- Question 1

- Question 2

- Question 3

- Question 4

- Question 5

- Question 6

- Question 7

- Question 8

- Question 9

Quiz 7: CLV - Non-contractual settings

Daniel Redel

2023-01-26

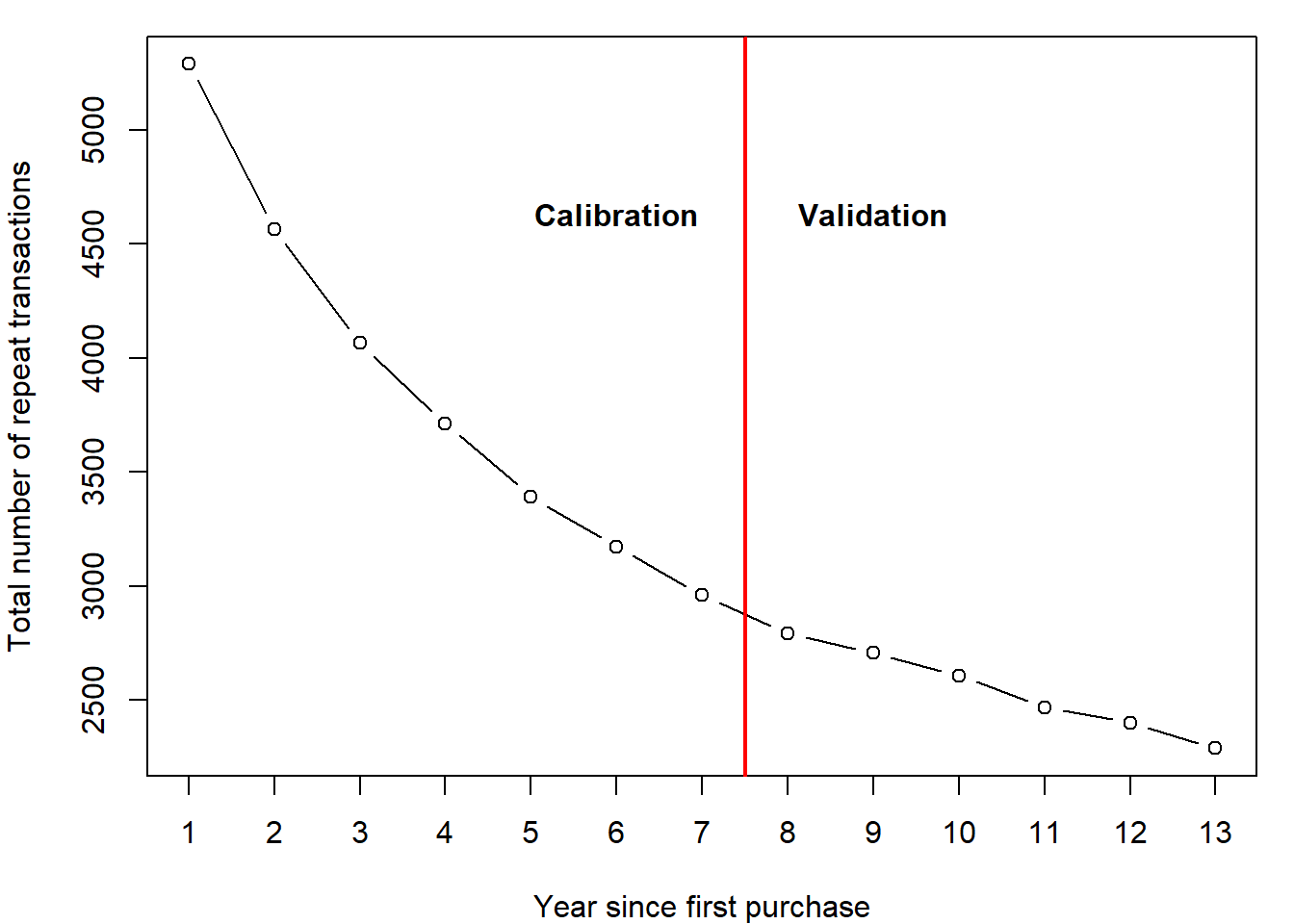

In this assignment, we will use a different data set with 10000 customers and 13 periods total. We estimate the model on the first 7 (calibration) and test it on the final 6 periods (holdout).

cal.rf.matrix <- read.csv("cal.rf.matrix.csv")

trans <- read.csv("annual_transactions.csv")

holdout <- read.csv("holdout.trans.rf.matrix.csv")Question 1

Create a graph of aggregate transactions per year. What are the total number of purchases in year 8 after the first purchase?

