Assignment 4: Subset Selection, LASSO & Trees

Daniel Redel

2022-11-19

Data Import:

bank <- read.csv('bank.csv', stringsAsFactors = TRUE)

bank <- bank[-c(1:3)]

n <- nrow(bank)

set.seed(19103)

sample <- sample(c(TRUE, FALSE), n, replace=TRUE, prob=c(0.7, 0.3))

bank.train <- bank[sample, ]

bank.holdout <- bank[!sample, ]A bank wants to implement a proactive churn policy. They assemble a data set of past customers who either churned or stayed (were retained) along with several variables that can be used to predict this decision. This data set is called bank.csv. The churn variable is called Exited (1 churn, 0 not churn).

Question 1: What variable enters last in Forward Selection?

Use forward selection starting from an intercept-only model adding explanatory variables until the AIC minimum is reached or all 10 variables are added. What variable enters last?

Full Model, but without interaction terms (10 variables in total):

full <- glm(Exited ~ ., data=bank.train, family = "binomial")

summary(full)##

## Call:

## glm(formula = Exited ~ ., family = "binomial", data = bank.train)

##

## Deviance Residuals:

## Min 1Q Median 3Q Max

## -2.330 -0.665 -0.463 -0.274 2.969

##

## Coefficients:

## Estimate Std. Error z value Pr(>|z|)

## (Intercept) -3.2994976420 0.2910304887 -11.34 < 0.0000000000000002 ***

## CreditScore -0.0006358323 0.0003335113 -1.91 0.05659 .

## GeographyGermany 0.7481890738 0.0804480337 9.30 < 0.0000000000000002 ***

## GeographySpain 0.0089364591 0.0836470250 0.11 0.91492

## GenderMale -0.5503216618 0.0646080453 -8.52 < 0.0000000000000002 ***

## Age 0.0740294328 0.0030836019 24.01 < 0.0000000000000002 ***

## Tenure -0.0216144137 0.0110427763 -1.96 0.05031 .

## Balance 0.0000020672 0.0000006086 3.40 0.00068 ***

## NumOfProducts -0.0870781223 0.0558204283 -1.56 0.11877

## HasCrCard -0.0685495618 0.0700553570 -0.98 0.32782

## IsActiveMember -1.0512041124 0.0683755435 -15.37 < 0.0000000000000002 ***

## EstimatedSalary -0.0000000877 0.0000005603 -0.16 0.87565

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## (Dispersion parameter for binomial family taken to be 1)

##

## Null deviance: 7161.0 on 7011 degrees of freedom

## Residual deviance: 6087.2 on 7000 degrees of freedom

## AIC: 6111

##

## Number of Fisher Scoring iterations: 5# intercept only

null <- glm(Exited ~ 1, data=bank.train, family = "binomial")

start_time <- Sys.time()

fwd.model=step(null, direction = 'forward', scope=formula(full), keep = function(model, aic) list(model = model, aic = aic))## Start: AIC=7163

## Exited ~ 1

##

## Df Deviance AIC

## + Age 1 6609 6613

## + Geography 2 6985 6991

## + IsActiveMember 1 7009 7013

## + Gender 1 7074 7078

## + Balance 1 7080 7084

## + NumOfProducts 1 7146 7150

## + CreditScore 1 7157 7161

## + Tenure 1 7159 7163

## <none> 7161 7163

## + HasCrCard 1 7160 7164

## + EstimatedSalary 1 7161 7165

##

## Step: AIC=6613

## Exited ~ Age

##

## Df Deviance AIC

## + IsActiveMember 1 6344 6350

## + Geography 2 6444 6452

## + Gender 1 6526 6532

## + Balance 1 6536 6542

## + NumOfProducts 1 6600 6606

## + CreditScore 1 6605 6611

## + Tenure 1 6606 6612

## <none> 6609 6613

## + HasCrCard 1 6609 6615

## + EstimatedSalary 1 6609 6615

##

## Step: AIC=6350

## Exited ~ Age + IsActiveMember

##

## Df Deviance AIC

## + Geography 2 6186 6196

## + Gender 1 6268 6276

## + Balance 1 6273 6281

## + NumOfProducts 1 6338 6346

## + Tenure 1 6340 6348

## + CreditScore 1 6341 6349

## <none> 6344 6350

## + HasCrCard 1 6343 6351

## + EstimatedSalary 1 6344 6352

##

## Step: AIC=6196

## Exited ~ Age + IsActiveMember + Geography

##

## Df Deviance AIC

## + Gender 1 6114 6126

## + Balance 1 6172 6184

## + NumOfProducts 1 6180 6192

## + Tenure 1 6181 6193

## + CreditScore 1 6182 6194

## <none> 6186 6196

## + HasCrCard 1 6185 6197

## + EstimatedSalary 1 6186 6198

##

## Step: AIC=6126

## Exited ~ Age + IsActiveMember + Geography + Gender

##

## Df Deviance AIC

## + Balance 1 6098 6112

## + NumOfProducts 1 6107 6121

## + Tenure 1 6110 6124

## + CreditScore 1 6111 6125

## <none> 6114 6126

## + HasCrCard 1 6113 6127

## + EstimatedSalary 1 6114 6128

##

## Step: AIC=6112

## Exited ~ Age + IsActiveMember + Geography + Gender + Balance

##

## Df Deviance AIC

## + Tenure 1 6094 6110

## + CreditScore 1 6095 6111

## + NumOfProducts 1 6096 6112

## <none> 6098 6112

## + HasCrCard 1 6097 6113

## + EstimatedSalary 1 6098 6114

##

## Step: AIC=6110

## Exited ~ Age + IsActiveMember + Geography + Gender + Balance +

## Tenure

##

## Df Deviance AIC

## + CreditScore 1 6091 6109

## + NumOfProducts 1 6092 6110

## <none> 6094 6110

## + HasCrCard 1 6093 6111

## + EstimatedSalary 1 6094 6112

##

## Step: AIC=6109

## Exited ~ Age + IsActiveMember + Geography + Gender + Balance +

## Tenure + CreditScore

##

## Df Deviance AIC

## + NumOfProducts 1 6088 6108

## <none> 6091 6109

## + HasCrCard 1 6090 6110

## + EstimatedSalary 1 6091 6111

##

## Step: AIC=6108

## Exited ~ Age + IsActiveMember + Geography + Gender + Balance +

## Tenure + CreditScore + NumOfProducts

##

## Df Deviance AIC

## <none> 6088 6108

## + HasCrCard 1 6087 6109

## + EstimatedSalary 1 6088 6110end_time<-Sys.time()

t=end_time-start_timeHere is the table showing the variables added per step.

fwd.model$anova## Step Df Deviance Resid. Df Resid. Dev AIC

## 1 NA NA 7011 7161 7163

## 2 + Age -1 552.16 7010 6609 6613

## 3 + IsActiveMember -1 264.61 7009 6344 6350

## 4 + Geography -2 158.51 7007 6186 6196

## 5 + Gender -1 71.43 7006 6114 6126

## 6 + Balance -1 16.14 7005 6098 6112

## 7 + Tenure -1 3.92 7004 6094 6110

## 8 + CreditScore -1 3.61 7003 6091 6109

## 9 + NumOfProducts -1 2.45 7002 6088 6108Question 2: How many variables (excluding the intercept) are in the final model?

Note not all coefficients were added.

## Forward Selection Model: 9## Full Model: 11Question 3: How many variables (excluding the intercept) are in this model?

