Quiz 6: CLV - Contractual Settings

Daniel Redel

2023-01-26

Question 1

Consider Netflix. A month-long subscription from a customer generates a profit flow of 10 per month, and they use a 0.008 discount rate. Below is a cohort of subscribers who all began their subscription in January 2020: 1000 initially joined; a month later 631 of them did not cancel, etc.

active_cust=c(1000,

631,

468,

382,

326,

289,

262,

241,

223,

207,

194)

cbind(0:10,active_cust) %>%

kbl() %>%

kable_styling()| active_cust | |

|---|---|

| 0 | 1000 |

| 1 | 631 |

| 2 | 468 |

| 3 | 382 |

| 4 | 326 |

| 5 | 289 |

| 6 | 262 |

| 7 | 241 |

| 8 | 223 |

| 9 | 207 |

| 10 | 194 |

What is the actual retention rate and actual survival function at 10 months since joining?

Provide your answers with a dot and three decimals (e.g. 0.234)

Survivor Function:

S <- active_cust/active_cust[1]

S## [1] 1.000 0.631 0.468 0.382 0.326 0.289 0.262 0.241 0.223 0.207 0.194Retention Rate:

r <- S[2:11]/S[1:10]

r## [1] 0.631 0.742 0.816 0.853 0.887 0.907 0.920 0.925 0.928 0.937Final Data:

cbind(0:10, S, c(NA,r)) %>%

kbl() %>%

kable_styling()| S | ||

|---|---|---|

| 0 | 1.000 | NA |

| 1 | 0.631 | 0.631 |

| 2 | 0.468 | 0.742 |

| 3 | 0.382 | 0.816 |

| 4 | 0.326 | 0.853 |

| 5 | 0.289 | 0.887 |

| 6 | 0.262 | 0.907 |

| 7 | 0.241 | 0.920 |

| 8 | 0.223 | 0.925 |

| 9 | 0.207 | 0.928 |

| 10 | 0.194 | 0.937 |

Question 2

Fit the Beta-Geometric model to the retention data using only data from the beginning until (and including) 4 months since joining. For your estimation use starting values a = 1 and b = 1.

What are the estimates of a and b?

Provide your answers with a dot and three decimals (e.g. 0.123)

Calibration Sample:

lost <- -diff(active_cust[1:5])

active <- active_cust[1:5][-1]Likelihood Estimation:

loop.lik <- function(params) {

a <- params[1]

b <- params[2]

ll <- 0

for (i in 1:length(lost)) {

ll <- ll+lost[i]*log(beta(a+1,b+i-1)/beta(a,b))

}

ll <- ll+active[i]*log(beta(a,b+i)/beta(a,b))

return(-ll) #return the negative of the function to max. LL

}

#find parameters for a and b with optim

sBG <- optim(par=c(1,1),loop.lik)a <- sBG$par[1]

b <- sBG$par[2]## a= 0.763 b= 1.29Question 3

Our holdout sample is everything after period 4.