Provide your answer without any decimals (e.g. 12)

trans <- trans$x

par(mfrow=c(1,1))

par(mai=c(.8,.8,.2,.2))

plot(seq(1,13,1),trans, type="b", ylab="Total number of repeat transactions", xlab="Year since first purchase", main="", xaxt='n')

axis(1, at = seq(0, 13, by = 1))

abline(v=7.5,col = "red", lwd = 2)

text(x = 6,y = 4500,"Calibration", cex=1, pos=3, col="black", font = 2)

text(x = 9,y = 4500,"Validation", cex=1, pos=3, col="black", font = 2)

Question 2

Estimate the BG/BB parameters using the calibration data, the first seven years. What are the parameters?

Provide your answers with a dot and two decimals (e.g. 0.12)

Initial Parameters:

rf.matrix <- cal.rf.matrix

par.start <- c(1, 1, 1, 1)MLE Estimation:

params <- bgbb.EstimateParameters(rf.matrix, par.start)

round(params, 2)## [1] 1.32 0.67 0.51 2.09## Check log-likelihood of the params:

LL <- bgbb.rf.matrix.LL(params, rf.matrix)

LL## [1] -33013Question 3

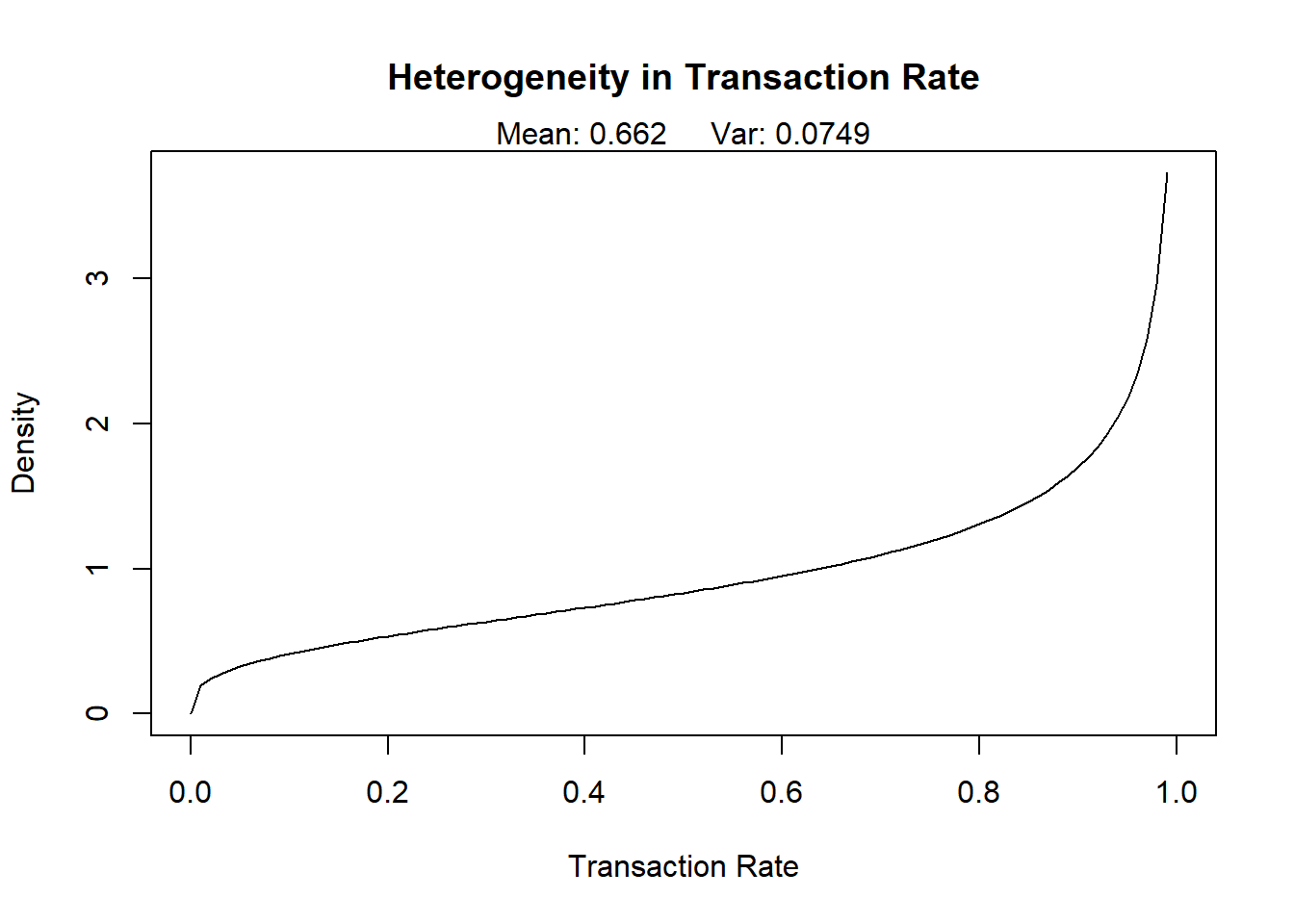

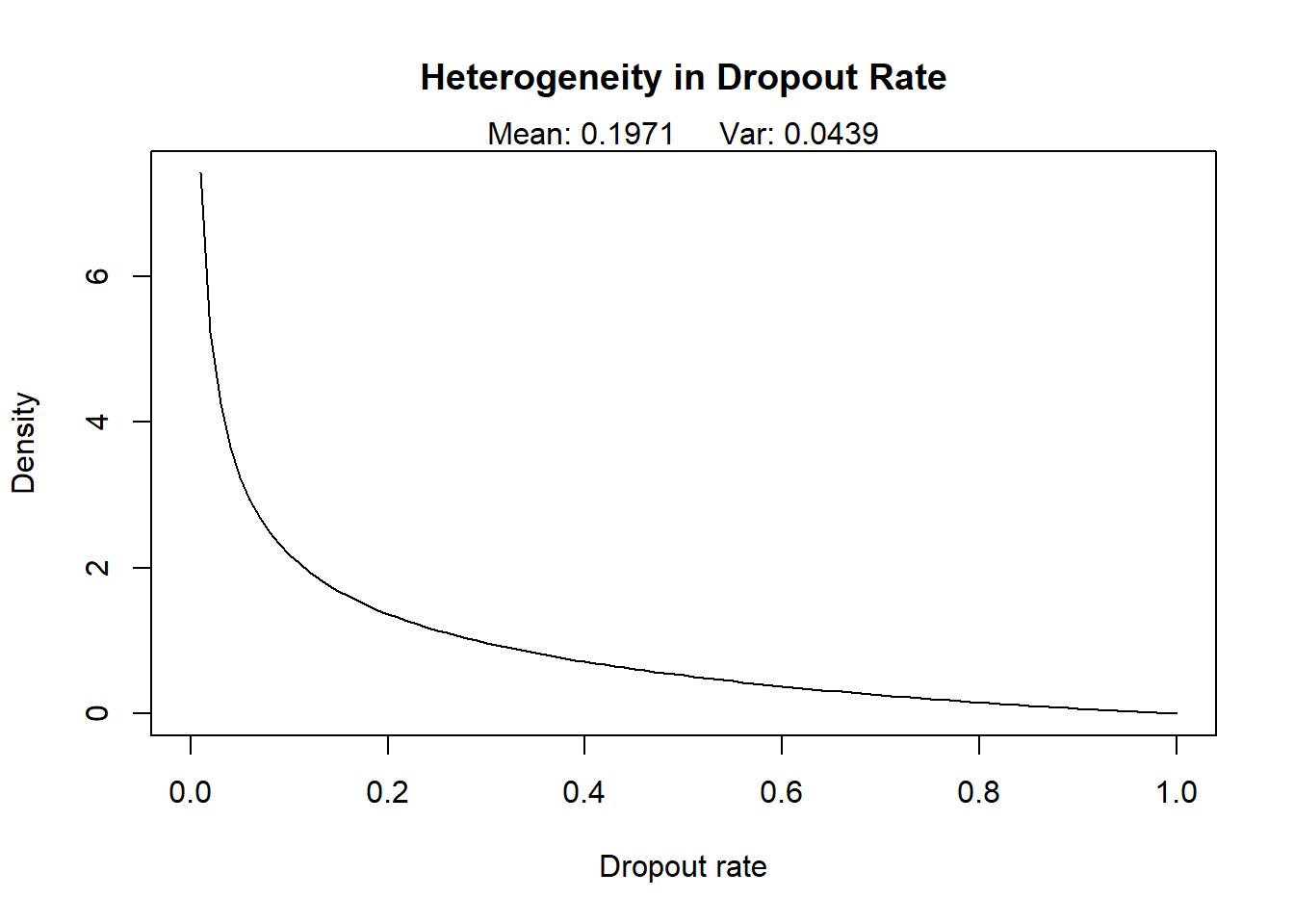

Graph out the distributions of the transaction rate and dropout rate. What are the average values of each in the population?

Provide your answer with a dot and two decimals (e.g. 0.12)

Average transaction rate:

round(params[1]/(params[1]+params[2]),2)## [1] 0.66bgbb.PlotTransactionRateHeterogeneity(params)

## [1] 0.000 0.193 0.241 0.275 0.303 0.326 0.346 0.365 0.382 0.398 0.413 0.427 0.441 0.454 0.466 0.479 0.490 0.502 0.513 0.524 0.535 0.545 0.556 0.566 0.576 0.586 0.596 0.606 0.616 0.625 0.635 0.645 0.654 0.664 0.674 0.683 0.693 0.703 0.712 0.722 0.732 0.742 0.751 0.761 0.771 0.781 0.792 0.802 0.812

## [50] 0.823 0.834 0.844 0.855 0.867 0.878 0.889 0.901 0.913 0.925 0.938 0.950 0.963 0.976 0.990 1.004 1.018 1.033 1.048 1.064 1.080 1.096 1.114 1.131 1.150 1.169 1.190 1.211 1.233 1.256 1.280 1.306 1.334 1.363 1.394 1.427 1.463 1.502 1.545 1.592 1.644 1.702 1.768 1.844 1.933 2.040 2.173 2.345 2.586

## [99] 2.963 3.730 InfAverage dropout rate:

round(params[3]/(params[3]+params[4]),2)## [1] 0.2bgbb.PlotDropoutRateHeterogeneity(params)

## [1] Inf 7.41359 5.23277 4.24797 3.65150 3.23854 2.92955 2.68628 2.48774 2.32130 2.17884 2.05487 1.94553 1.84800 1.76019 1.68047 1.60761 1.54060 1.47864 1.42107 1.36737 1.31707 1.26980 1.22525 1.18312 1.14320 1.10527 1.06915 1.03469 1.00176 0.97022 0.93998 0.91093 0.88299 0.85608 0.83014

## [37] 0.80509 0.78088 0.75746 0.73478 0.71280 0.69148 0.67078 0.65067 0.63112 0.61209 0.59356 0.57552 0.55792 0.54076 0.52402 0.50767 0.49170 0.47609 0.46083 0.44590 0.43129 0.41699 0.40299 0.38927 0.37583 0.36265 0.34973 0.33706 0.32463 0.31243 0.30045 0.28870 0.27715 0.26581 0.25467 0.24373

## [73] 0.23298 0.22241 0.21202 0.20181 0.19177 0.18190 0.17220 0.16266 0.15328 0.14405 0.13499 0.12607 0.11731 0.10870 0.10024 0.09193 0.08377 0.07576 0.06790 0.06019 0.05265 0.04527 0.03805 0.03102 0.02419 0.01758 0.01124 0.00524 0.00000Question 4