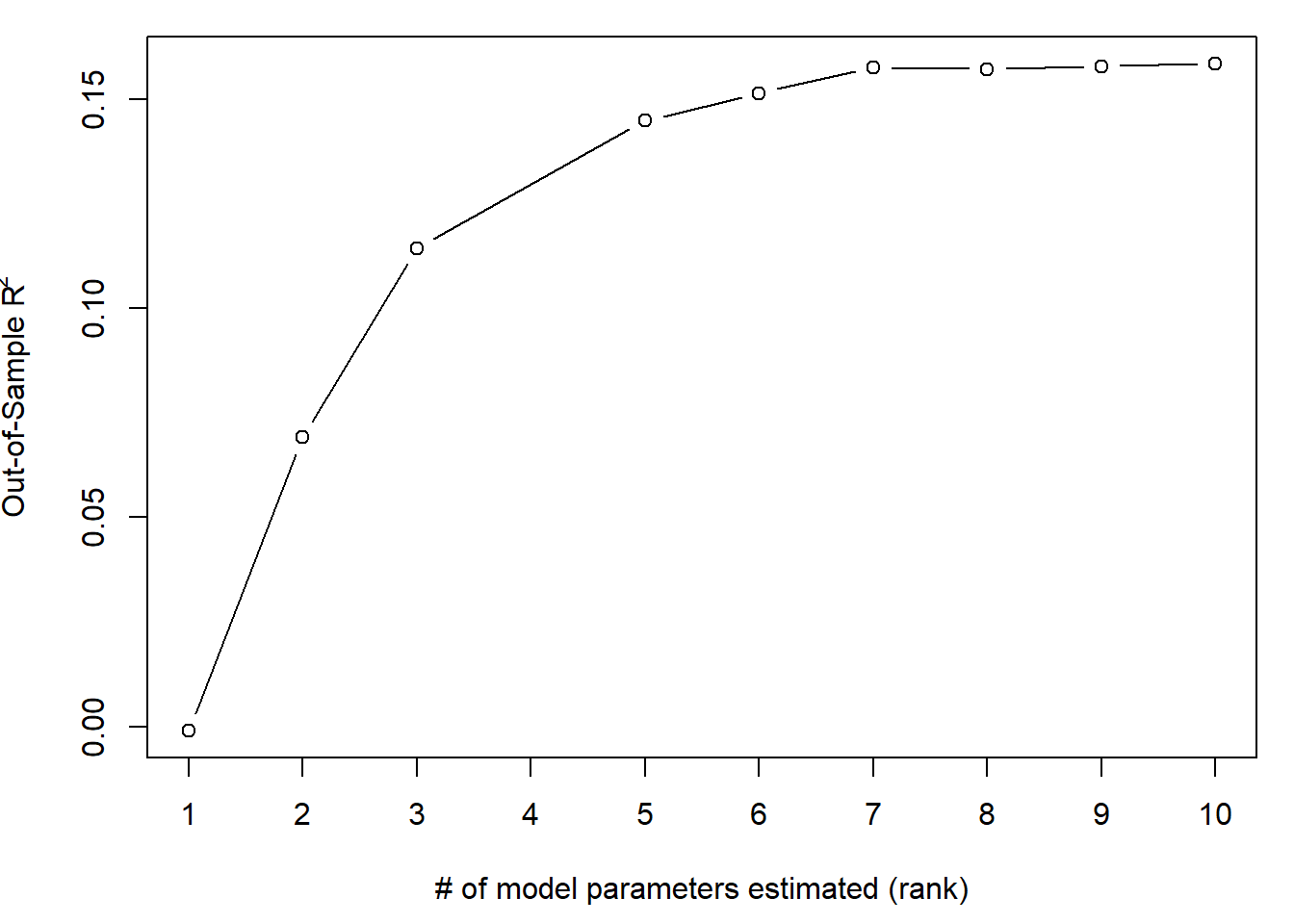

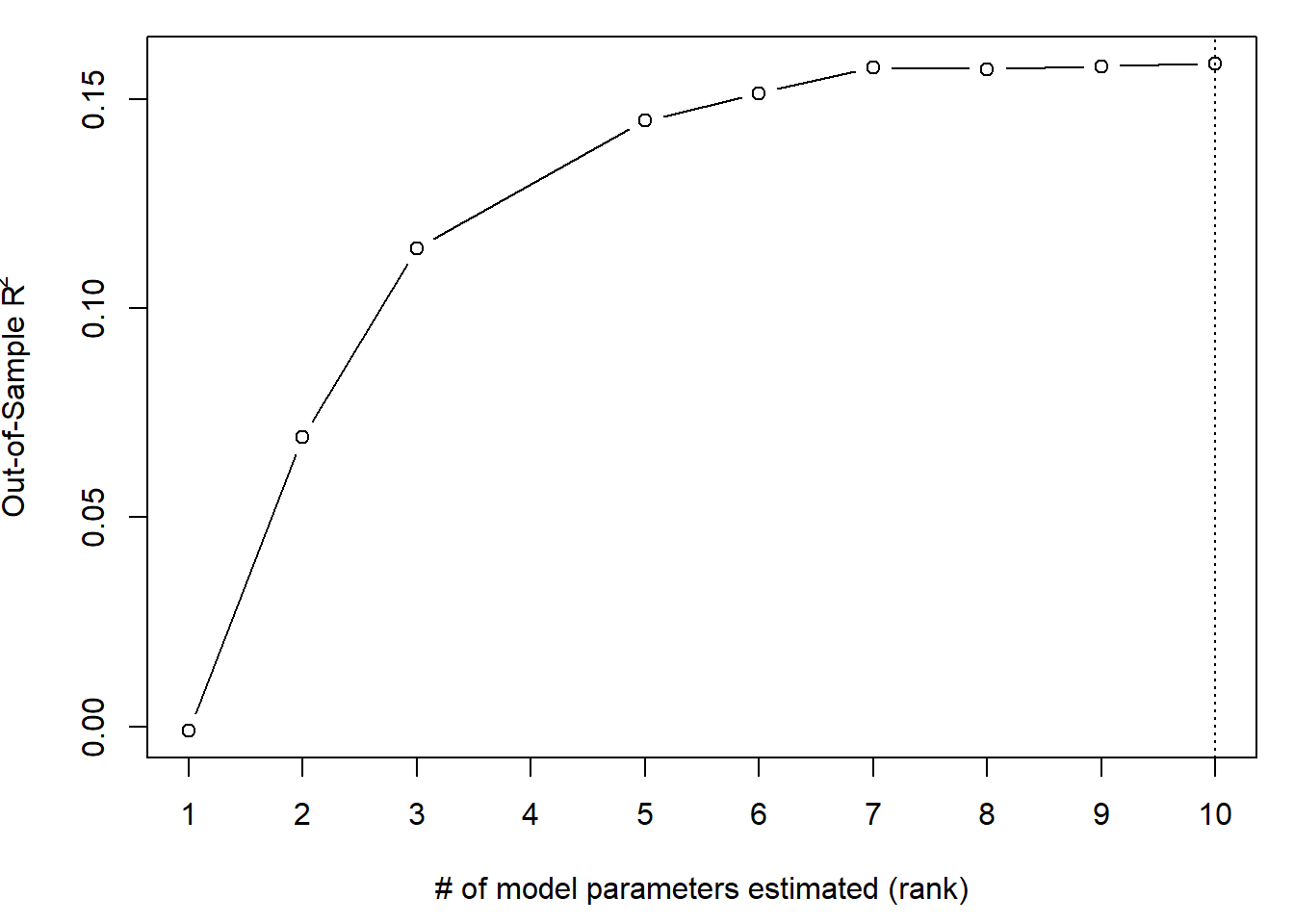

Use the holdout data set to choose the right size model from the forward selection procedure. Choose the model with the largest Out Of Sample R2.

