuY3Rpb24oeCkgZ2V0KHgpJGRldmlhbmNlKSAjIGdldCBkZXZpYW5jZSBEIGZvciBlYWNoDQpEMCA8LSBtb2RlbF8wJG51bGwuZGV2aWFuY2UgIyBEXzAgaXMgdGhlIHNhbWUgZm9yIGFsbCBtb2RlbHMNClIyIDwtIDEtRC9EMA0KYGBgDQoNCmBgYHtyfQ0KcGFyKG1haT1jKC45LC44LC4yLC4yKSkNCmJhcnBsb3QoUjIsIG5hbWVzLmFyZyA9IGMoIm1vZGVsIDAiLCJtb2RlbCAxIiwgIm1vZGVsIDIiLCAibW9kZWwgMyIpLCBtYWluPWV4cHJlc3Npb24ocGFzdGUoIkluLVNhbXBsZSBSIl4iMiIpKSwgeGxhYj0iTW9kZWwiLCB5bGFiPWV4cHJlc3Npb24ocGFzdGUoIlIiXiIyIikpKQ0KYGBgDQoNCk1vZGVscyAwLCAxLCAyIGFuZCAzIGFyZSBleHBsYWluaW5nIGByIHJvdW5kKFIyWzFdLDIpKjEwMGAlIGByIHJvdW5kKFIyWzJdLDIpKjEwMGAlLCBgciByb3VuZChSMlszXSwyKSoxMDBgJSBhbmQgYHIgcm91bmQoUjJbNF0sMikqMTAwYCUsIHJlc3BlY3RpdmVseSwgb2YgdGhlIGRldmlhbmNlIGluIGN1c3RvbWVyIGNodXJuLg0KDQojIyMgT3ZlcmZpdHRpbmcsIEstZm9sZCBvdXQgb2Ygc2FtcGxlDQoNCioqQnV0LCBpcyB0aGUgYmV0dGVyIHBlcmZvcm1hbmNlIG9mIG1vZGVsIGEgcmVzdWx0IG9mIG92ZXJmaXR0aW5nPyoqDQoNCldoYXQgd2UgcmVhbGx5IGNhcmUgYWJvdXQgaXMgYmVpbmcgYWJsZSB0byBwcmVkaWN0ICoqbmV3KiogZGF0YS4gVGhlIFIyIGFuZCBkZXZpYW5jZSBtZWFzdXJlcyBhcmUgYWxsIGFib3V0IGluLXNhbXBsZSwgbm90IG91dC1vZi1zYW1wbGUgZml0LiBTbyBpdCBkb2Vzbid0IHRlbGwgdXMgaG93IHdlbGwgb3VyIG1vZGVsIHBlcmZvcm1zIG9uIG90aGVyIGRhdGEuDQoNCldlIGNhbiBtaW1pYyB0aGUgcHJlc2VuY2Ugb2YgbmV3IGRhdGEgYnkgaG9sZGluZyBvdXQgcGFydCBvZiB0aGUgZGF0YS4NCg0KV2UgdXNlIEstZm9sZCBvdXQgb2Ygc2FtcGxlIHZhbGlkYXRpb24uDQoNCmBgYHtyLCBjYWNoZT1UUlVFfQ0KIyB5b3UgZG9uJ3QgbmVlZCB0byBrbm93IGhvdyB0byB3cml0ZSB0aGlzIGNvZGUuDQpzZXQuc2VlZCgxOTEwMykNCm4gPSBucm93KHRlbGNvKQ0KSyA9IDEwICMgIyBmb2xkcw0KZm9sZGlkID0gcmVwKDE6SywgZWFjaD1jZWlsaW5nKG4vSykpW3NhbXBsZSgxOm4pXQ0KIyBmb2xkaWRbMToxMF0NCk9PUyA8LSBkYXRhLmZyYW1lKG1vZGVsMD1yZXAoTkEsIEspLCBtb2RlbDE9cmVwKE5BLEspLCBtb2RlbDI9cmVwKE5BLEspLCBtb2RlbDM9cmVwKE5BLEspKQ0KDQoNCiMjIHByZWQgbXVzdCBiZSBwcm9iYWJpbGl0aWVzICgwPHByZWQ8MSkgZm9yIGJpbm9taWFsDQogIGRldmlhbmNlIDwtIGZ1bmN0aW9uKHksIHByZWQsIGZhbWlseT1jKCJnYXVzc2lhbiIsImJpbm9taWFsIikpew0KICAgIGZhbWlseSA8LSBtYXRjaC5hcmcoZmFtaWx5KQ0KICAgIGlmKGZhbWlseT09ImdhdXNzaWFuIil7DQogICAgICByZXR1cm4oIHN1bSggKHktcHJlZCleMiApICkNCiAgICB9ZWxzZXsNCiAgICAgIGlmKGlzLmZhY3Rvcih5KSkgeSA8LSBhcy5udW1lcmljKHkpPjENCiAgICAgIHJldHVybiggLTIqc3VtKCB5KmxvZyhwcmVkKSArICgxLXkpKmxvZygxLXByZWQpICkgKQ0KICAgIH0NCiAgfQ0KDQojIyBnZXQgbnVsbCBkZXZhaW5jZSB0b28sIGFuZCByZXR1cm4gUjINCiAgUjIgPC0gZnVuY3Rpb24oeSwgcHJlZCwgZmFtaWx5PWMoImdhdXNzaWFuIiwiYmlub21pYWwiKSl7DQogIGZhbSA8LSBtYXRjaC5hcmcoZmFtaWx5KQ0KICBpZihmYW09PSJiaW5vbWlhbCIpew0KICAgIGlmKGlzLmZhY3Rvcih5KSl7IHkgPC0gYXMubnVtZXJpYyh5KT4xIH0NCiAgfQ0KICBkZXYgPC0gZGV2aWFuY2UoeSwgcHJlZCwgZmFtaWx5PWZhbSkNCiAgZGV2MCA8LSBkZXZpYW5jZSh5LCBtZWFuKHkpLCBmYW1pbHk9ZmFtKQ0KICByZXR1cm4oMS1kZXYvZGV2MCkNCiAgfSAgDQoNCiMgdGhpcyBwYXJ0IHdpbGwgdGFrZSBzZXZlcmFsIG1pbnV0ZXMsIGZpdHRpbmcgMyBtb2RlbHMgSyB0aW1lcyBlYWNoDQogIA0KZm9yKGsgaW4gMTpLKXsNCiAgdHJhaW4gPSB3aGljaChmb2xkaWQhPWspICMgZGF0YSB1c2VkIHRvIHRyYWluDQogIA0KICAjIGZpdCByZWdyZXNzaW9ucw0KICBtb2RlbF8wPC0gZ2xtKENodXJuIH4gdGVudXJlLCBkYXRhPXRlbGNvW3RyYWluLF0sIGZhbWlseT0iYmlub21pYWwiKQ0KICBzdW1tYXJ5KG1vZGVsXzApDQogIA0KICBtb2RlbF8xIDwtIGdsbShDaHVybiB+IC4gLCBkYXRhPXRlbGNvW3RyYWluLF0sIGZhbWlseT0iYmlub21pYWwiKQ0KICBzdW1tYXJ5KG1vZGVsXzEpDQogIA0KICBtb2RlbF8yIDwtIGdsbShDaHVybiB+IC4gK2FzLmZhY3Rvcih0ZW51cmUpIC10ZW51cmUsIGRhdGE9dGVsY29bdHJhaW4sXSwgZmFtaWx5PSJiaW5vbWlhbCIpDQogIHN1bW1hcnkobW9kZWxfMikNCiAgDQogIG1vZGVsXzMgPC0gZ2xtKENodXJuIH4gLiArYXMuZmFjdG9yKHRlbnVyZSkqYXMuZmFjdG9yKFBheW1lbnRNZXRob2QpIC10ZW51cmUgLVBheW1lbnRNZXRob2QsIGRhdGE9dGVsY29bdHJhaW4sXSwgZmFtaWx5PSJiaW5vbWlhbCIpDQogIHN1bW1hcnkobW9kZWxfMykNCiAgDQogIA0KICAjIHByZWRpY3Qgb24gaG9sZG91dCBkYXRhICgtdHJhaW4pDQogIHByZWQwPC0gcHJlZGljdChtb2RlbF8wLCBuZXdkYXRhPXRlbGNvWy10cmFpbixdLCB0eXBlID0gInJlc3BvbnNlIikNCiAgcHJlZDE8LSBwcmVkaWN0KG1vZGVsXzEsIG5ld2RhdGE9dGVsY29bLXRyYWluLF0sIHR5cGUgPSAicmVzcG9uc2UiKQ0KICBwcmVkMjwtIHByZWRpY3QobW9kZWxfMiwgbmV3ZGF0YT10ZWxjb1stdHJhaW4sXSwgdHlwZSA9ICJyZXNwb25zZSIpDQogIHByZWQzPC0gcHJlZGljdChtb2RlbF8zLCBuZXdkYXRhPXRlbGNvWy10cmFpbixdLCB0eXBlID0gInJlc3BvbnNlIikNCiAgDQogICMgY2FsY3VsYXRlIFIyDQogIE9PUyRtb2RlbDBba108LVIyKHkgPSB0ZWxjbyRDaHVyblstdHJhaW5dLHByZWQ9cHJlZDAsIGZhbWlseT0iYmlub21pYWwiKQ0KICBPT1MkbW9kZWwxW2tdPC1SMih5ID0gdGVsY28kQ2h1cm5bLXRyYWluXSxwcmVkPXByZWQxLCBmYW1pbHk9ImJpbm9taWFsIikNCiAgT09TJG1vZGVsMltrXTwtUjIoeSA9IHRlbGNvJENodXJuWy10cmFpbl0scHJlZD1wcmVkMiwgZmFtaWx5PSJiaW5vbWlhbCIpDQogIE9PUyRtb2RlbDNba108LVIyKHkgPSB0ZWxjbyRDaHVyblstdHJhaW5dLHByZWQ9cHJlZDMsIGZhbWlseT0iYmlub21pYWwiKQ0KICANCiAgIyBwcmludCBwcm9ncmVzcw0KICBjYXQoaywgIiAgIikNCiAgICANCn0NCmBgYA0KDQpQbG90IFJlc3VsdHM6DQoNCmBgYHtyfQ0KcGFyKG1haT1jKC45LC44LC4yLC4yKSkgIA0KYm94cGxvdChPT1NbLDE6NF0sIGRhdGE9T09TLCBtYWluPWV4cHJlc3Npb24ocGFzdGUoIk91dC1vZi1TYW1wbGUgUiJeIjIiKSksDQogICAgICAgIHhsYWI9Ik1vZGVsIiwgeWxhYj1leHByZXNzaW9uKHBhc3RlKCJSIl4iMiIpKSkNCmBgYA0KDQotICAgTW9kZWwgMyBoYWQgdGhlIGhpZ2hlc3QgaW4tc2FtcGxlICRSXjIkLCBhbmQgbm93IGl0IGhhcyB0aGUgd29yc3Qgb3V0LW9mLXNhbXBsZSAkUl4yJC4gSXQncyBldmVuICoqbmVnYXRpdmUqKiENCg0KLSAgIEJvdHRvbSBsaW5lOiBNb2RlbCAzIGlzIG92ZXItZml0dGluZy4gSXQgaXMgY2FwdHVyaW5nIHBhdHRlcm5zIGluIHRoZSBpbi1zYW1wbGUgZGF0YSB0aGF0IGRvIG5vdCBnZW5lcmFsaXplIHRvIHRoZSBvdXQtb2Ytc2FtcGxlIGRhdGEuIFRoaXMgaXMgd2h5IGl0IGRvZXMgc3VjaCBhIHBvb3Igam9iIGF0IHByZWRpY3RpbmcuDQoNCi0gICBNb2RlbHMgMSBhbmQgMiBoYXZlIGJhc2ljYWxseSB0aGUgc2FtZSBvdXQgb2Ygc2FtcGxlICRSXjIkLg0KDQotICAgVGhpcyBtZWFucyBmYXZvcmluZyB0aGUgc2ltcGxlciBtb2RlbHMuIE1vZGVsIDEsIGJlaW5nIHRoZSBzaW1wbGVzdCwgYW5kIHRpZWQgZm9yIHRoZSBiZXN0IHByZWRpY3RpdmUgcGVyZm9ybWFuY2UgaXMgdGhlIHdpbm5lci4NCg0KIyMjIFByZWRpY3QNCg0KSGVyZSB3ZSB1c2UgbW9kZWwgMSB0byBwcmVkaWN0IHRoZSBwcm9iYWJpbGl0eSBvZiBkZWZhdWx0IGZvciBhIGNlcnRhaW4gY3VzdG9tZXIgd2l0aCBhIHNwZWNpZmljIHByb2ZpbGU6IGEgbWFsZSwgc2VuaW9yIGNpdGl6ZW4gd2l0aG91dCBhIHBhcnRuZXIgb3IgZGVwZW5kZW50cywgZXRjLiBTZWUgYmVsb3cuDQoNCmBgYHtyfQ0KbmV3ZGF0YSA9IGRhdGEuZnJhbWUoZ2VuZGVyID0gIk1hbGUiLCBTZW5pb3JDaXRpemVuPWFzLmZhY3RvcigxKSxQYXJ0bmVyPSJObyIsRGVwZW5kZW50cz0iTm8iLCB0ZW51cmU9NzIsUGhvbmVTZXJ2aWNlPSJZZXMiLE11bHRpcGxlTGluZXM9Ik5vIiwgSW50ZXJuZXRTZXJ2aWNlPSJEU0wiLCBPbmxpbmVTZWN1cml0eT0iTm8iLCBPbmxpbmVCYWNrdXA9Ik5vIiwgRGV2aWNlUHJvdGVjdGlvbj0iTm8iLCBUZWNoU3VwcG9ydD0iWWVzIiwgU3RyZWFtaW5nVFY9IlllcyIsIFN0cmVhbWluZ01vdmllcz0iTm8iLCBDb250cmFjdD0iT25lIHllYXIiLCBQYXBlcmxlc3NCaWxsaW5nPSJObyIsIFBheW1lbnRNZXRob2Q9Ik1haWxlZCBjaGVjayIsIE1vbnRobHlDaGFyZ2VzPTMwLFRvdGFsQ2hhcmdlcz0xKQ0KDQpwcmVkaWN0KG1vZGVsXzEsbmV3ZGF0YSx0eXBlPSJyZXNwb25zZSIpDQpgYGANCg0KVGhlIHByb2JhYmlsaXR5IG9mIGNodXJuIGlzIGxvdy4NCg0KIyMjIEhvbGRvdXQgc2FtcGxlDQoNCk5vdyB3ZSBsb29rIGF0IGhvdyB3ZWxsIG1vZGVsIDEgcGVyZm9ybXMgb24gb25lIGhvbGRvdXQgc2