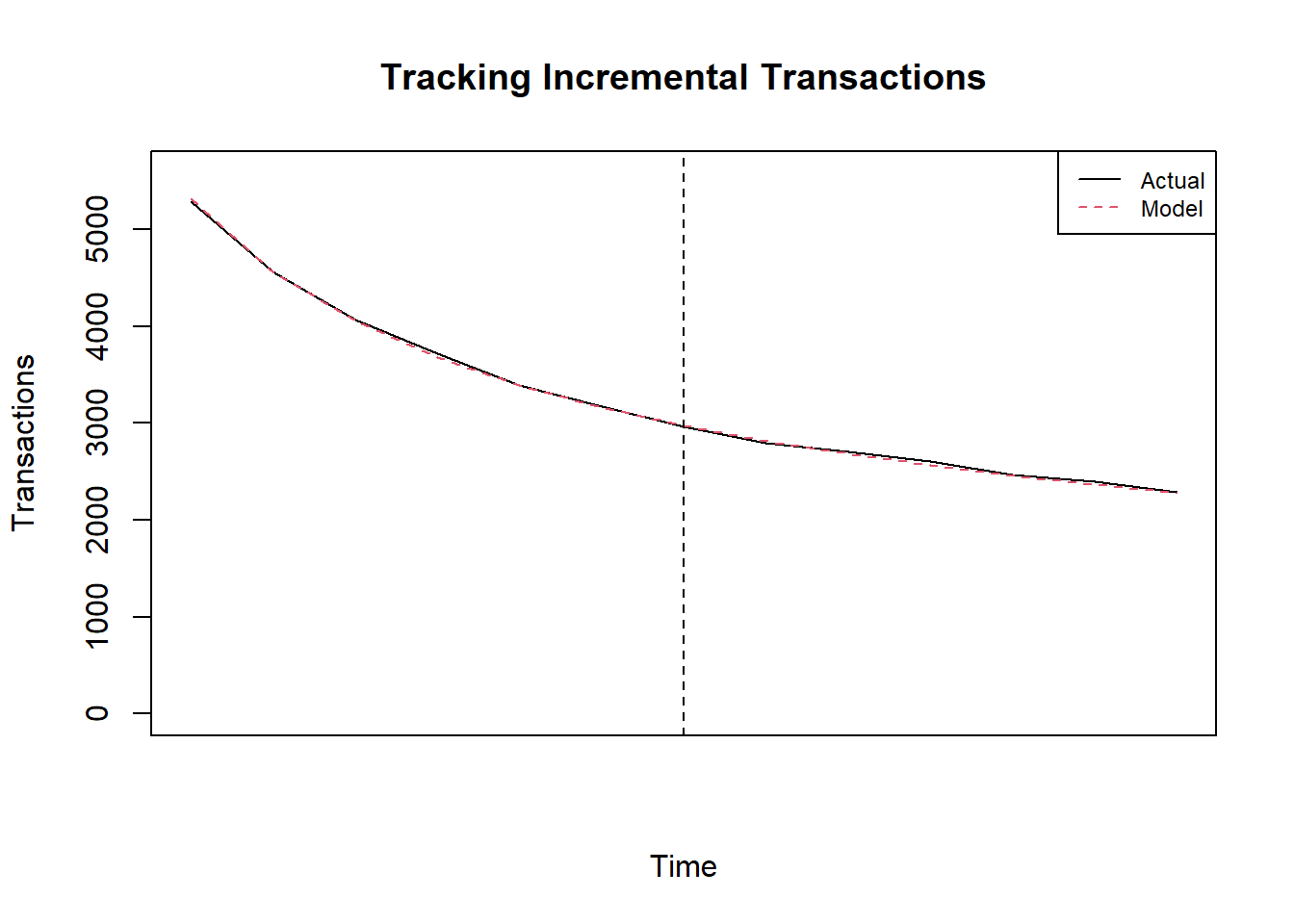

Graph out the actual and predicted transactions per year. What is the expected level of transactions in year 8 after the first purchase?

Provide your answer with zero decimals (e.g. 12)

Aggregate Forecasting:

pred <- bgbb.PlotTrackingInc(params, rf.matrix, trans)

## Q4 = 2817Question 5

According to the model, what is the predicted number of transactions in the holdout for a customer who was “7 for 7” in the calibration period? What is the actual number of holdout transactions for these customers?

Provide your answer with a dot and two decimals (e.g. 0.12)

Predicted:

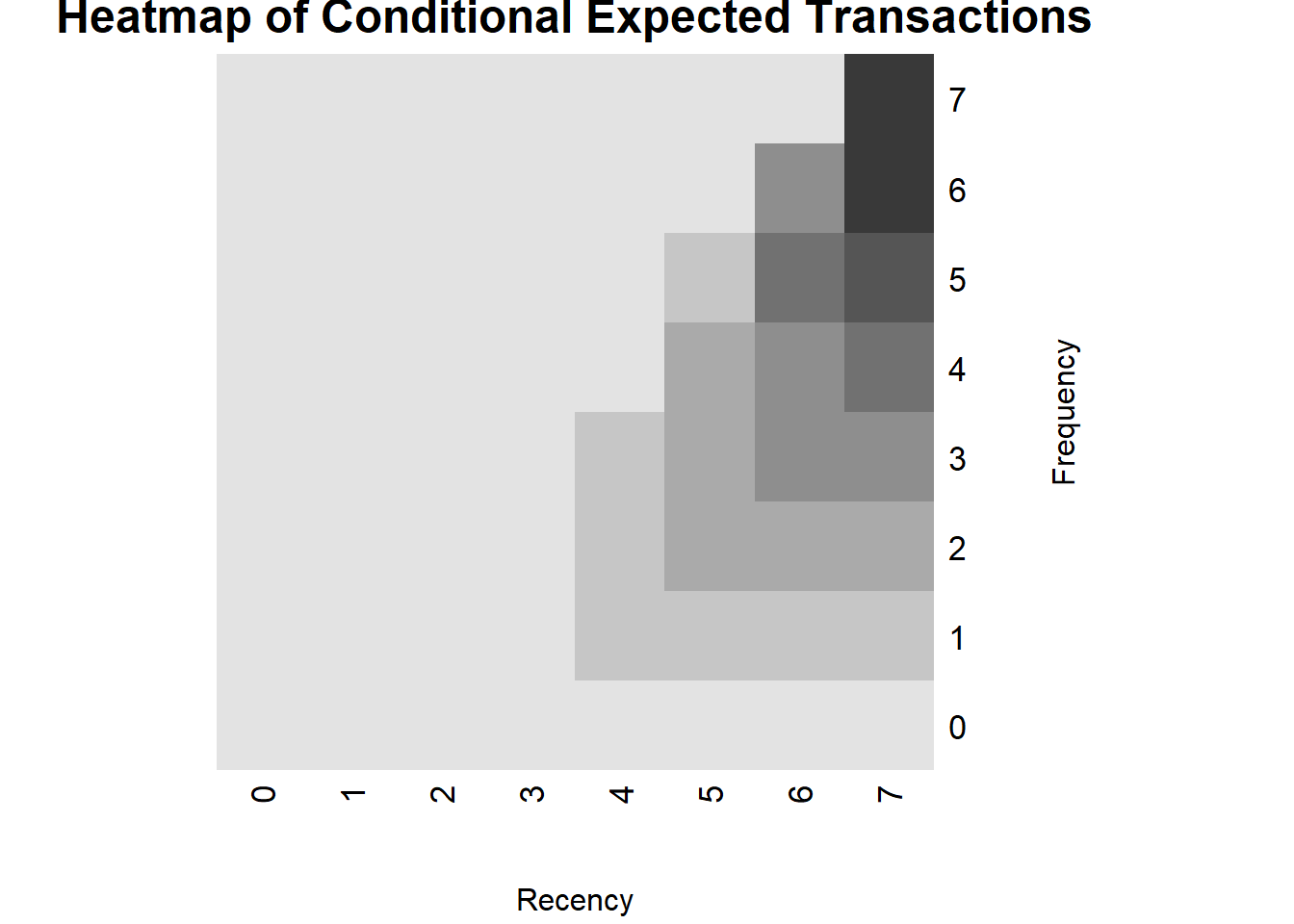

bgbb.HeatmapHoldoutExpectedTrans(params, n.cal = 7, n.star = 6)## layout: widths = 0.05 4 , heights = 0.25 4 ; lmat=