How many variables (excluding the intercept) are in this model?

set.seed(19103)

M <- dim(fwd.model$keep)[2]

OOS=data.frame(R2=rep(NA,M), rank=rep(NA, M))

## pred must be probabilities (0<pred<1) for binomial

deviance <- function(y, pred, family=c("gaussian","binomial")){

family <- match.arg(family)

if(family=="gaussian"){

return( sum( (y-pred)^2 ) )

}else{

if(is.factor(y)) y <- as.numeric(y)>1

return( -2*sum( y*log(pred) + (1-y)*log(1-pred) ) )

}

}

## get null devaince too, and return R2

R2 <- function(y, pred, family=c("gaussian","binomial")){

fam <- match.arg(family)

if(fam=="binomial"){

if(is.factor(y)){ y <- as.numeric(y)>1 }

}

dev <- deviance(y, pred, family=fam)

dev0 <- deviance(y, mean(y), family=fam)

return(1-dev/dev0)

}

for(k in 1:M){

pred = predict(fwd.model$keep[["model",k]], newdata=bank.holdout, type = "response")

OOS$R2[k]<-R2(y = bank.holdout$Exited,pred=pred, family="binomial")

OOS$rank[k]<-fwd.model$keep[["model",k]]$rank

}

ax=c(1:max(OOS$rank))

par(mai=c(.9,.8,.2,.2))

plot(x=OOS$rank, y = OOS$R2, type="b", ylab=expression(paste("Out-of-Sample R"^"2")), xlab="# of model parameters estimated (rank)", xaxt="n")

axis(1, at=ax, labels=ax)

max.idx <- which.max(OOS$R2)

# OOS$rank[max.idx]

cat("Cross Validation Model: ",OOS$rank[max.idx]-1, "coefficients")## Cross Validation Model: 9 coefficientsax=c(1:max(OOS$rank))

par(mai=c(.9,.8,.2,.2))

plot(x=OOS$rank, y = OOS$R2, type="b", ylab=expression(paste("Out-of-Sample R"^"2")), xlab="# of model parameters estimated (rank)", xaxt="n")

axis(1, at=ax, labels=ax)

abline(v=OOS$rank[max.idx], lty=3)

model <- fwd.model$keep[["model",max.idx]]model_full_data<-glm(model$formula, data = bank, family = binomial(link = "logit"))

summary(model_full_data) ## 10-2 = 8 Variables##

## Call:

## glm(formula = model$formula, family = binomial(link = "logit"),

## data = bank)

##

## Deviance Residuals:

## Min 1Q Median 3Q Max

## -2.327 -0.659 -0.455 -0.268 2.983

##

## Coefficients:

## Estimate Std. Error z value Pr(>|z|)

## (Intercept) -3.376667347 0.235940447 -14.31 < 0.0000000000000002 ***

## Age 0.072684500 0.002574758 28.23 < 0.0000000000000002 ***

## IsActiveMember -1.075352000 0.057666511 -18.65 < 0.0000000000000002 ***

## GeographyGermany 0.774058893 0.067657508 11.44 < 0.0000000000000002 ***

## GeographySpain 0.035864566 0.070625185 0.51 0.612

## GenderMale -0.529117847 0.054481703 -9.71 < 0.0000000000000002 ***

## Balance 0.000002653 0.000000514 5.16 0.00000024 ***

## Tenure -0.015954160 0.009349985 -1.71 0.088 .

## CreditScore -0.000668170 0.000280314 -2.38 0.017 *

## NumOfProducts -0.100719348 0.047124456 -2.14 0.033 *

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## (Dispersion parameter for binomial family taken to be 1)

##

## Null deviance: 10110 on 9999 degrees of freedom

## Residual deviance: 8563 on 9990 degrees of freedom

## AIC: 8583

##

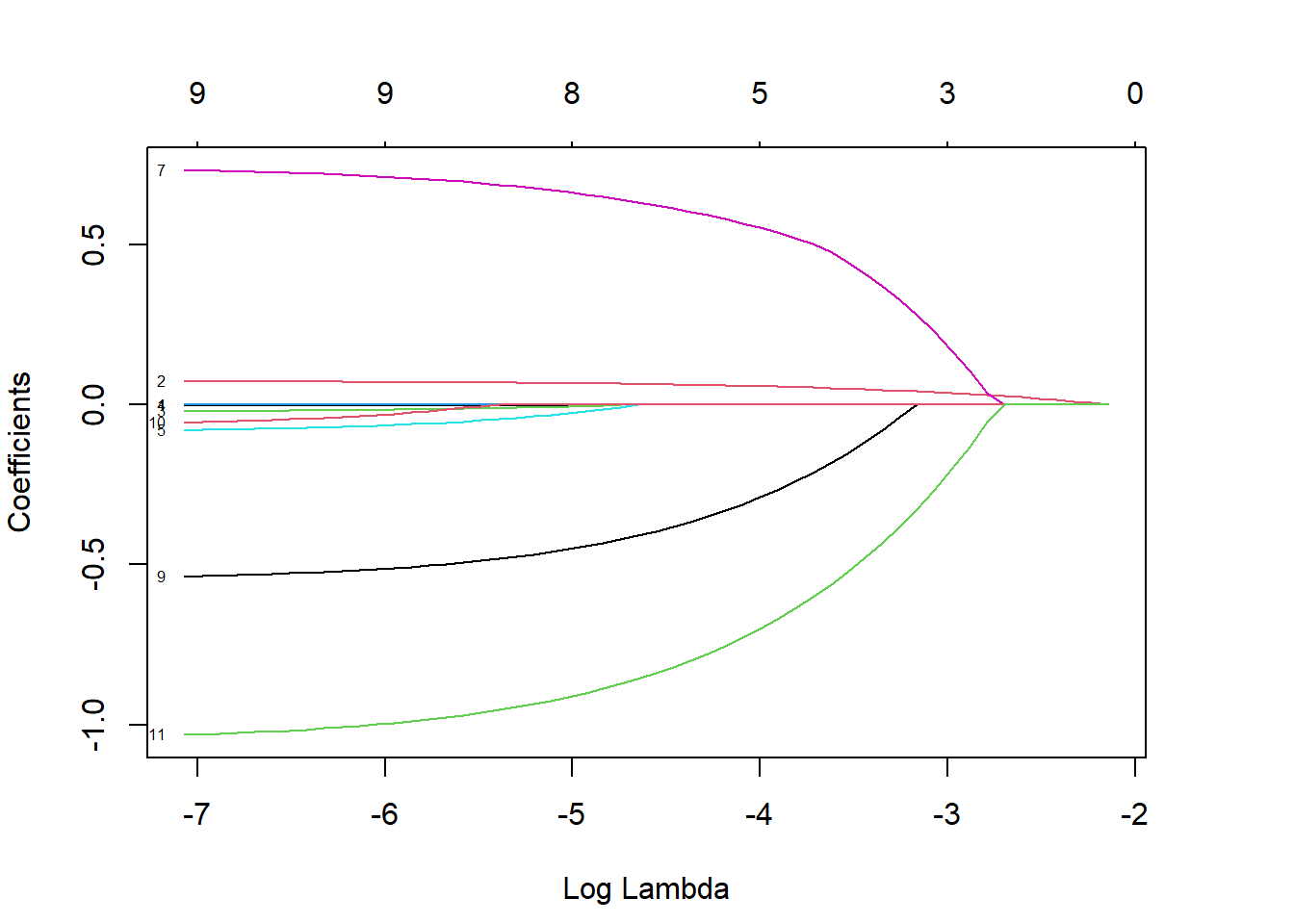

## Number of Fisher Scoring iterations: 5Question 4: First non-zero coefficient variable in LASSO?

Run LASSO on the training data.