FtcGxlLCAqKmhvbGRvdXRfdGVsY28uY3N2KiouDQoNCmBgYHtyLCBpbmNsdWRlPUZBTFNFLCB3YXJuaW5nPUZBTFNFfQ0KDQpob2xkb3V0X3RlbGNvIDwtIHJlYWRfY3N2KCJ0ZWxjb19ob2xkb3V0LmNzdiIpDQoNCiMgSUQgY29sdW1uIGRvbid0IG5lZWQgdG8gZHJvcC4NCiMgbWFrZSBzZW5pb3IgY2l0aXplbiBhIGZhY3RvciB2YXJpYWJsZSwgYW5kIGRpdmlkZSB0b3RhbGNoYXJnZXMgYnkgMTAwMA0KaG9sZG91dF90ZWxjbyRTZW5pb3JDaXRpemVuPC1hcy5mYWN0b3IoaG9sZG91dF90ZWxjbyRTZW5pb3JDaXRpemVuKQ0KaG9sZG91dF90ZWxjbyRUb3RhbENoYXJnZXM8LWhvbGRvdXRfdGVsY28kVG90YWxDaGFyZ2VzLzEwMDANCg0KIyBDaGFuZ2UgQ2h1cm4gZnJvbSAibm8iICJ5ZXMiIHRvIDAgMQ0KDQpob2xkb3V0X3RlbGNvIDwtIGhvbGRvdXRfdGVsY28gJT4lDQogICAgICBtdXRhdGUoQ2h1cm4gPSBpZmVsc2UoQ2h1cm4gPT0gIk5vIiwwLDEpKQ0Kbl9jaHVybmVyczwtc3VtKGhvbGRvdXRfdGVsY28kQ2h1cm4pDQpyYmFyX2hvIDwtIG1lYW4oaG9sZG91dF90ZWxjbyRDaHVybikNCmBgYA0KDQpUaGUgY2h1cm4gcmF0ZSB3ZSBzZWUgaW4gdGhlIGhvbGRvdXQgc2FtcGxlLCBgciByb3VuZChyYmFyX2hvLDMpYCwgaXMgY2xvc2UgdG8gdGhhdCBpbiB0aGUgZXN0aW1hdGlvbiBzYW1wbGUgd2UgdXNlZCBlYXJsaWVyLCBgciByYmFyYC4NCg0KTm93IHdlIHVzZSB0aGUgbW9kZWwgZXN0aW1hdGVkIG9uIHRoZSBvdGhlciBkYXRhIHRvIG1ha2UgcHJlZGljdGlvbnMgb24gdGhpcyBuZXcgZGF0YS4gTm90ZSB0aGF0IG91ciBwcmVkaWN0ZWQgcHJvYmFiaWxpdGllcyBsaWUgYmV0d2VlbiAwIGFuZCAxLCB3aGVyZWFzIG91ciBkYXRhIGFyZSBiaW5hcnkuIFdlIGNhbiBnZXQgdGhlIHByZWRpY3Rpb25zIGZvciBlYWNoIGN1c3RvbWVyIGFuZCBncmFwaCB0aGVtIHdpdGggdGhlIDAvMSBjaHVybiBkZWNpc2lvbnMuDQoNCmBgYHtyfQ0KIyBwcmVkaWN0ZWQgeCdiZXRhIHBhcnQgb2YgDQp4YiA8LSBwcmVkaWN0KG1vZGVsXzEsIHR5cGUgPSAibGluayIsIG5ld2RhdGE9aG9sZG91dF90ZWxjbykNCiMgdGhlIHByZWRpY3RlZCBwcm9iYWJpbGl0eSANCnByb2IgPC0gcHJlZGljdChtb2RlbF8xLCB0eXBlID0gInJlc3BvbnNlIiwgbmV3ZGF0YT1ob2xkb3V0X3RlbGNvKQ0KaGVhZChjYmluZCh4Yixwcm9iKSkgJT4lIA0KICBrYmwoKSAlPiUNCiAga2FibGVfc3R5bGluZygpDQojIG9yZGVyIGN1c3RvbWVycyBmcm9tIGxlYXN0IGxpa2VseSB0byBjaHVybiAoYWNjb3JkaW5nIHRvIG1vZGVsKSB0byBtb3N0IGxpa2VseQ0KaW5kIDwtIG9yZGVyKHByb2IpDQpgYGANCg0KUGxvdA0KDQpgYGB7cn0NCnBhcihtYWk9YyguOSwuOCwuMiwuMikpDQpwbG90KHhiW2luZF0saG9sZG91dF90ZWxjbyRDaHVybltpbmRdLCBwY2g9NCxjZXg9MC4zLGNvbD0iYmx1ZSIsIHhsYWI9IngnYmV0YSIseWxhYj0iUChDaHVybikgb24gaG9sZG91dCBkYXRhIikNCmxpbmVzKHg9eGJbaW5kXSwgeT1wcm9iW2luZF0sIGNvbD0icmVkIiwgbHdkPTIpDQpsZWdlbmQoJ2xlZnQnLGxlZ2VuZD1jKCJhY3R1YWwiLCAicHJlZGljdGVkIChtb2RlbCAxKSIpLGNvbD1jKCJibHVlIiwicmVkIiksIHBjaD1jKDEsTkEpLGx0eT1jKE5BLDEpLCBsd2Q9YyhOQSwyKSkNCmBgYA0KDQojIyMgQ29uZnVzaW9uIG1hdHJpeA0KDQpXZSBjYW4gYWxzbyAqY2xhc3NpZnkqIHByZWRpY3Rpb25zIGJ5IHR1cm5pbmcgdGhlbSBpbnRvIDAncyBhbmQgMSdzLiBJZiAkXGhhdHtwfV9pID4gMC41LCBcOyBcdGV4dHJte3ByZWR9ID0gMSQgb3RoZXJ3aXNlIDAuDQoNCmBgYHtyfQ0KY29uZnVzaW9uX21hdHJpeCA8LSAodGFibGUoaG9sZG91dF90ZWxjbyRDaHVybiwgcHJvYiA+IDAuNSkpDQpjb25mdXNpb25fbWF0cml4IDwtIGFzLmRhdGEuZnJhbWUubWF0cml4KGNvbmZ1c2lvbl9tYXRyaXgpDQpjb2xuYW1lcyhjb25mdXNpb25fbWF0cml4KSA8LSBjKCJObyIsICJZZXMiKQ0KY29uZnVzaW9uX21hdHJpeCRQZXJjZW50YWdlX0NvcnJlY3QgPC0gY29uZnVzaW9uX21hdHJpeFsxLF0kTm8vKGNvbmZ1c2lvbl9tYXRyaXhbMSxdJE5vK2NvbmZ1c2lvbl9tYXRyaXhbMSxdJFllcykqMTAwDQpjb25mdXNpb25fbWF0cml4WzIsXSRQZXJjZW50YWdlX0NvcnJlY3QgPC0gY29uZnVzaW9uX21hdHJpeFsyLF0kWWVzLyhjb25mdXNpb25fbWF0cml4WzIsXSRObytjb25mdXNpb25fbWF0cml4WzIsXSRZZXMpKjEwMA0KDQpwcmludChjb25mdXNpb25fbWF0cml4KQ0KYGBgDQoNCmBgYHtyfQ0KY2F0KCdPdmVyYWxsIFBlcmNlbnRhZ2U6JywgKGNvbmZ1c2lvbl9tYXRyaXhbMSwxXStjb25mdXNpb25fbWF0cml4WzIsMl0pL25yb3coaG9sZG91dF90ZWxjbykqMTAwKQ0KYGBgDQoNCiMjIyBST0MgY3VydmVzDQoNCmBgYHtyLCB3YXJuaW5nPUZBTFNFLCBtZXNzYWdlPUZBTFNFfQ0KcGFyKG1haT1jKC45LC44LC4yLC4yKSkNCnBsb3Qocm9jKGhvbGRvdXRfdGVsY28kQ2h1cm4sIHByb2IpLCBwcmludC5hdWM9VFJVRSwgDQogICAgIGNvbD0iYmxhY2siLCBsd2Q9MSwgbWFpbj0iUk9DIGN1cnZlIiwgeGxhYj0iU3BlY2lmaWNpdHk6IHRydWUgbmVnYXRpdmUgcmF0ZSIsIHlsYWI9IlNlbnNpdGl2aXR5OiB0cnVlIHBvc2l0aXZlIHJhdGUiLCB4bGltPWMoMSwwKSkNCnRleHQoY29uZnVzaW9uX21hdHJpeCRQZXJjZW50YWdlX0NvcnJlY3RbWzFdXS8xMDAsIGNvbmZ1c2lvbl9tYXRyaXgkUGVyY2VudGFnZV9Db3JyZWN0W1syXV0vMTAwLCAiLjUgdGhyZXNob2xkIikNCmFibGluZShoPWNvbmZ1c2lvbl9tYXRyaXgkUGVyY2VudGFnZV9Db3JyZWN0W1syXV0vMTAwLCBjb2w9InJlZCIsbHdkPS4zKQ0KYWJsaW5lKHY9Y29uZnVzaW9uX21hdHJpeCRQZXJjZW50YWdlX0NvcnJlY3RbWzFdXS8xMDAsIGNvbD0icmVkIixsd2Q9LjMpDQpgYGANCg0KIyMjIExpZnQgY3VydmVzDQoNCkxpZnQgaXMgYSBjb21tb24gbWVhc3VyZSBpbiBtYXJrZXRpbmcgb2YgbW9kZWwgcGVyZm9ybWFuY2UuIFRoZSBsaWZ0IGFza3MgaG93IG11Y2ggbW9yZSBsaWtlbHkgYXJlIGN1c3RvbWVycyBpbiB0aGUgdG9wICRrXntcdGV4dHJte3RofX0kIGRlY2lsZSB0byBjaHVybiBjb21wYXJlZCB0byB0aGUgYXZlcmFnZS4NCg0KYGBge3J9DQpudGlsZXMgPC0gZnVuY3Rpb24oeCwgYmlucykgew0KICBxdWFudGlsZXMgPSBzZXEoZnJvbT0wLCB0byA9IDEsIGxlbmd0aC5vdXQ9YmlucysxKQ0KICBjdXQoZWNkZih4KSh4KSxicmVha3M9cXVhbnRpbGVzLCBsYWJlbHM9RikNCn0NCiMgY3JlYXRlIGRlY2lsZXMNCnByb2JfZGVjaWxlID0gbnRpbGVzKHByb2IsIDEwKQ0KDQojIHByb2IsIGRlY2lsZSBhbmQgYWN0dWFsDQpwcmVkPC1kYXRhLmZyYW1lKGNiaW5kKHByb2IscHJvYl9kZWNpbGUsIGhvbGRvdXRfdGVsY28kQ2h1cm4pKQ0KY29sbmFtZXMocHJlZCk8LWMoInByZWRpY3RlZCIsImRlY2lsZSIsICJhY3R1YWwiKQ0KDQojIGNyZWF0ZSBsaWZ0IHRhYmxlIGJ5IGRlY2lsZQ0KIyBhdmVyYWdlIGNodXJuIHJhdGUgYnkgZGVjaWxlDQoNCiMgbGlmdCBpcyB0aGUgYWN0dWFsIGNodXJuIHJhdGUgaW4gdGhlIGRlY2lsZSBkaXZpZGVkIGJ5IGF2ZXJhZ2Ugb3ZlcmFsbCBjaHVybiByYXRlDQogIA0KbGlmdF90YWJsZTwtcHJlZCAlPiUgZ3JvdXBfYnkoZGVjaWxlKSAlPiUgIHN1bW1hcml6ZShhY3R1YWxfY2h1cm4gPSBtZWFuKGFjdHVhbCksIGxpZnQgPSBhY3R1YWxfY2h1cm4vcmJhcl9obywgbl9jdXN0b21lcnM9bigpKSAlPiUgYXJyYW5nZShkZXNjKGRlY2lsZSkpICU+JSBtdXRhdGUoY3VtX2N1c3RvbWVycz1jdW1zdW0obl9jdXN0b21lcnMpKSAlPiUgbXV0YXRlKGN1bV9saWZ0PWN1bXN1bShhY3R1YWxfY2h1cm4pL3N1bShhY3R1YWxfY2h1cm4pKjEwMCkNCg0KaGVhZChsaWZ0X3RhYmxlKSAlPiUgDQogIGtibCgpICU+JQ0KICBrYWJsZV9zdHlsaW5nKCkNCmBgYA0KDQpDdXN0b21lcnMgaW4gdGhlIHRvcCBkZWNpbGUgYXJlIHRoZSB0b3AgMTAlIG1vc3QgbGlrZWx5IHRvIGNodXJuICphY2NvcmRpbmcgdG8gb3VyIG1vZGVsKi4gVGhlIHRvcCBkZWNpbGUgbGlmdCBpcyBgciBsaWZ0X3RhYmxlW1sxLDNdXWAuIEN1c3RvbWVycyBpbiB0aGUgdG9wIGRlY2lsZSBhcmUgYHIgbGlmdF90YWJsZVtbMSwzXV1gIHRpbWVzIG1vcmUgbGlrZWx5IHRvICphY3R1YWxseSogY2h1cm4gdGhhbiB0aGUgYXZlcmFnZSBjdXN0b21lci4NCg0KVGhlIHJpZ2h0bW9zdCBjb2x1bW4gc2hvd3MgdGhlIGN1bXVsYXRpdmUgbGlmdC4gVGhlIGN1bXVsYXRpdmUgbGlmdCBmb3IgdGhlICRrJCBkZWNpbGUgaXMgdGhlIHBlcmNlbnRhZ2Ugb2YgYWxsIGNodXJuZXJzIGFjY291bnRlZCBmb3IgY3VtdWxhdGl2ZWx5IGJ5IHRoZSBmaXJzdCAkayQgZGVjaWxlcy4gVGhlIGZpcnN0IGRlY2lsZSBjb250YWlucyBgciByb3VuZChsaWZ0X3RhYmxlW1sxLDRdXSwwKWAlIG9mIGFsbCBjaHVybmVycyBpbiB0aGUgZGF0YSBzZXQgKGluIHRvdGFsIHRoZXJlIGFyZSBgciBuX2NodXJuZXJzYCBjaHVybmVycyBpbiB0aGUgaG9sZG91dCBkYXRhc2V0KS4NCg0KVGhlIGN1bXVsYXRpdmUgbGlmdCBvZiBkZWNpbGUgMiBpcyBgciByb3VuZChsaWZ0X3RhYmxlW1syLDRdXSwwKWAlIG9mIGFsbCBjaHVybmVycyBhcmUgaW4gdGhlIHRvcCAyIGRlY2lsZXMuIEluIHRoZSBib3R0b20gbW9zdCBkZWNpbGVzIHRoZXJlIGFyZSBiYXJlbHkgYW55IGNodXJuZXJzLCBzbyB0aGUgY3VtdWxhdGl2ZSBsaWZ0IGluY3JlYXNlcyBsaXR0bGUgb3Igbm90IGF0IGFsbC4NCg0KV2UgY2FuIGdyYXBoIHRoaXMgb3V0IGJlbG93LiBUaGUgdG9wIHRocmVlIGRlY2lsZXMgYWNjb3VudCBmb3IgYHIgcm91bmQobGlmdF90YWJsZVtbMyw0XV0sMClgJSBvZiBhbGwgY2h1cm5lcnMuIFdlIGNhbiB1c2UgdGhpcyB0byBjb21wYXJlIG1vZGVscy4gVGhlIGhpZ2hlciB0aGUgbGlmdCBmb3IgYSBnaXZlbiBkZWNpbGUsIHRoZSBiZXR0ZXIgdGhlIG1vZGVsLiBBIHN0cmFpZ2h0IGxpbmUsIHdoZXJlIHdlIHJhbmRvbWx5IHNvcnRlZCBjdXN0b21lcnMgaW5zdGVhZCBvZiB1c2luZyBhIG1vZGVsLCBpcyB0aGUgbmFpdmUgbW9kZWwuDQoNCmBgYHtyfQ0KIyBvcmRlciBmcm9tIGhpZ2hlc3QgdG8gc21hbGxlc3QgaW4gdGVybXMgb2YgcHJvYg0KIyBwZXJjZW50YWdlIG9mIGNodXJuZXJzIGZyb20gYmVnaW5uaW5nIHRvIGVuZC4NCnByZWQ8LXByZWQgJT4lIGFycmFuZ2UoZGVzYyhwcmVkaWN0ZWQpKSAlPiUgbXV0YXRlKHByb3BfY2h1cm4gPSBjdW1zdW0oYWN0dWFsKS9zdW0oYWN0dWFsKSoxMDAsIHByb3BfY3VzdCA9IHNlcShucm93KHByZWQpKS9ucm93KHByZWQpKjEwMCkNCmhlYWQocHJlZCkgJT4lIA0KICBrYmwoKSAlPiUNCiAga2FibGVfc3R5bGluZygpDQoNCmBgYA0KDQpgYGB7cn0NCiMgUGxvdHRpbmcgcGVyY2VudGFnZSBvZiBjaHVybmVycyBhcyBhIGZ1bmN0aW9uIG9mIHBlcmNlbnRhZ2Ugb2YgY3VzdG9tZXJzDQpwYXIobWFpPWMoLjksLjgsLjIsLjIpKQ0KcGxvdChwcmVkJHByb3BfY3VzdCxwcmVkJHByb3BfY2h1cm4sdHlwZT0ibCIseGxhYj0iJSBvZiBjdXN0b21lcnMgdGFyZ2V0ZWQgdXNpbmcgbW9kZWwiLHlsYWI9IiUgb2YgY2h1cm5lcnMgYWNjb3VudGVkIGZvciIseGxpbSA9IGMoMCwxMDApLCAseWxpbSA9IGMoMCwxMDApLGNvbD0iYmx1ZSIpDQpsZWdlbmQoJ3RvcGxlZnQnLCBsZWdlbmQ9YygiTmFpdmUiLCAiTG9naXN0aWMiKSwgY29sPWMoInJlZCIsICJibHVlIiksIGx0eT0xOjEsIGNleD0wLjgpDQphYmxpbmUoYT0wLGI9MSxjb2w9InJlZCIpDQpwb2ludHMoeD0zMCwgeT0gbGlmdF90YWJsZSRjdW1fbGlmdFszXSwgcGNoPTQsIGNvbD0icmVkIiwgIGNleD0yLCBsd2Q9MikNCnRleHQoeCA9IDI4LHk9IGxpZnRfdGFibGUkY3VtX2xpZnRbM10rNSwgcGFzdGUocm91bmQobGlmdF90YWJsZSRjdW1fbGlmdFszXSwwKSwgIiUiICkpDQpgYGANCg0KLSAgIFRoaXMgZ2l2ZXMgdXMgZXF1aXZhbGVudCBpbmZvcm1hdGlvbiB0byB0aGUgY2h1cm4gdGFibGUuDQoNCi0gICB0YXJnZXRpbmcgdGhlIHRvcCAxMCUgdXNpbmcgdGhlIG1vZGVsIHdvdWxkIGdpdmUgdXMgYHIgcHJlZCRwcm9wX2NodXJuW3doaWNoLm1pbihhYnMocHJlZCRwcm9wX2N1c3QtMTApKV1gJSBvZiB0b3RhbCBjaHVybmVycyBpbiB0aGUgZGF0YS4NCg0KIyMjIFNlbGVjdGluZyBkZWNpbGVzIHRvIHRhcmdldA0KDQpPbmNlIHdlIGhhdmUgdXNlZCB0aGUgbW9kZWwgdG8gcHV0IGN1c3RvbWVycyBpbiB0aGUgcmlnaHQgZGVjaWxlLCB0YXJnZXRpbmcgaXMgc2ltcGxlLiBXZSBjYWxjdWxhdGUgdGhlIHByb2ZpdCBmcm9tIGVhY2ggbi10aWxlIGFuZCB0YXJnZXQgY3VzdG9tZXJzIHdobyBhcmUgaW4gdGhlIHByb2ZpdGFibGUgdGlsZXMuIFdlIHdpbGwgdXNlIHRoZSBwcm9hY3RpdmUgY2h1cm4gZnJhbWV3b3JrIGZyb20gQmxhdHRiZXJnLCBLaW0gYW5kIE5lc2xpbiB0byBjYWxjdWxhdGUgZXhwZWN0ZWQgcHJvZml0cy4gVGhpcyBhcHByb2FjaCB0YWtlcyBpbnRvIGFjY291bnQgdGhlIGFjdHVhbCBwcm9wb3J0aW9uIG9mIGNodXJuZXJzIGFzIGlkZW50aWZpZWQgYnkgdGhlIG1vZGVsLg0KDQpUaGUga2V5IHBhcmFtZXRlciBpcyAkXGJldGFfSyQsIHRoZSBwcm9wb3J0aW9uIG9mIGNodXJuZXJzIGluIHRoZSB0b3AgJEskIGRlY2lsZXMgY29udGFjdGVkLlwNCiQkDQpcYmV0YV9LID0gXGZyYWN7XHN1bV97az0xfV57S30gXDsgcl9rIFwsIG5fa317XHN1bV97az0xfV57S30gXDsgbl9rfSBccXVhZCBcdGV4dHJte3doZXJlfSBcOyBLID0gMSwgMiwgLi4gXGRvdHMsICAxMA0KJCQgV2UgY2FsY3VsYXRlICRcYmV0YSQsIHRoZSBwcm9iYWJpbGl0eSB0aGF0IGEgdGFyZ2V0ZWQgY3VzdG9tZXIgaXMgYSBjaHVybmVyLCBieSB0YWtpbmcgdGhlIGN1bXVsYXRpdmUgcHJvcG9ydGlvbiBvZiBjaHVybmVycyBpbiB0aGUgdG9wICRrJCBkZWNpbGVzLg0KDQpgYGB7cn0NCmdhbW1hID0gMC4xICAjIHByb2JhYmlsaXR5IHRoYXQgY3VzdG9tZXIgaXMgcmVzY3VlZCBpZiBoZSBvciBzaGUgaXMgYSBjaHVybmVyDQpMVFYgPSA1MDAgICAjIGxpZmV0aW1lIHZhbHVlIG9mIHJlc2N1ZWQgY3VzdG9tZXINCmRlbHRhID0gNTAgICMgY29zdCBvZiBpbmNlbnRpdmUNCmMgPSAwLjUwICAjIGNvc3Qgb2YgY29udGFjdA0KDQojIHJlLW9yZGVyIGxpZnQgZnJvbSBoaWdoZXN0IHRvIGxvd2VzdA0KIyBhZGQgY29sdW1ucyB0byBvdXIgbGlmdCB0YWJsZQ0KDQpwcm9maXRfdGFibGU8LWxpZnRfdGFibGUgJT4lIG11dGF0ZSgNCiAgY3VtX3Byb3BfY2h1cm5lcnMgPSBjdW1zdW0oYWN0dWFsX2NodXJuKm5fY3VzdG9tZXJzKS9jdW1fY3VzdG9tZXJzLCANCiAgcHJvZml0ID0gY3VtX2N1c3RvbWVycyooKGdhbW1hKkxUVitkZWx0YSooMS1nYW1tYSkpKmN1bV9wcm9wX2NodXJuZXJzLWRlbHRhLWMpLA0KICBkZWNpbGU9MTEtZGVjaWxlKQ0KICAgICAgICAgICAgICAgICAgICAgICAgICAgICAgICAgICAgICAgICAgICAgICAgICAgICAgICAgICAgICAgICAgICAgIA0KaGVhZChwcm9maXRfdGFibGUpICU+JSANCiAga2JsKCkgJT4lDQogIGthYmxlX3N0eWxpbmcoKQ0KYGBgDQoNCmBgYHtyfQ0KcGFyKG1haT1jKC45LC44LC4yLC4yKSkNCmJwPC1iYXJwbG90KHByb2ZpdF90YWJsZSRwcm9maXQgfiBwcm9maXRfdGFibGUkZGVjaWxlLCBtYWluPSJleHBlY3RlZCBwcm9maXRzIGJ5ICMgb2YgZGVjaWxlcyB0YXJnZXRlZCIsIHhsYWI9IiMgZGVjaWxlcyB0YXJnZXRlZCIsIHlsYWI9ImV4cGVjdGVkIHByb2ZpdHMiKQ0KYGBgDQoNCldlIHNlZSBmcm9tIHRoZSB0YWJsZSBiZWxvdyB0aGF0IGdpdmVuIHRoaXMgbW9kZWwsIHRoZSBwcm9maXQgbWF4aW1pemluZyBudW1iZXIgb2YgZGVjaWxlcyB0byB0YXJnZXQgaXMgdGhlIHRvcCAyLg0K