## [,1] [,2]

## [1,] 0 3

## [2,] 2 1

## 0 1 2 3 4 5 6 7

## 0 0.0575 0.0000 0.0000 0.000 0.000 0.000 0.00 0.00

## 1 0.0000 0.0589 0.2629 0.551 0.830 1.049 1.21 1.31

## 2 0.0000 0.0000 0.0701 0.394 0.913 1.383 1.70 1.88

## 3 0.0000 0.0000 0.0000 0.109 0.692 1.553 2.15 2.45

## 4 0.0000 0.0000 0.0000 0.000 0.235 1.401 2.53 3.01

## 5 0.0000 0.0000 0.0000 0.000 0.000 0.698 2.75 3.58

## 6 0.0000 0.0000 0.0000 0.000 0.000 0.000 2.36 4.15

## 7 0.0000 0.0000 0.0000 0.000 0.000 0.000 0.00 4.71Actual:

cbind(cal.rf.matrix, holdout)## x t.x n.cal custs x

## 1 0 0 7 2900 152

## 2 1 1 7 933 50

## 3 1 2 7 218 58

## 4 2 2 7 489 29

## 5 1 3 7 95 67

## 6 2 3 7 160 61

## 7 3 3 7 292 14

## 8 1 4 7 73 75

## 9 2 4 7 113 104

## 10 3 4 7 130 74

## 11 4 4 7 189 50

## 12 1 5 7 51 59

## 13 2 5 7 98 113

## 14 3 5 7 131 219

## 15 4 5 7 137 250

## 16 5 5 7 161 153

## 17 1 6 7 34 39

## 18 2 6 7 92 155

## 19 3 6 7 168 367

## 20 4 6 7 162 426

## 21 5 6 7 204 569

## 22 6 6 7 209 479

## 23 1 7 7 50 56

## 24 2 7 7 104 190

## 25 3 7 7 205 493

## 26 4 7 7 320 956

## 27 5 7 7 401 1492

## 28 6 7 7 666 2783

## 29 7 7 7 1215 5738# take total transactions for last row divided by customers:

act <- holdout$x[29]/cal.rf.matrix[29,4] #ind=29 has 7 of 7, the last obs.## Actual = 4.72Question 6

What is the CLV, assuming each transaction yields on average 50 in profit and the discount rate is 0.1? You can use 200 periods for the sum.

Provide your answer with zero decimals (e.g. 12)

BGBBCLV<-function(params,m,d,T) {

params<-unname(params)

al<-params[1]

be<-params[2]

ga<-params[3]

de<-params[4]

DET<-1 # at time zero there has to be a purchase

for (i in 1:T) {

DET<-DET+(al/(al+be))*(beta(ga,de+i)/beta(ga,de))*1/(1+d)^{i}

}

CLV=m*DET # convert discount expected purchases into expected value

return(CLV) #return the CLV

}CLV:

CLV <- BGBBCLV(params = params, m=50,d=.1,T=200)

CLV## [1] 203Question 7

What is the RLV for a 7 for 7 customer? Again, assume each transaction yields on average 50 in profit, and the discount rate is 0.1.

Provide your answer with zero decimals (e.g. 12)

m <- 50

DERT <- bgbb.rf.matrix.DERT(params, rf.matrix = cal.rf.matrix, d=0.1)

RLV <- m*DERT

RLVmatrix <- cbind(cal.rf.matrix,round(RLV))

RLVmatrix## x t.x n.cal custs round(RLV)

## 1 0 0 7 2900 4

## 2 1 1 7 933 4

## 3 1 2 7 218 18

## 4 2 2 7 489 5

## 5 1 3 7 95 39

## 6 2 3 7 160 28

## 7 3 3 7 292 8

## 8 1 4 7 73 58

## 9 2 4 7 113 64

## 10 3 4 7 130 49

## 11 4 4 7 189 16

## 12 1 5 7 51 74

## 13 2 5 7 98 97

## 14 3 5 7 131 109

## 15 4 5 7 137 98

## 16 5 5 7 161 49

## 17 1 6 7 34 85

## 18 2 6 7 92 119

## 19 3 6 7 168 151

## 20 4 6 7 162 178

## 21 5 6 7 204 193

## 22 6 6 7 209 166

## 23 1 7 7 50 92

## 24 2 7 7 104 132

## 25 3 7 7 205 172

## 26 4 7 7 320 212

## 27 5 7 7 401 251

## 28 6 7 7 666 291

## 29 7 7 7 1215 331RLV:

max(RLV)## [1] 331Question 8

Consider a charity with just one opportunity for people to donate per year. Consider a donor has donated 3 times in the past five years with the last donation occurring in year 4. In the context of the BG/BB model, what are the donor’s sufficient statistics: n, t_x, and x

n=5

t_x = 4

x = 3

Assume that = 0.6 and Θ = 0.2.

What is the likelihood of this customer’s donations?

Provide your answer with a dot and three decimals (e.g. 0.123)

n <- 5

t_x <- 4

x <- 3

p <- 0.6

theta <- 0.2L(p,θ|x,tx,n)=px(1−p)n−x(1−θ)n+n−tx−1∑j=0px(1−p)tx−x+jθ(1−θ)tx+j

a <- (p^3)*(1-p)*((1-theta)^4)*theta

b <- (p^3)*(1-p)^2*((1-theta)^5) ## the last obs. does not have theta

likelihood <- a+b

round(likelihood,3)## [1] 0.018Question 9

What is the probability that the customer is alive at the end?

Provide your answer with a dot and three decimals (e.g. 0.123)

Pr

(p^3)*((1-p)^2)*((1-theta)^5)/likelihood## [1] 0.615