# all the factor variables

xfactors<- model.matrix(Exited ~ Geography + Gender + HasCrCard + IsActiveMember , data = bank.train)

# remove intercept

xfactors<-xfactors[,-1]

# all continuous variables

x<-as.matrix(data.frame(bank.train$CreditScore, bank.train$Age, bank.train$Tenure, bank.train$Balance, bank.train$NumOfProducts, bank.train$EstimatedSalary, xfactors)) lasso_bank <- glmnet(x, y=as.factor(bank.train$Exited), alpha = 1, family = "binomial", nlambda = 100)par(mai=c(.9,.8,.8,.8))

par(mfrow=c(1,1))

plot(lasso_bank, xvar="lambda", label = TRUE, )

What is the first variable that has a non-zero coefficient as the penalty weight is gradually decreased?

dimnames(x)[2] # Age## [[1]]

## [1] "bank.train.CreditScore" "bank.train.Age"

## [3] "bank.train.Tenure" "bank.train.Balance"

## [5] "bank.train.NumOfProducts" "bank.train.EstimatedSalary"

## [7] "GeographyGermany" "GeographySpain"

## [9] "GenderMale" "HasCrCard"

## [11] "IsActiveMember"## First non-zero coefficient variable: bank.train.Age or AgeQuestion 5: Number of non-zero coefficients in Model

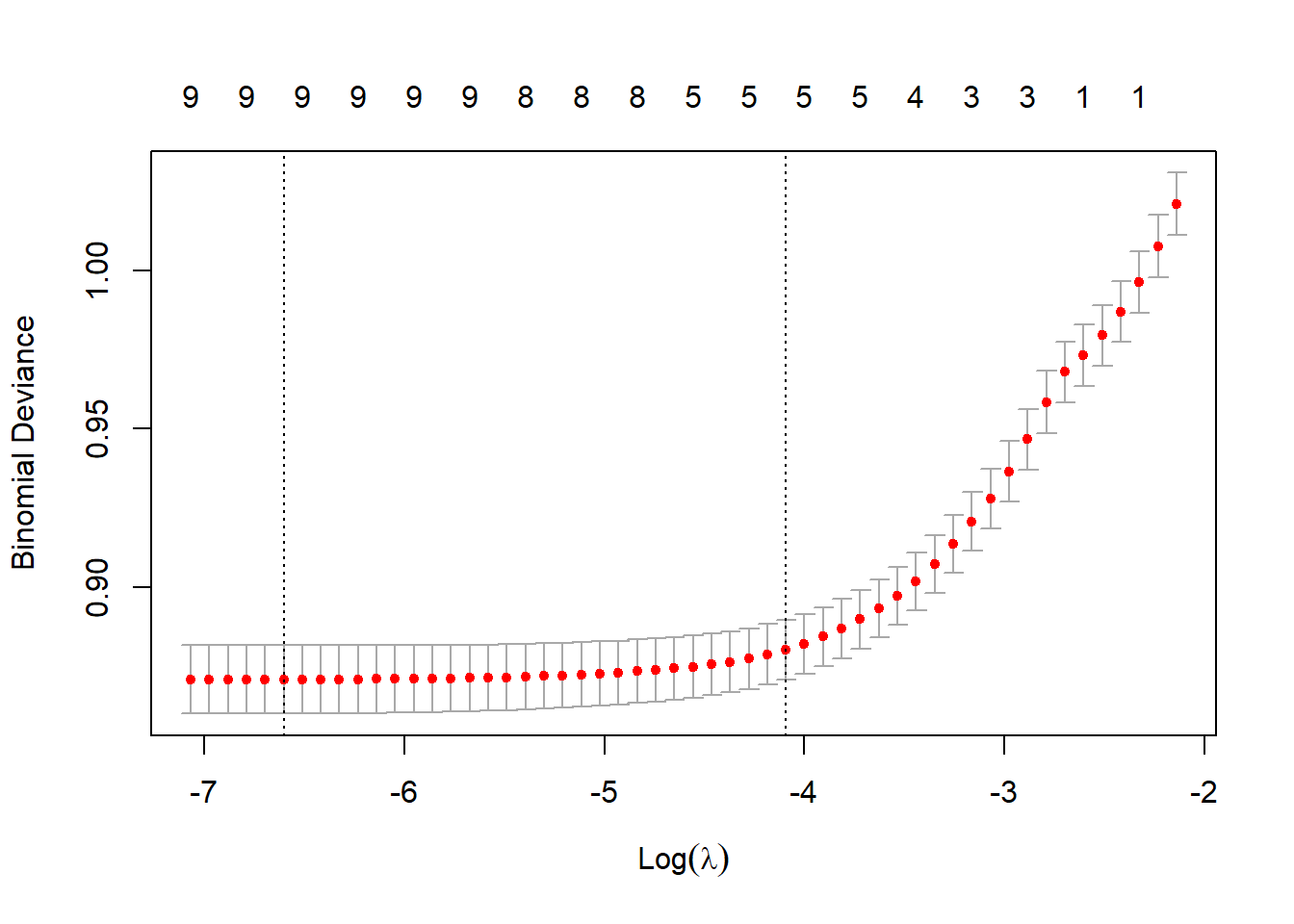

Use cross-validation to tune the penalty weight.

set.seed(19103)

lasso_cv <- cv.glmnet(x, y=bank.train$Exited, family = "binomial", type.measure = "deviance")

plot(lasso_cv)

How many non-zero coefficients (excluding the intercept) are there in this model?

## Number of non-zero Coefficients: 9Question 6: What’s the OOS R2 for the LASSO model?

What’s the OOS R2 for the LASSO model?

Provide your answer with two decimals separated by a dot, not a comma (e.g. 0.12).

cv.glmnet() does k-fold cross-validation for glmnet.

Default is nfolds = 10.

## OOS R-Squared: 0.15Alt: We start by transforming the holdout:

# all the factor variables

xfactors<- model.matrix(Exited ~ Geography + Gender + HasCrCard + IsActiveMember , data = bank.holdout)

# remove intercept

xfactors<-xfactors[,-1]

# all continuous variables

x<-as.matrix(data.frame(bank.holdout$CreditScore, bank.holdout$Age, bank.holdout$Tenure, bank.holdout$Balance, bank.holdout$NumOfProducts, bank.holdout$EstimatedSalary, xfactors)) Now we predict:

pred <- predict(lasso_cv, newx=x, s = "lambda.min", type = "response")

R2(y = bank.holdout$Exited,pred=pred,family="binomial")## [1] 0.158Hardcore

set.seed(19103)

n = nrow(bank.train)

K = 10 # # folds

foldid = rep(1:K, each=ceiling(n/K))[sample(1:n)]

OOS=data.frame(R2=rep(NA,K), rank=rep(NA, K))

## pred must be probabilities (0<pred<1) for binomial

deviance <- function(y, pred, family=c("gaussian","binomial")){

family <- match.arg(family)

if(family=="gaussian"){

return( sum( (y-pred)^2 ) )

}else{

if(is.factor(y)) y <- as.numeric(y)>1

return( -2*sum( y*log(pred) + (1-y)*log(1-pred) ) )