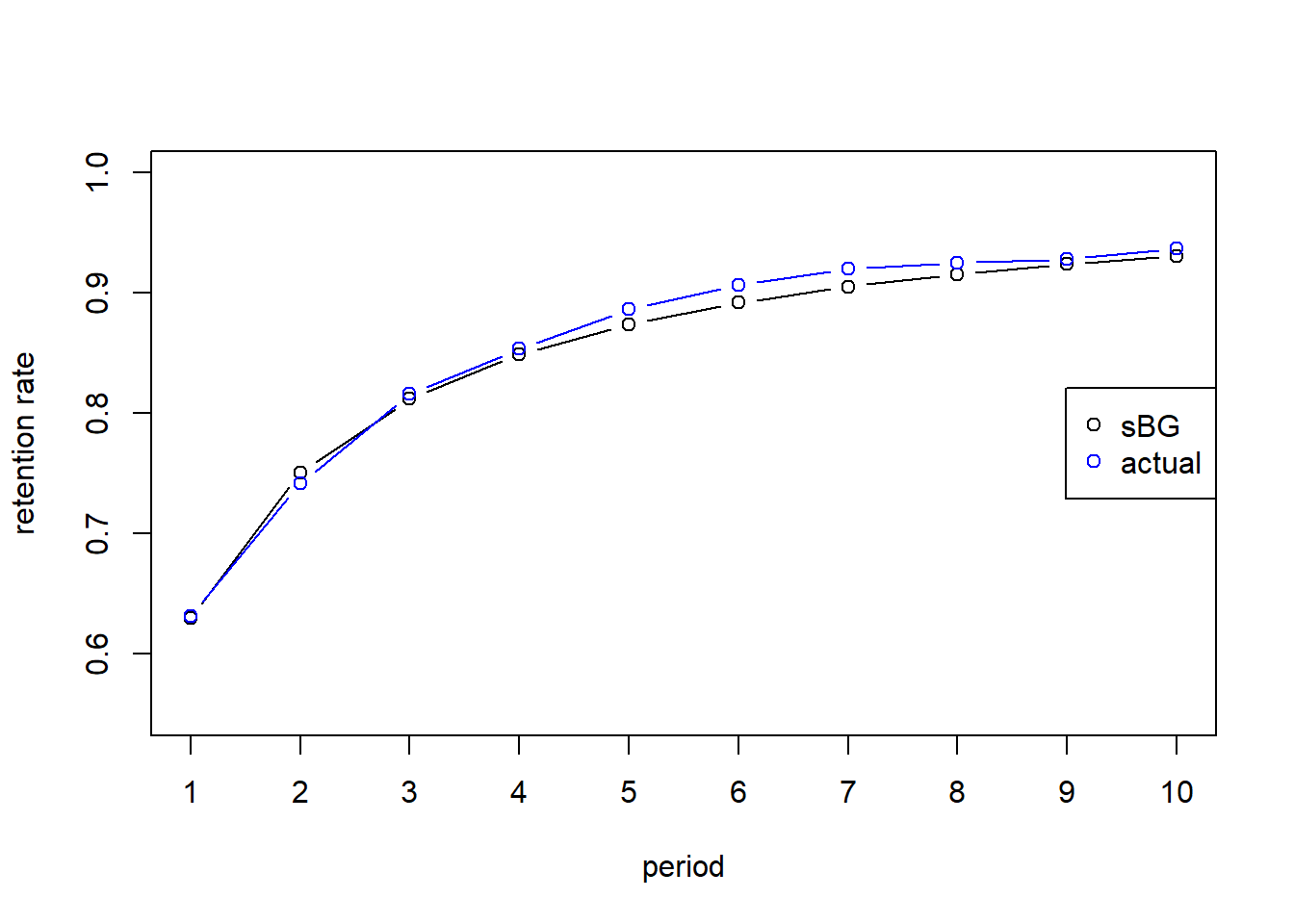

How well does the model fit the data from period 5 onward? Make a graph. Use the model estimates to predict retention and survival function at 10 months since joining.

Provide your answers with a dot and three decimals (e.g. 0.234)

Retention Rate (Prediction):

r_sBG = function(a,b,t){

(b+t-1)/(a+b+t-1)

}

# Prediction

t <- seq(1:10)

r_pred <- r_sBG(a,b,t)par(mfrow=c(1,1))

plot(t, r_pred,ylab="retention rate",xlab="period",type="b", xaxt="none", ylim = c(.55,1))

lines(t, r, type="b", col="blue")

axis(1, seq(0,10,1))

legend('right',legend=c("sBG", "actual"),col=c("black","blue"), pch=c(1,1))