}

}

## get null devaince too, and return R2

R2 <- function(y, pred, family=c("gaussian","binomial")){

fam <- match.arg(family)

if(fam=="binomial"){

if(is.factor(y)){ y <- as.numeric(y)>1 }

}

dev <- deviance(y, pred, family=fam)

dev0 <- deviance(y, mean(y), family=fam)

return(1-dev/dev0)

}

for(k in 1:K){

train = which(foldid!=k)

# train.data conversion

btrain <- bank.train[train,]

xfactors<- model.matrix(Exited ~ Geography + Gender + HasCrCard + IsActiveMember, data = btrain)

xfactors<-xfactors[,-1]

x <- as.matrix(data.frame(btrain$CreditScore, btrain$Age, btrain$Tenure, btrain$Balance, btrain$NumOfProducts, btrain$EstimatedSalary, xfactors))

# test.data conversion

btest <- bank.train[-train,]

xfactors<- model.matrix(Exited ~ Geography + Gender + HasCrCard + IsActiveMember, data = btest)

xfactors<-xfactors[,-1]

xx <- as.matrix(data.frame(btest$CreditScore, btest$Age, btest$Tenure, btest$Balance, btest$NumOfProducts, btest$EstimatedSalary, xfactors))

#fit regression

glmnet(x, y=as.factor(btrain$Exited), alpha = 1, family = "binomial", nlambda = 100)

#predict

pred <- predict(lasso_cv, newx=xx, s = "lambda.min", type = "response")

#R2

OOS$R2[k] <- R2(y = btest$Exited,pred=pred,family="binomial")

# print progress

cat(k, " ")

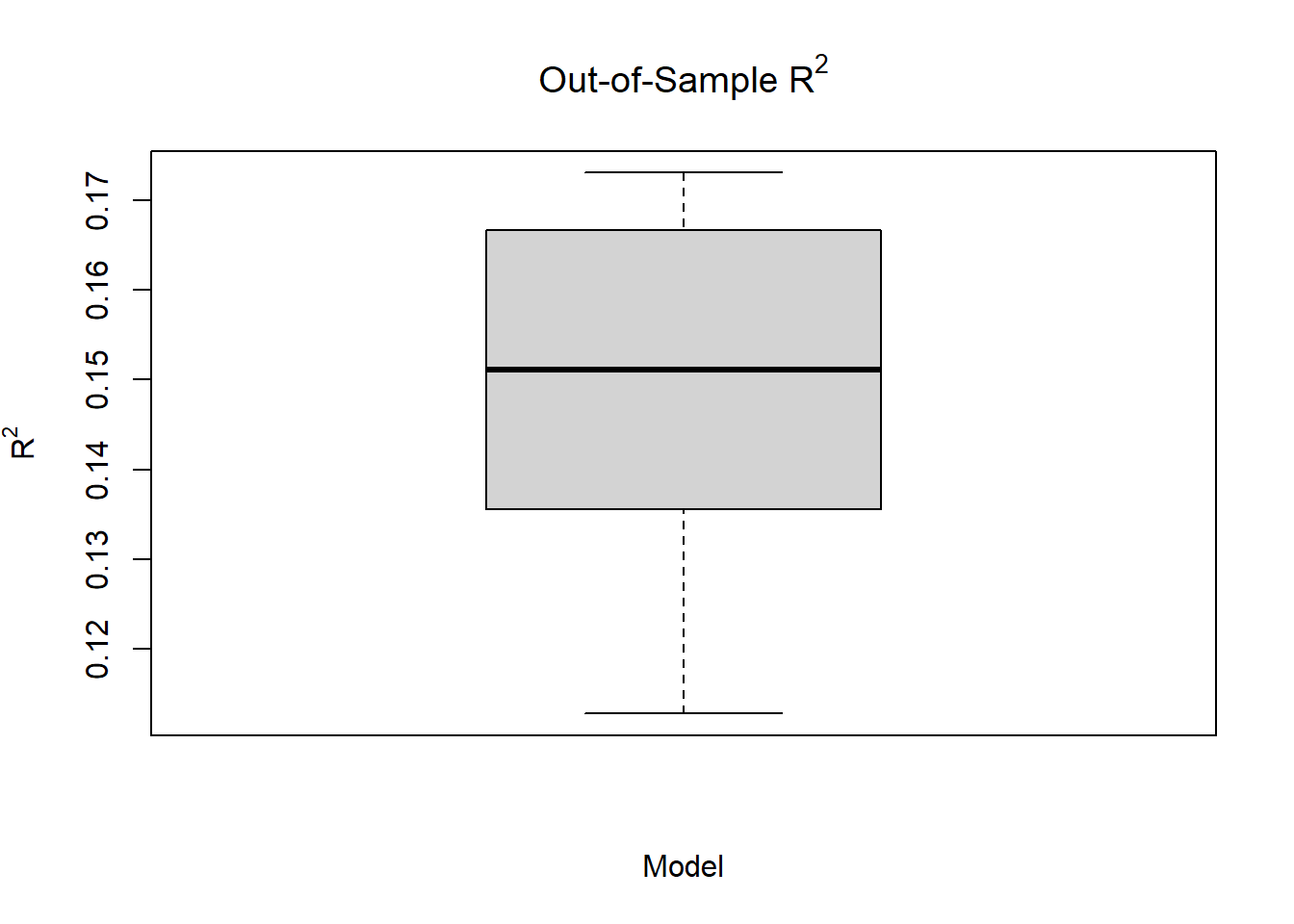

}## 1 2 3 4 5 6 7 8 9 10round(mean(OOS$R2),2)## [1] 0.15 boxplot(OOS[1], data=OOS, main=expression(paste("Out-of-Sample R"^"2")),

xlab="Model", ylab=expression(paste("R"^"2")))

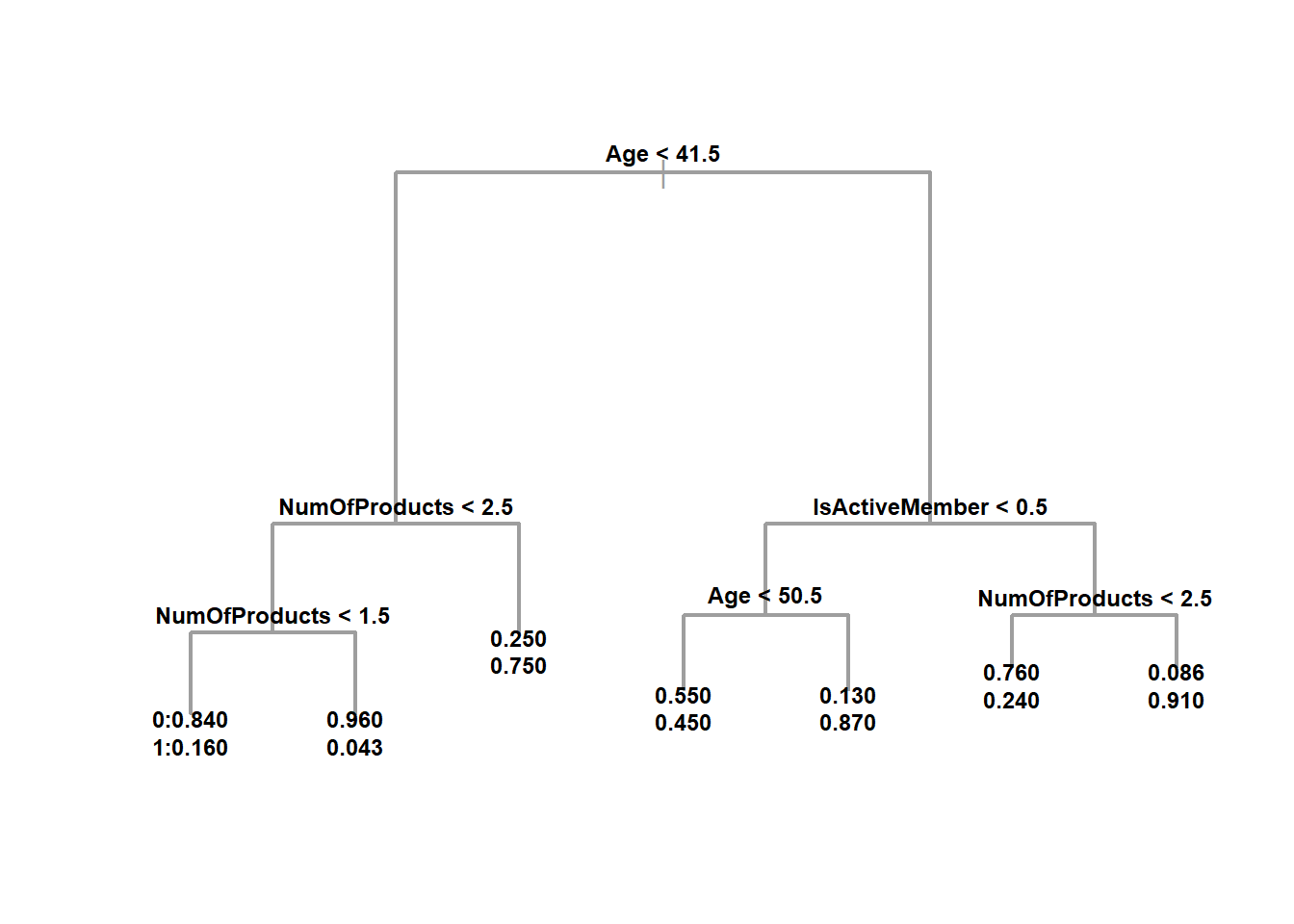

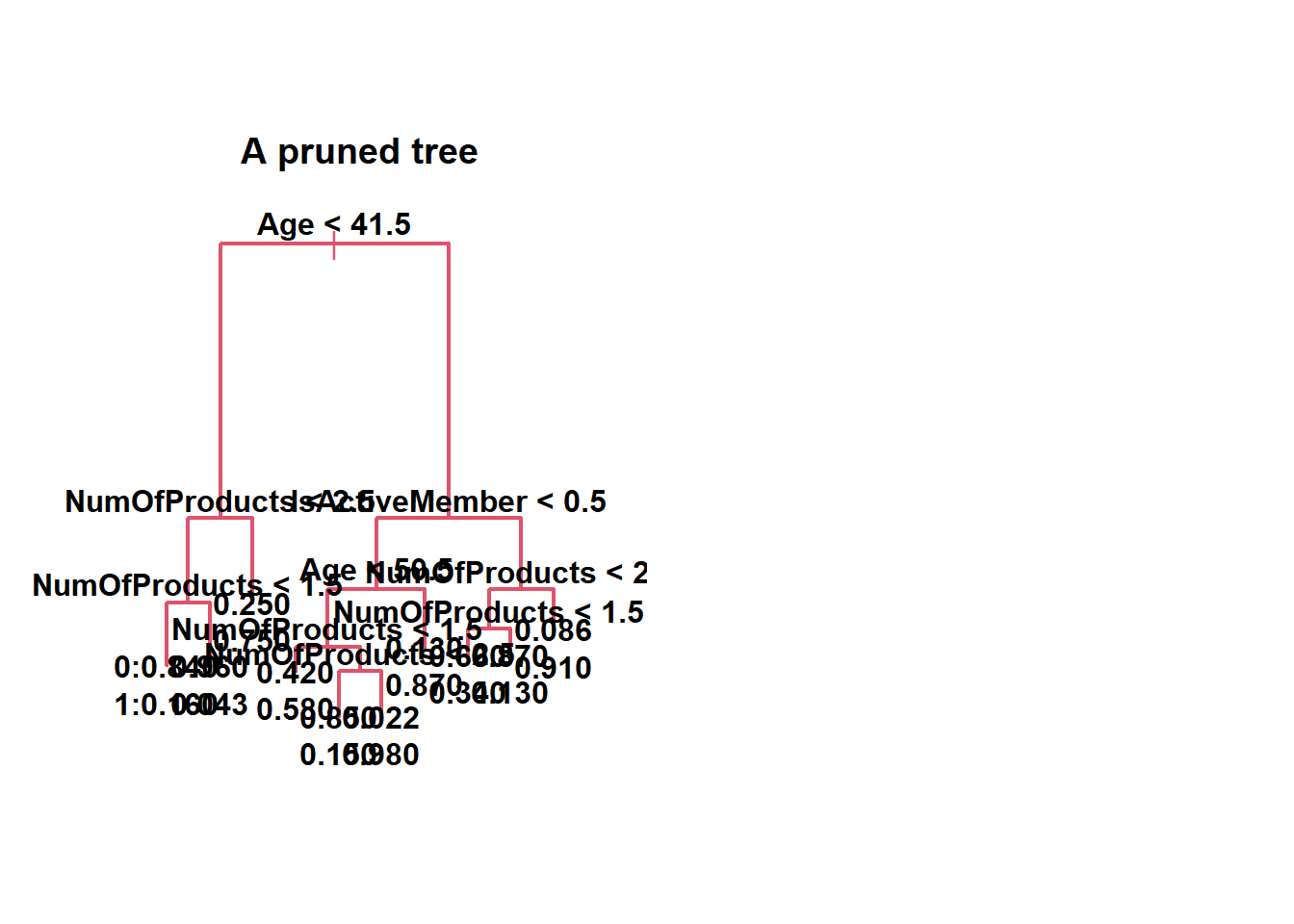

Question 7: How many terminal nodes does the tree have?

Fit a decision tree to the training data with mindev = 0.01.

How many terminal nodes does the tree have?

tree <- tree(as.factor(Exited) ~ ., data=bank.train, mindev=0.01)

summary(tree) # 7##

## Classification tree:

## tree(formula = as.factor(Exited) ~ ., data = bank.train, mindev = 0.01)

## Variables actually used in tree construction:

## [1] "Age" "NumOfProducts" "IsActiveMember"

## Number of terminal nodes: 7

## Residual mean deviance: 0.787 = 5510 / 7000

## Misclassification error rate: 0.164 = 1147 / 7012par(mfrow=c(1,1))

plot(tree, col=8, lwd=2)

# cex controls the size of the type, 1 is the default.

# label="yprob" gives the probability

text(tree, label = "yprob", cex=.75, font=2, digits = 2, pretty=0)

Question 8: Predict Probability

What’s the probability that a 55-year-old German female with 2 products, a 650 credit score, a tenure of 2, a balance of 80.000, a 100.000 salary, no card, not an active member exits?

Provide your answer with two decimals separated by a dot, not a comma (e.g. 0.12).

example <- as.data.frame(cbind(CreditScore = 650,

Geography = "Germany",

Gender = "Female",

Age = 55,

Tenure = 2,

Balance = 80000,

NumOfProducts = 2,

IsActiveMember = 0,

HasCrCard = 0,

EstimatedSalary = 100000,

Exited = 1))

example1 <- example %>%

mutate(CreditScore = as.integer(CreditScore),

Geography = as.factor(Geography),

Gender = as.factor(Gender),

Age = as.integer(Age),

Tenure = as.integer(Tenure),

Balance = as.double(Balance),

NumOfProducts = as.integer(NumOfProducts),

IsActiveMember = as.integer(IsActiveMember),

HasCrCard = as.integer(HasCrCard),

EstimatedSalary = as.double(EstimatedSalary),

Exited = as.integer(Exited))

#lets make a prediction for our data. It will create two columns, one with probability for response and no response.

pred_tree <- predict(tree, example1, type = "vector")## Predicted probability of 0.87 to Exited==1Question 9: How many terminal nodes does the lowest CV error tree have?