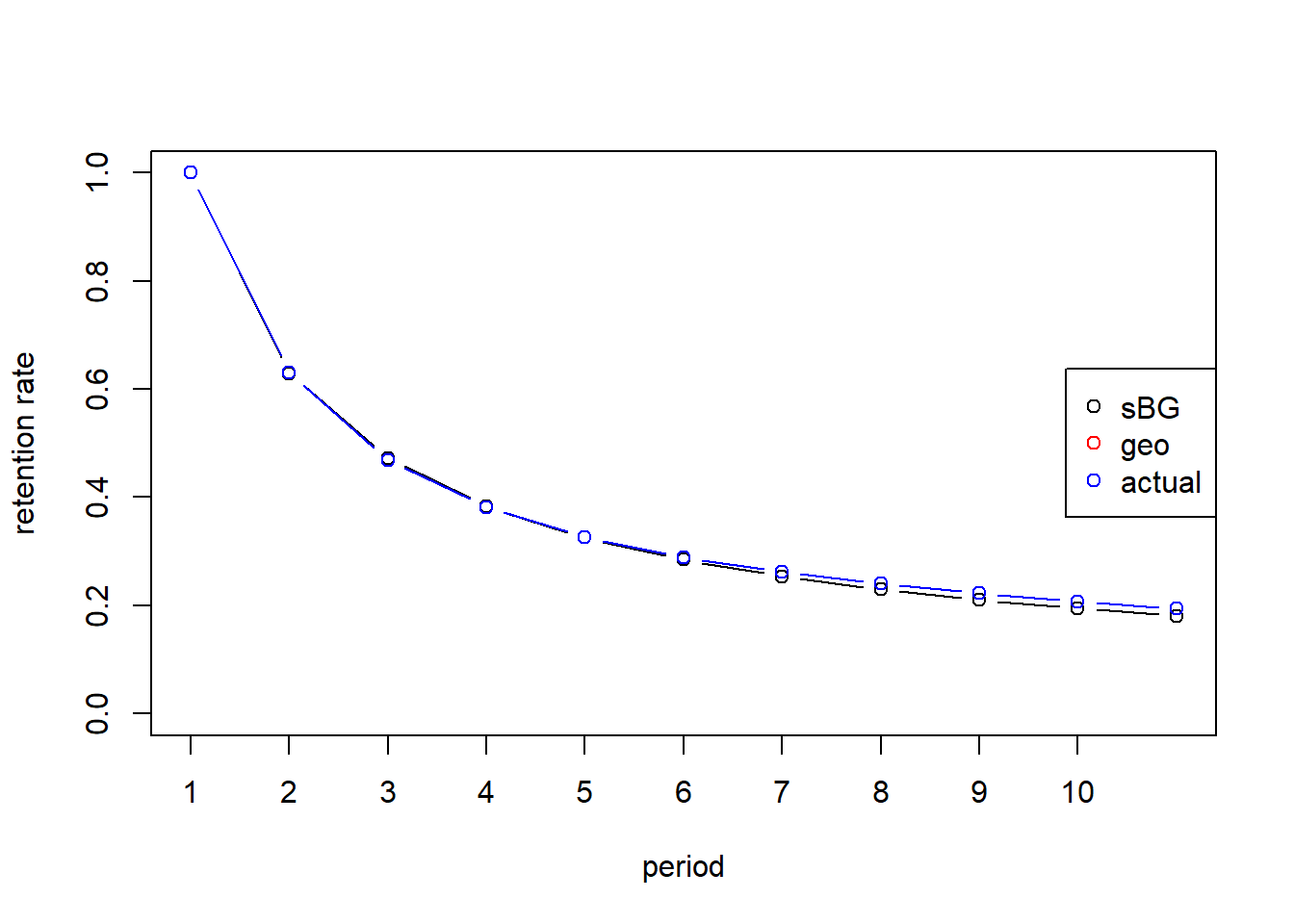

Survivor Function (Prediction):

S_pred <- c(1,cumprod(r_pred))

S_pred## [1] 1.000 0.629 0.472 0.383 0.325 0.284 0.254 0.230 0.210 0.194 0.181par(mfrow=c(1,1))

plot(seq(0:10), S_pred, ylab="retention rate",xlab="period",type="b", xaxt="none", ylim = c(0,1))

lines(seq(0:10),S, type="b", col="blue")

axis(1, seq(0,10,1))

legend('right',legend=c("sBG", "geo", "actual"),col=c("black","red","blue"), pch=c(1,1))

Question 4

Up to how much would Netflix pay to acquire a new customer with a value according to that implied by the model? Use 200 months in your calculation.

Round to the nearest whole number.

CLV:

d <- 0.008

m <- 10

t <- seq(1,200) # time periods

r_pred <- r_sBG(a,b,t) # predicted retention rate

S_pred <- c(1,cumprod(r_pred)[1:199])

dis <- 1/(1+d)^(t-1) # discount factor, first term is present so no discounting

CLV_sBG <- sum(m*S_pred*dis) # the sum of margin x survivor x discount factor

CLV_sBG## [1] 90.1Question 5

Now calculate CLV using the geometric model that assumes a constant retention rate.

To estimate that constant rate, you can use the results of the BG model. The average retention rate in the population at time 0 is b/(a+b). Use that quantity as your estimate of the retention rate for the geometric model.

Give the whole number.

geoCLV<-function(p,m,d){

m*(1+d)/(1+d-p)

}

p <- b/(a+b) # its B! not A

geo <- geoCLV(p, m, d) # use that estimate

round(geo,0)## [1] 27Question 6

Back to the original BG coefficients.

What is the expected residual lifetime value of a customer who has renewed once, standing just before time 2, when he or she makes his or her second renewal decision?

Give the whole number.

RLV:

tau<-1

t<-seq(1,tau+200)

r_pred<-r_sBG(a,b,t)

S_pred<-cumprod(r_pred)S_shift <- S_pred[(tau+1):length(S_pred)] # survival function from tau + 1 until T

dis <- 1/(1+d)^(t(1:200)-1) # discount rate

RLV_sBG<-sum(m*S_shift/S_pred[tau]*dis)

RLV_sBG## [1] 119