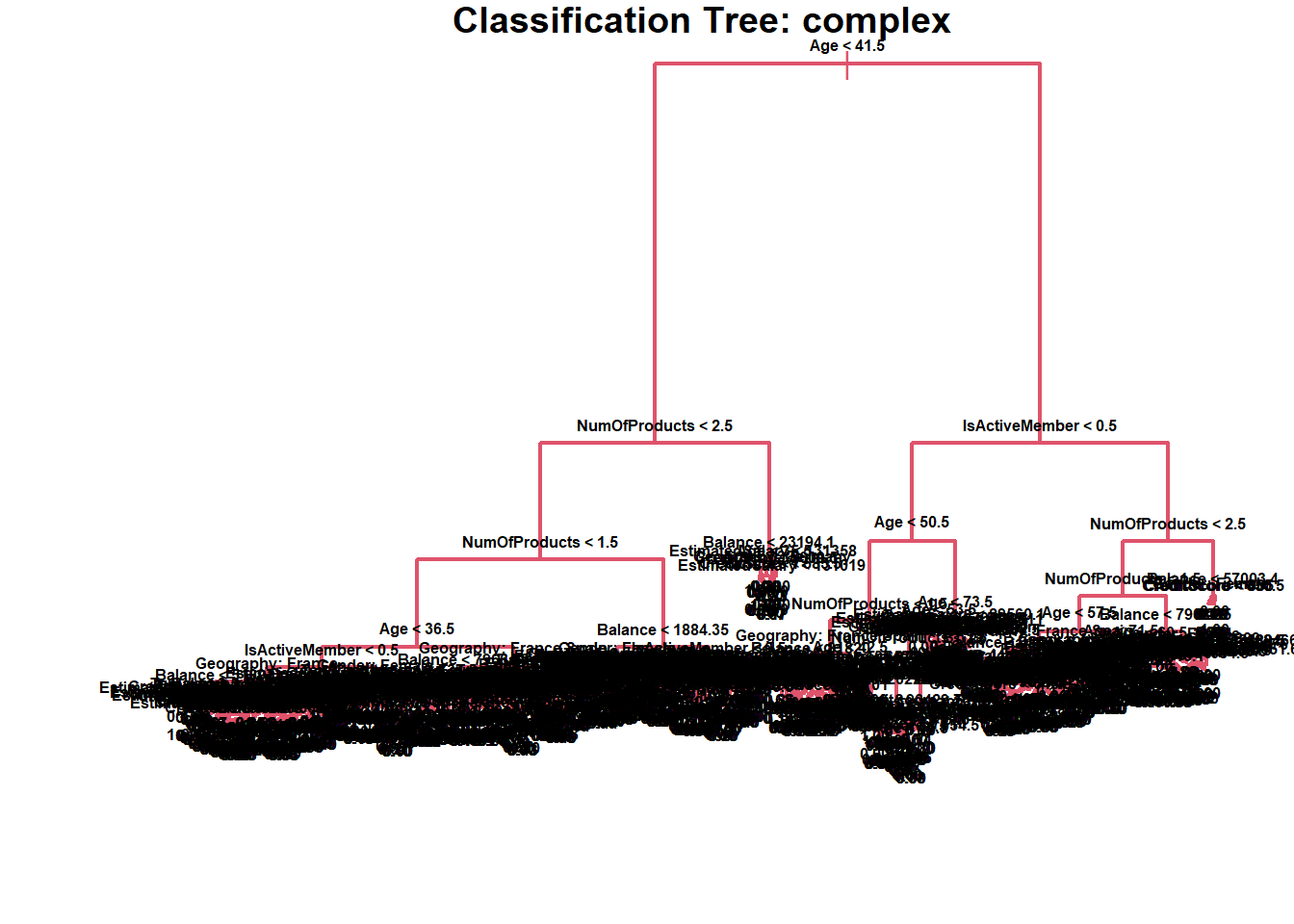

Fit a decision tree with mindev = 0.0001. Use 5 fold cross-validation to prune the tree.

set.seed(19103)

tree_complex <- tree(as.factor(Exited) ~ . , data=bank.train, mindev=0.0001)

summary(tree_complex)##

## Classification tree:

## tree(formula = as.factor(Exited) ~ ., data = bank.train, mindev = 0.0001)

## Number of terminal nodes: 553

## Residual mean deviance: 0.344 = 2220 / 6460

## Misclassification error rate: 0.0809 = 567 / 7012## It can be either 7 or 10 depending on whether we define mincut=100 or notpar(mfrow=c(1,1))

par(mai=c(.8,.8,.2,.2))

plot(tree_complex, col=10, lwd=2)

text(tree_complex, cex=.5, label="yprob", font=2, digits = 2, pretty = 0)

title(main="Classification Tree: complex")

The Model:

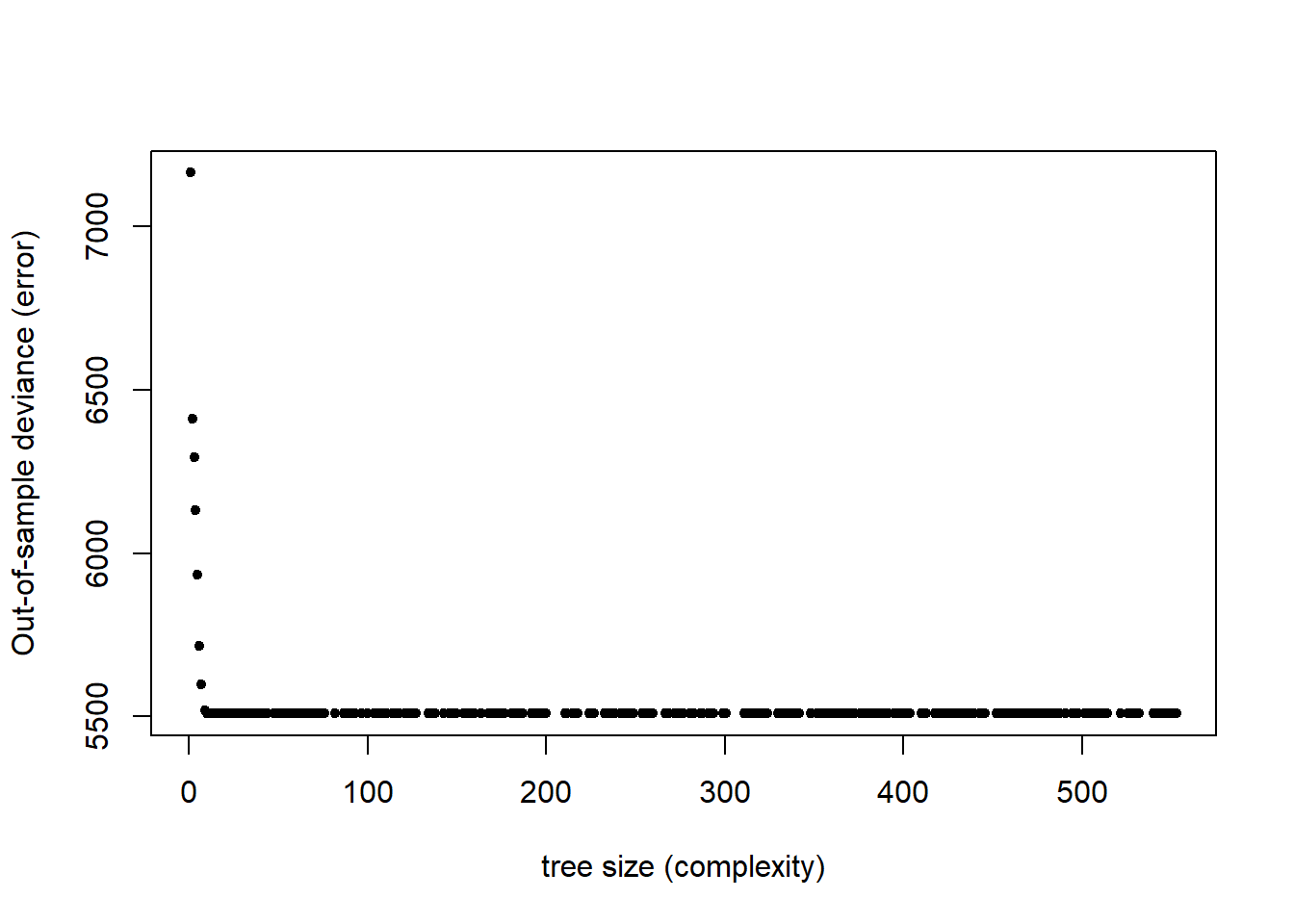

set.seed(19103)

cv.tree_complex <- cv.tree(tree_complex, K=5)

#cv.tree_complex <- cv.tree(tree_complex, K=5, FUN = prune.misclass)How many terminal nodes does the lowest CV error tree have?

par(mfrow=c(1,1))

plot(cv.tree_complex$size, cv.tree_complex$dev, xlab="tree size (complexity)", ylab="Out-of-sample deviance (error)", pch=20) # 7 or 10 Size

par(mfrow=c(1,2), oma = c(0, 0, 2, 0))

tree_cut <- prune.tree(tree_complex, best=10)

plot(tree_cut, col=10, lwd=2)

text(tree_cut, cex=1, label="yprob", font=2, digits = 2, pretty = 0)

title(main="A pruned tree")

Some Statistic Summary of Pruned Tree:

tree_cut <- prune.tree(tree_complex, best=10)

summary(tree_cut)##

## Classification tree:

## snip.tree(tree = tree_complex, nodes = c(51L, 15L, 50L, 13L,

## 5L, 24L, 28L, 9L, 29L, 8L))

## Variables actually used in tree construction:

## [1] "Age" "NumOfProducts" "IsActiveMember"

## Number of terminal nodes: 10

## Residual mean deviance: 0.749 = 5250 / 7000

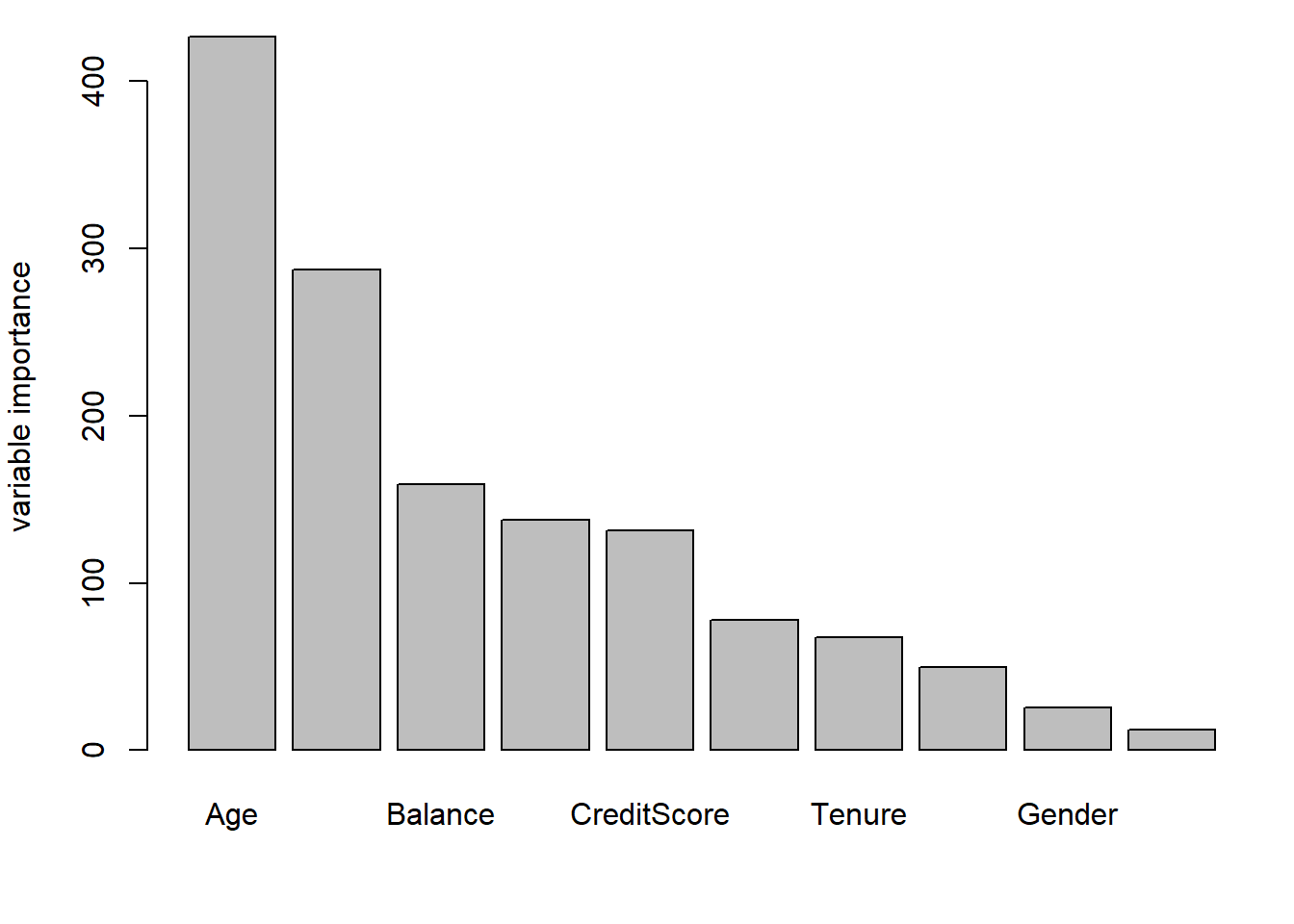

## Misclassification error rate: 0.148 = 1037 / 7012Question 10: What is the second most important variable in the random forest?

Use a random forest on the training set with 1000 trees, a minimum node size of 25, importance impurity, probability true, and seed 19103.

set.seed(19103)

bank_rf <- ranger(Exited ~ ., data=bank.train, write.forest=TRUE, num.trees = 1000, min.node.size = 25, importance = "impurity", probability=TRUE, seed = 19103)par(mfrow=c(1,1))

par(mai=c(.9,.8,.2,.2))

sort(bank_rf$variable.importance, decreasing = TRUE)## Age NumOfProducts Balance EstimatedSalary CreditScore

## 426.8 287.7 159.1 137.9 131.4

## IsActiveMember Tenure Geography Gender HasCrCard

## 77.8 67.3 49.9 25.5 12.3barplot(sort(bank_rf$variable.importance, decreasing = TRUE), ylab = "variable importance")

What is the SECOND most important variable in the random forest?

sort(bank_rf$variable.importance, decreasing = TRUE)[2]## NumOfProducts

## 288